How Being Frugal Will Keep You From Being Broke

I've been called a lot of things, but being called frugal is by far one of the best compliments I've ever received.

This comes as a surprise to many, because the word frugal is often equated with being broke.

The truth is many frugal people are far better off than those who are not.

In Thomas Stanley's

The Millionaire Next Door (a fantastic book that should be required reading in high school), he notes that

the average millionaire lives a rather modest lifestyle.

Your life is the sum total of all the decisions you make- good or bad, and it's the small decisions that matter most.

Why? Because the small decisions and habits you develop early on dictate how you respond to larger decisions.

You can call me frugal, just don't call me broke, and let me explain why.

A NEW DEFINITION OF BROKE

Broke probably isn't what you think it is.

It might be the family next door with the brand new SUV. Or, it could be your flashy cousin who just bought a half million dollar home on the golf course.

Simply put, being broke means you spend more money than you take in, you don't save any of your income, and/or you have debt.

Until those three things change, you're broke.

WHAT SETS FRUGAL PEOPLE APART

1. DEBT FREE LIVING

If you're living under the bondage of debt, you're not living at all.

The truth about debt is that it is a

product that has been so heavily marketed to us that we feel like we can't live without it.

Most people think having $10k on a credit card, a car loan, a house loan, and student loans is

normal.

Those same people scratch their head and wonder why they never have any money left over to put into savings for unexpected financial difficulty or retirement.

When you have monthly payments, you are a

slave.

Those monthly payments TELL YOU what to do with your money, instead of YOU TELLING your money where to go.

We used the

debt snowball

to

pay off over $20k of student loan debt

in 12 months when newly married and living on one income.

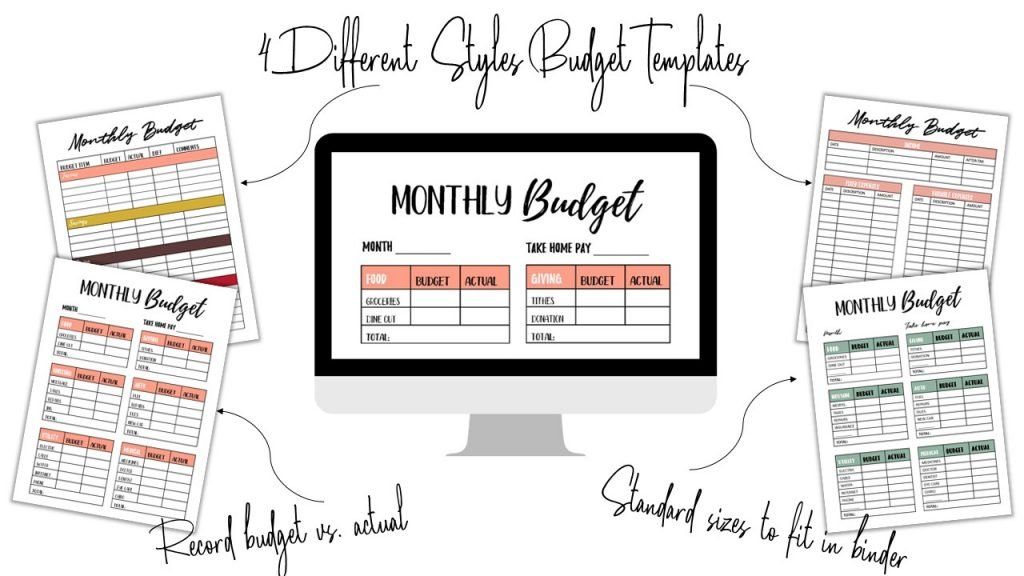

The spreadsheets seen above are the perfect sheets to help you track your debt payoff progress!

2. WE LIVE ON FAR LESS THAN WE MAKE

Frugal people understand the value of

delayed pleasure.

We choose to live on far less than we make so that

later we can enjoy the fruits of our labor.

This is accomplished by living on a

household budget.

Budgeting is the key to unlocking financial freedom.

It all starts with the

small disciplines that you add to your daily life that influences the direction of your finances.

While budgeting seems like a good thing to do but not necessarily something that will change your life,

I'd challenge you to give it a try and see how it transforms your finances.

When you start living on a written,

monthly budget

, you all of a sudden feel like you have more money!

3. SAVING IS SECOND NATURE

Frugal people understand the opportunity costs of their financial decisions. If you decide to buy an expensive item, that means you forgo the opportunity to invest that money and earn compound interest on it. However, they also understand that focusing on value when making purchases is important. Instead of buying expensive items on a credit card, they save up for them. In addition, they save for retirement, and have a fully-funded emergency fund for a rainy day.

Saving up for large purchases over time can be accomplished using sinking funds. Ditch the credit card and try your hand at saving up over time. You'll never go back!

4. WE UNDERSTAND YOU ARE NOT WHAT YOU DRIVE

A

car payment is most people's second largest monthly payment aside from their mortgage.

Car payments kill your ability to build wealth.

I got made fun of quite often for driving a 16 year old car I bought in college until this year when we bought a used minivan with cash.

But you know what?

It really doesn't bother me at all.

I have reached the point where what people think is not my primary motivator.

Am I against drive a nice, new car that's paid for in cash? Absolutely not!

However, I know that a new car is most definitely not an investment.

A new vehicle loses 60 percent of it's value in the first four years. A $28,000 car will lose $17,000 of value in the first four years you own it. This equates to almost $100 per week.

You might as well drive down the highway throwing $100 bills out the window.

I drove my 16 year old car because there's nothing wrong with it and it's cheap to drive.

Driving a fancy vehicle isn't a priority for me because it's not an investment.

5. CREDIT CARDS DON'T ENTICE US

Credit card is just the greek phrase for demon. Just kidding. Kind of.

We don't see a need for a credit card. If we only buy what we can afford, we don't need one.

I've done my research regarding credit cards.

I know that the additional money you spend because of the psychological effect of credit on your brain

far outweighs the benefit of cash back or airline miles.

Most people don't understand how we can live without a credit card because of the myth of the credit score.

To put it simply, we don't bow down to our FICO score and we haven't needed to show

"good credit" for anything other than buying our home.

A good credit score isn't an indication that you're good with money. It indicates that you interact with debt

a lot.

My debit card does everything a credit card would do, the kicker with the debit card is I have to actually have the money to spend it.

Dumb, right?

6. OUR GOAL ISN'T TO KEEP UP WITH THE JONESES

Most people struggle with the temptation to 'Keep Up With the Joneses' at some point in their life.

This is a struggle for me all the time.

I'm committed to being a disciplined saver and invester, but with that comes

sacrifice

We live on a

budget. Our cars aren't brand new but they are

paid for. We are not

house poor.

In other words,

we are delaying our gratification.

We are going to live like no one else now, so that LATER we can live like no one else.

7. WE SAY NO TO LITTLE THINGS SO WE CAN SAY YES TO BIG THINGS

I might say no to an extra vacation every year, eating out multiple times a week, and buying an obnoxious amount of Christmas gifts,

but you can but I'm saying yes to investing over 15% of our gross income for retirement.

Our kids won't be involved in every single activity there is growing up, but Lord willing their parents will leave them a legacy one day.

Frugal people say no to

small things so they can say YES to

big things.

Share this post!