5 Simple Steps That Will Get You Out of Debt For Good

The absolute best way to get out of debt is to use the debt snowball method, made famous by Dave Ramsey.

Simply put, the debt snowball method is where you aggressively pay off your debt in order from smallest to largest, regardless of interest rate.

When you are in debt payoff mode, you should stop all saving and investing efforts.

Every single penny that isn't going to bills should be going to your debt, with a few exceptions.

WHEN SHOULD YOU START PAYING OFF DEBT?

You should not start paying off debt using the debt snowball until you have at least $1,000 in your starter emergency fund and you have created a monthly budget.

The best way to get results when paying off debt is to add your extra debt payments into your monthly budget.

A budget is the game plan for your money, an essential piece of your debt payoff strategy.

A budget is telling your money where to go instead of wondering where it all went.

If you aren't sure how to start a budget, check out the resources listed below!

Related Posts:

THE DEBT SNOWBALL METHOD

Personal finance is 80% about behavior and 20% about circumstances and math.

Dave Ramsey says, "the problem with your money isn't your math. It's the person in the mirror."

The debt snowball method allows you to stay motivated and feel like you can actually attack your debt, instead of looking at your total debt and feeling hopeless.

When you attack small debts first, you begin to see your plan working.

On the other hand, if you try and attack the largest battle first, you're more likely to quit.

Trust me, this method works! This is the method we used to pay off $20k of student loan debt in 12 months (while living on one income).

These are the exact templates we used to track our debt payoff progress, it helped me so much to have a cute visual reminder of how far we had come!

These templates are included in my Budget Bundle!

If we can do it, so can you!

Related Posts:

1. WRITE OUT ALL YOUR DEBT

Make a list of all your debt (with your spouse if married), excluding your mortgage.

It's important that you know exactly where things are.

Examples of debt that should be included in the debt snowball:

- Student loans

- Credit cards

- Payday loans

- Car loans

- Medical bills

- Home equity loans

Don't worry about paying off your mortgage early until you have a fully-funded emergency fund and you are saving and investing at least 15% of your gross income.

The purpose of this step is to make you face reality.

The truth is debt is one of the biggest financial roadblocks to wealth, and there is no such thing as good debt.

2. LIST FROM SMALLEST TO LARGEST

Next, organize your debt from smallest to largest balance, regardless of interest rate.

Paying off debt in order from smallest to largest rather than in order of highest to lowest interest rate seems wacky to most people.

But like I said earlier, money is all about BEHAVIOR , not math.

The benefit of paying off debts from smallest to largest is that you get small wins early and that taste of success is what gives you the power to stay motivated to finish the race!

3. MAKE MINIMUM PAYMENTS ON ALL DEBTS EXCEPT THE SMALLEST

Make the minimum payment on all your debts except the smallest one, throw any extra money you have leftover every month at your smallest debt.

This is where you need to get really, really intense. You can't be in "kind of" paying off debt mode.

The only way you're going to knock off your debt in a short time period is if you are all in.

That being said, there are a few ways you can increase your monthly income and start really building your snowball.

Find a Way to Make Extra Cash

When you are in debt payoff mode, consider picking up some extra hours at work or taking on a second job for the time being.

This is a temporary sacrifice that'll help you build your momentum.

I started paying off my student loans my second semester of my senior year of college. Although I had a job as an intern, I kept my retail job as well during this time because I wanted to throw as much as I could at my debt.

Sell Stuff

A quick, easy way to make some extra cash is to start selling stuff.

Sell your clothes you haven't worn in years, appliances in storage, the baby clothes you've been hanging onto, etc.... your spouse. You do you. Kidding.

Watch Marie Kondo, the only thing that will be left is your spouse.

You get the point. Whatever you can live without, sell it!

Cut Expenses

If you're in debt, you're broke and you need to cut out everything except the essentials.

After you've tracked your spending for a whole month, what areas need trimming? For most people, the highest areas of overspending include groceries, dining out, and recreation/entertainment.

Most importantly, get on a budget and track your spending, because that will save you the most money.

Next, find ways to save more money.

Cut the latte's down to one a week instead of a daily pit stop. Skip the fancy restaurant for date night and have date night in instead. Cut cable.

Related Content:

4. LET YOUR DEBT SNOWBALL ROLL

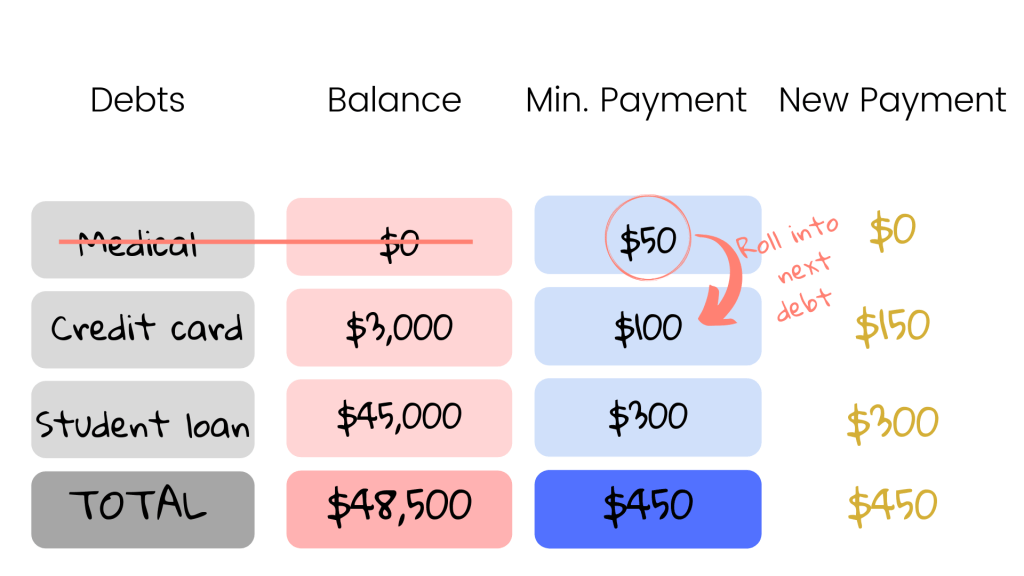

Once the smallest debt is gone, take that payment and apply it to the next smallest debt while continuing to make minimum payments on the rest.

See this illustrated in the picture below using the earlier example.

This is where the snowball begins to kick in, are you starting to see it?

Notice the minimum payment on the debt that was paid off is now applied to the next largest debt.

One the credit card debt is paid off, the new payment on the student loan would be $450 (plus any extra money you can find to throw at it).

Using the snowball method allows you to gain momentum as you go, fueling you to knock out the largest debt last and in the fastest way possible!

You can use this nifty debt snowball calculator to find out when you'll have your debts paid off if you pay extra every month!

5. REPEAT UNTIL ALL YOUR DEBT IS PAID IN FULL

Keep snowballing your debts until you are completely debt-free (except your mortgage)!

Depending on how much debt you have, this could take quite a bit of time.

For some families is takes a year, and for others it takes seven years.

There are lots of different factors affecting your debt payoff timeline, including your income, commitment, and how much debt you are starting with.

Without a doubt the most important factor in how fast you become debt-free is your commitment level.

Are you wiling to stay the course?

STAYING MOTIVATED WITH YOUR DEBT SNOWBALL

Getting into debt is really freaking easy, but disciplining yourself is not. You aren't just going to walk out of debt like you walked into it.

- Create visual reminders

- Write down/remember your "why"

- Stop comparing yourself to others

- Give yourself a small reward whenever you pay off a debt

- Find people who encourage you and hold you accountable

When we were in our debt snowball period, I created visual reminders and taped them to our fridge.

Whenever a debt would be paid off, I would also tape the "loan paid in full" notice to our fridge.

It's the small things, friends :)

Share this post!