Transform Your Finances with a Zero Based Budget Worksheet

For nearly 8 years, I’ve been making a zero based budget worksheet. Whether single and saving for a wedding, married and paying off debt rapidly, and now married with three kids in tow, the budget has drastically evolved over the years. However, the concept has remained the same: every dollar of income is given a specific purpose before the month begins.

Our monthly budget is our roadmap to success. When I get behind and don’t have the budget made before the month begins, I feel disorganized, out-of-sorts, and tend to be more impulsive with my financial decisions.

A zero based budget is a budgeting approach that will help you achieve your financial goals no matter how big or how little your income, and that's why it's my favorite!

What is a Zero-Based Budget?

Made famous by Dave Ramsey (read about his baby steps here), a zero-based budget is simply a budget that has a zero dollar balance. This means that total income less total expenses equals zero. It doesn’t mean you have zero dollars in your bank account at the end of every month.

Rather, the key principle is every single dollar of your income is being assigned to a budget line item, including line items such as saving and investing!

Although this is a straight-forward concept, many people struggle to put together a zero-based budget on paper. Understanding and utilizing the principles of zero-based budgeting outlined below will make all the difference in your financial planning!

Zero-Based Budgeting Principles

- Planning. Success requires planning. Being haphazard with your money will leave you frustrated and discouraged. No matter how much or how little you make, with a plan, you can be successful and reach your financial goals. Zero-based budgeting requires upfront planning.

- Prioritizing. Although you might always have money in your bank account without a budget, you likely aren’t prioritizing your money and making it work for you. Part of budget planning is prioritizing your expenditures– because money is finite.

- Tracking. The “set it and forget it” method of budgeting won’t get you very far unfortunately :) Rather, you must be proactive in the budgeting process and track your spending throughout the month so you can update your budget accordingly.

Advantages of Zero-Based Budgeting

Zero-sum budgeting is the best budgeting method to reach your money goals for many reasons:

- Flexibility. Although your goal is to stick to your budget, there is also freedom in knowing that your final budget for the month doesn't have to look like when you created it. You're going to update it as the month happens and actual pay comes in and actual expenses go out. The budget is your framework for financial success, budget often requires some tweaking.

- Not a one-size-fits all framework. Other budgeting methods that use percentages for budget categories (like the 50/30/20 budget), don't have considerations for age, current retirement savings, debt, financial goals, or your specific needs.

- Intentionality. The main difference between zero-sum budgeting and other traditional budgets is the intentionality.

How to Set Up Zero-Based Budget Worksheet

Setting up a zero based budget is a fairly simple process, it just requires you take the time to get things right. The most work is done up-front when creating a monthly budget. Beyond the first few months of tweaking the budget to get it right, it’s smooth sailing!

Follow this step-by-step guide to create your zero based budget!

Click here to get one of my free zero-based budget templates (or skip to the end of the post to see more free options).

1. Determine Monthly Income

First, determine your total household income, using take-home income (after-tax pay) vs. gross income (before-tax pay). This should be pretty straightforward, depending on how many sources of income you have. If you are paid hourly, straight-commission, or a combo of both, there are a few different ways to calculate your income.

If you’re paid hourly but your income is fairly predictable, simply use an average of your last 6-12 months of pay. Alternatively, you can use your lowest estimated monthly income from the last 12 months to base your budget off of.

Irregular Income

If you have irregular income or unpredictable income (such as a small business owner), simply base your budget on your lowest expected monthly income. Look at historical data to assist you in determining your final number.

2. Calculate Expenses

Second, calculate and categorize your monthly expenses. Calculating your true expenses requires thinking beyond your obvious monthly spending– you want to include both monthly and non-monthly expenses in your budget.

Monthly Expenses

Using your last 3-6 months of bank statements, add up and categorize all your monthly expenses, both fixed and variable.

Fixed Expenses

Fixed expenses are those that do not change from month to month. These expenses are easy to budget because you know exactly how much they will be and when they are due. Most essentials will fall into this category.

Examples of fixed expenses:

- Housing

- Utilities

- Transportation

- Debt payments

- Childcare

- Car Insurance

- Home insurance

- Monthly subscriptions & memberships

Generally, fixed expenses are harder to cut than variable expenses. It’s typically easier to cut your entertainment, grocery, and dining out expenses as opposed to trying to cut your housing costs in half.

Variable Expenses

Variable expenses refers to expenses that do change month to month. These expenses are directly influenced by your choices, and some are more easily controlled than others. However, it’s still important to set a maximum budget amount for each variable expense category.

If, for example, you decide to not set a max amount for groceries or clothing because of the variable nature of the expense, you’ll be shocked when you add up how much you spent at the end of the month.

To set a budget amount for variable expenses, first look at your average spending for that budget category.

Examples of variable expenses:

- Groceries

- Clothing

- Recreation

- Kids activities

- Gifts/celebrations

- Restaurants

- Entertainment

- Personal spending

- Miscellaneous

As I have noted above, these expenses are typically easier to adjust than fixed expenses. If you need to trim the budget, start with your variable expenses, especially those that are non-essentials.

Non-Monthly Expenses

Many expenses are obvious: groceries, gas, utilities, housing, etc. But what about random birthday parties and get-togethers? What about when the refrigerator goes out and you have to allocate a good chunk of your paycheck to a replacement? What about the annual insurance premiums due January 1st?

In addition to budgeting for monthly expenses, you want to budget for non-monthly expenses in order to capture your true expenses.

To budget for these, set up sinking funds. A sinking fund is a strategic way to save for an expense or multiple expenses over time by setting aside money every month.

Unexpected Expenses

Without a doubt, unexpected expenses will come up during the month. Appliances don’t beep and tell you they are about to fail you (and probably right after you just replaced a bunch of other things). You can’t foresee the sprained ankle, broken arm, or tooth that got knocked out during the elementary basketball game.

However, I’d argue that although we don’t know when these expenses will come up, or what the nature of the expense will be, we do know this: they will come up.

So are they really that unexpected?

For instance, although you don’t know when your car will need repair or how much it will cost, you do know that it is likely your car will need repair at some point. You don't know how many birthday gifts you'll have to buy during the year for your kids various parties, but you there will be some.

We know these things happen, we just neglect to set aside money for them for various reasons. I get it – sometimes it’s too stressful to think about, the funds aren’t there, or you feel like you don’t have time.

However, putting these expenses in the budget will relieve so much financial stress and frustration.

Examples of unexpected expenses:

- Car repairs

- Home repairs

- Medical bills

Set aside money for these expenses on a monthly basis. Keep these funds in a separate savings account (called a sinking fund) so you aren’t tempted to spend on something else!

Expected Expenses

Non-monthly expenses that are easier to estimate are those that are probable and easily estimable.

- Property taxes

- Christmas

- Insurance premiums

- Annual gym dues

- Registrations

- School dues & supplies

- Extracurricular activities

- Gifts (weddings, birthdays, anniversaries, etc.)

First, write down the expense amounts that you know (insurance premiums and gym dues for example), and divide by months until due. For instance, if it’s January and your auto insurance premium is $1,200 due Jan. 1st, budget $100 per month.

For all other expenses, estimate what you’ll need to set aside or what your budget limits you to. You might want to be able to set aside $200/month for car repairs, but after working through the budget steps, you might find that you can only reasonably set aside $100/month. That’s totally fine! Don’t be discouraged. Remember, something is better than nothing. Small disciplines add up over time!

Budget Categories

Because many people like to have a point of reference, below I’ve listed

Dave Ramsey’s recommended budget guidelines. These are broad categories that can be broken down further if needed:

Remember, your numbers will likely not fall exactly within these guidelines, and that’s okay! Every person has a unique situation with unique needs. These are meant to give you a point of reference– nothing more :)

3. Set Financial Goals

Third, set your financial goals and put them in the budget. This is the major difference between living paycheck to paycheck and a zero dollar budget– your financial goals are being met.

Some financial goals might include:

- Invest 15% of take-home pay into tax-advantaged retirement accounts

- Have 3-6 months of expenses in an emergency fund (see more below)

- Pay off all debt as quickly as possible using the debt snowball method

- Save for a down payment on a home

- Save for a new (used) car replacement

- Kids college fund/school tuition

Keep in mind some of your goals will be a monthly expense (like investing), and some will be sinking funds (like a car replacement fund)– a separate, specific savings account that you carry the balance over from month to month.

Emergency Fund

An emergency fund is your financial security blanket— unexpected, large expenses become an inconvenience rather than a crisis. I find it necessary to stress the importance of having this be a financial goal, if you don’t already have this done.

Aim to set aside 6-12 months of household expenses in a separate savings account that is easily accessible. Household expenses include all necessities (food, utilities, transportation, housing).

4. Prioritize Expenses

The next step is to prioritize your expenses. Necessities should be budgeted for first, followed by irregular/seasonal expenses. Finally, budget for discretionary expenses, or the wants in your budget.

The point is to create a budget from your priorities. Is saving and investing a top priority? Budget for investing before budgeting for recreation, dining out, etc.

5. Zero Based Budget

At this point, it’s time to adjust your numbers until total income less total expenses equals zero. Chances are, the first time you go through the budget it won’t look how you want. That’s ok! Keep adjusting numbers until you get it as close to what you want as possible.

If your budget comes out with a negative balance, you are spending more than you make and you’re going to have to either cut expenses or increase income.

Any extra money left at the end of the worksheet should be allocated to a budget category. Leftover money should not be considered "slush funds."

No matter what, at the end of the worksheet your budget balance should be a big zero!

6. Paycheck Schedule

Creating a paycheck budget schedule will help you break down your monthly budget into smaller, more manageable chunks. A monthly budget works great for those who are paid once per month. However, if you are paid weekly or biweekly, it can be confusing to try to get your pay schedule to line up with your budget.

- Step 1: Make a separate column for each paycheck at the top of your budget worksheet. If you are paid bi-weekly, you'll have two columns. If you are paid weekly, you'll have 4-5.

- Step 2: Grab a blank calendar and write your bills and paychecks on it. For each expense that has a due date, assign it to a paycheck before that date. For larger expenses (such as rent/mortgage), break it up into multiple paychecks to keep even cash flow. For variable expenses (groceries, restaurants, gas/fuel, etc.), it might be helpful to break these down into weekly amounts.

- Step 3: Allocate discretionary/flexible expenses last. Simply plug those into wherever they fit.

- Step 4: Budget every single paycheck down to zero. Just like we’re doing with the big-picture monthly budget!

- Step 5: Once you are paid, consult your budget for that paycheck. Pay expenses that need to be paid with that paycheck, and earmark the rest of it for other expenses/goals.

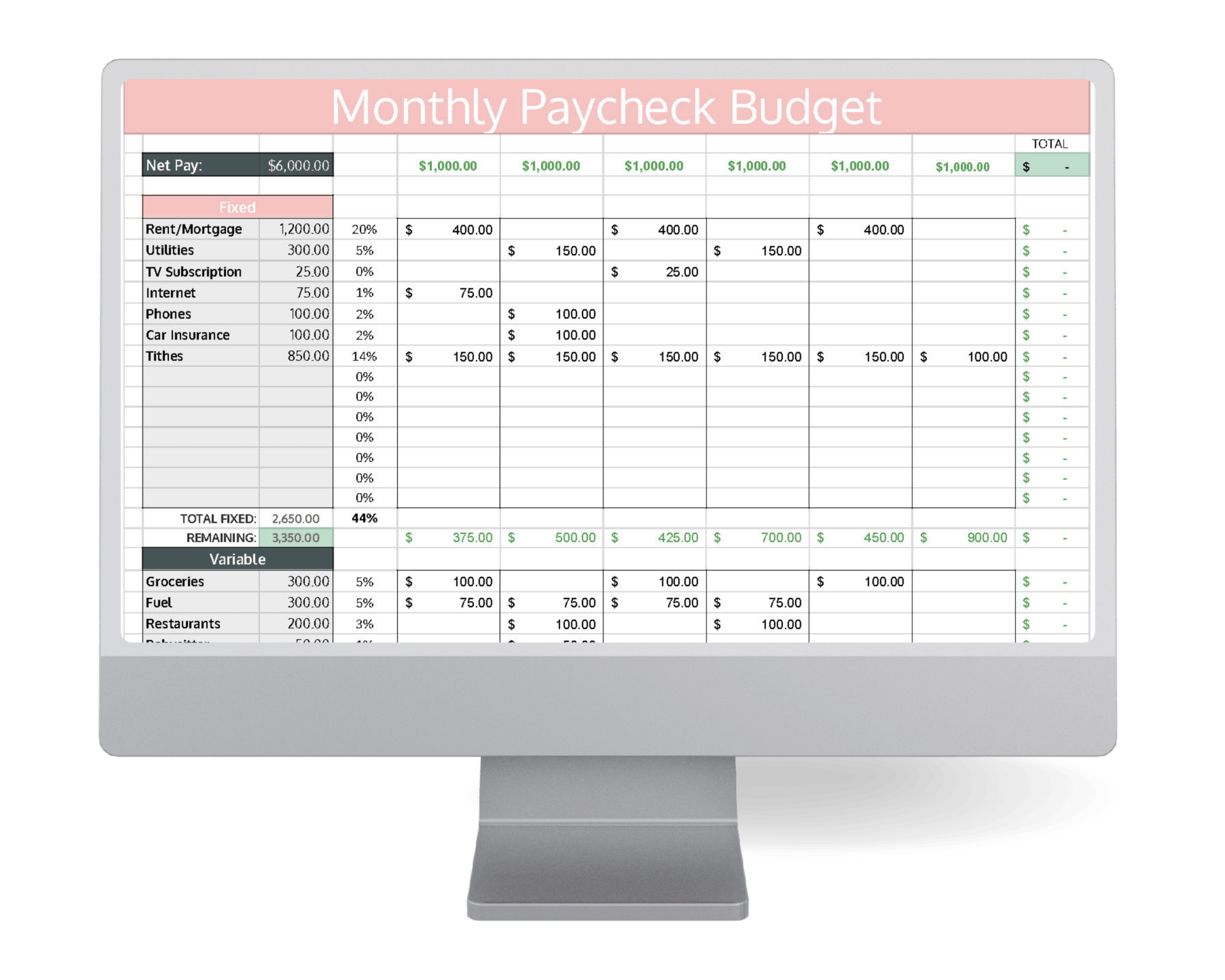

Here's an example of a paycheck budget schedule:

7. Track Spending

Finally, your budget is useless if you fail to track your spending throughout the month. the best way to track spending is to set aside time daily or weekly to update your budget for your month-to-date spending. This way, you know exactly how much you have left to spend for each budget category. No guessing!

8. Create a New Budget for Next Month

Resist the temptation to copy + paste your prior months budget the following month. Every month is different. Thus, every month requires a new budget! Once you get the hang of budgeting, you'll find your budget doesn't need as much tweaking month to month. But, this typically doesn't happen until months 3-6. Trust the process!

Can You Create a Zero-Based Budget with Irregular Income?

It is so important to budget especially when you have irregular and unpredictable income. Otherwise, your finances become haphazard.

For irregular income budgeting, follow the steps above, but always budget for necessary expenses first. Then, in months that you have extra income, "catch up" your money goals like saving and investing. Still use your budget sheet as your guide and think over the long-term vs. the short-term.

Example of a Zero-Based Budget

I learn best by seeing and doing rather than simply reading. Therefore, I wanted to include an example of a zero-based budget so you can attach the concept to a picture.

FREE Zero-Based Budget Template

To help you in creating a zero-based budget, utilize one of the free budget templates below!

Best PDF Template

Sign up below to download my free pdf zero-dollar budget templates!

Google Sheets Template / Microsoft Excel Budget Spreadsheet Template

Create your own personal budget spreadsheet compatible with both Google Sheets and Microsoft Excel. This free budget template is the most popular monthly budget template on the blog! !

Share this post!