retirement

How to Retire Well

When it comes to retirement sometimes we don’t know where to start. Here are a few ways you can start thinking about retirement.

retirement tools

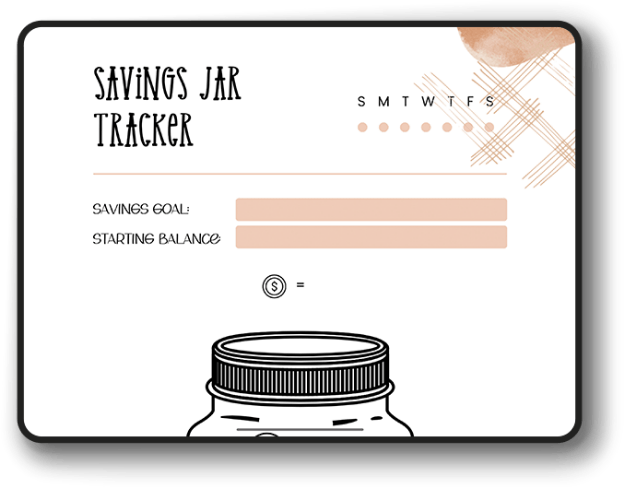

Freebies Made For You

Savings Tracker

A key part of hitting goals is writing them down, and being reminded of them every day. A visual reminder is a great way to motivate yourself to hit your goals every time! Use this free printable savings tracker to track your progress towards your money goals!