Why You Need to be Saving For Retirement Now [+ What Percentage to Save]

According to a survey by Nationwide , the average age American workers start to begin saving for retirement is 31 years old. The issue is most Americans don't realize how much of a difference time (starting earlier) makes in investing.

Furthermore, the same survey found that only 22% of employees say they feel prepared for retirement.

The truth is, when it comes to retirement planning, most Americans don't know where to start.

In their defense, retirement planning is not taught in high school or college (unless you’re majoring in a related field). They simply think social security + whatever they can save here and there starting in their 30’s will sustain their current lifestyle in retirement. Then, they’re surprised when they have to keep working well into retirement and/or majorly downgrade their lifestyle in their later years.

Additionally, many Americans would rather keep their current high-consumption lifestyle rather than saving for retirement.

They say there’s never any money left over at the end of the month, yet they live in a house with a mortgage that takes half their monthly income and a car payment that’s close.

So, where do we start?

The first step is to decide to take responsibility for your financial future. YOU are in charge of when you retire, how much you have in retirement, and whether you get there.

Second, start learning. My goal is to help you understand how you can set yourself up for financial peace both now, and later.

Let’s dive in!

⭐️ Related Posts:

- What You Need to Know About Retirement Planning

- Roth vs Traditional IRA: What's Best

- 5 Best Investing Tips

Saving For Retirement (What, Why, How)

When to Save?

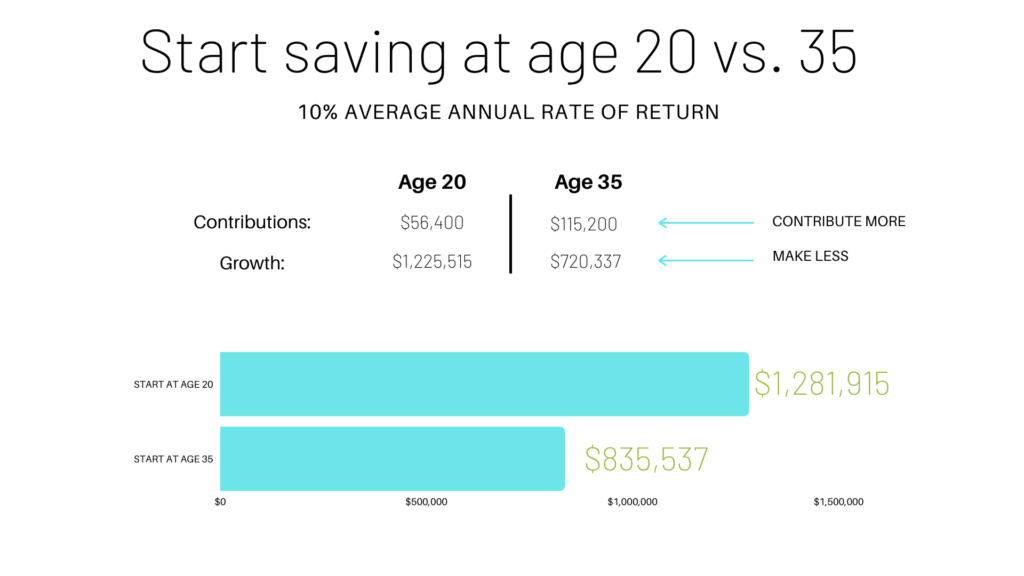

If you commit to start saving for retirement early on, it can pay huge dividends. Even if you invest a smaller amount of money in total than someone who starts late, a 10-year head start can mean you end up with more money than they do at retirement.

For example, if you start saving $100 per month starting at age 20 and ending at age 67, with a 10% average annual return, you’d have $1,281,915. On the other hand, if you start investing at age 35 and contribute $300 per month until age 67, with a 10% average annual return, you’d have only $835,537.

Although you tripled your contribution amount in the second scenario, you were still worse off in the end! Starting 15 years earlier made a difference of $446,378 – nearly half a million dollars!

Hopefully you can see that investing early pays massive dividends later in life!

I truly believe ANYONE has the ability to retire a millionaire, if they are willing to delay their gratification, practice self-discipline, and be consistent.

I’m not saying this is an easy task, but I am saying it will be worth it!

If You’re in Debt

Getting out of debt is foundational to building wealth. For this reason, if you’re in debt it’s a good idea to pause saving for retirement. This allows you to wholly focus on getting out of debt as fast as possible.

Although this defies mathematical logic, it goes hand in hand with behavior logic.

Research shows we are more productive and efficient when we focus on one thing at a time.

If you simultaneously focus on paying off debt quickly and investing, you won’t reach either goal as fast as you would if you focus on each separately.

Like many other things, personal finance is 80% behavior and 20% situational. We make progress in our personal finances when we change our beliefs and behaviors about money.

To change our behavior, we need to focus on the psychology of money.

This is why you pause all retirement saving (yes, even if you have an employer match), because studies show your BEHAVIOR will change dramatically if you focus on one goal at a time.

In The Baby Steps

Our family follows Dave Ramsey’s 7 Baby Steps to Financial Peace. These steps have changed our life! Here’s where investing fits in the steps:

- Save $1,000 Starter Emergency Fund

- Pay of All Debt

- Build Emergency Fund to 3-6 Months of Expenses

- Invest 15% of Your Gross Income for Retirement

- Save for Kids College

- Pay Off Your Home Early

- Build Wealth & GIVE

After paying off all non-mortgage debt, focus on saving. Then, once you build a solid savings cushion, focus on investing.

Note that baby steps 4-6 are done simultaneously. In other words, any extra money left over after investing should go to kids' college (if applicable) or extra mortgage payments.

How Much Will You Need?

The short answer: it depends. The better answer? More than you think!

If I’m being honest, I see myself taking a few vacations a year, visiting my grandkids often, and treating our family to some getaways. In addition, I’d love to be able to be outrageously generous to our church, missions, and various faith-based ministries. I’d love to bless people.

I look forward to (Lord-willing) seeing the fruits of my labor. Does this make me greedy? I hope not! The Bible says,

A good man leaves an inheritance to his children's children, but the sinner's wealth is laid up for the righteous.

Proverbs 13:22

It’s important to note that Proverbs is a book of principles, not promises. As a general principle, if you’re disciplined, you will be rewarded! However, this is not promised. Either way, our faith and hope should be in Jesus Christ- not our riches (or lack thereof).

Money is a TOOL to be used to the glory of God!

This doesn’t mean we idolize money, retirement, or enjoying life. It should not be our treasure (Matthew 6:21). Rather, we find a healthy balance between enjoyment of, but not worship of, the money we’ve worked hard to multiply.

If you’re a believer, your money doesn’t belong to you. It belongs to the Lord, who graciously provides our needs. You and I are simply stewarding the money God has entrusted us with.

This is no light responsibility- and we shouldn’t treat it as such!

We should be intentional with our money, so that we glorify God. Having a plan for retirement is a way we can be intentional with our money, making what God has given us go as far as possible, and bless as many people as possible!

What Percentage of Your Income Should You Save?

As a rule of thumb, you should aim to save 15% of your gross (pre-tax) income every year. Do not consider any employer match, that is just a bonus. The employer match portion is not considered in your 15% calculation.

Another common mistake is bad math. I often get asked questions like, If I defer 6% of my income for retirement at my job and my husband defers 6% at his job, we’ve hit 12% retirement savings, right?

Wrong. If both spouses defer 6% of their income for retirement into a 401(k), they are saving 6% of their income. Both spouses need to defer 15% of their income in order to hit the 15% savings goal in total.

Where Should You Keep It?

You can keep the money in your 401k (employer-sponsored retirement account), or an IRA (Individual Retirement Account NOT related to your employer).

Within both these forms of retirement accounts are two main types of retirement accounts – Roth and Traditional accounts.

For purposes of this post, I’m not going to go into detail about the differences between a Roth IRA and a Traditional IRA. However, note that for MOST people, a Roth IRA is a better option than a Traditional IRA. The reason being money contributed to a Roth IRA GROWS tax-free and is never taxed when distributed in retirement. For a more in-depth explanation of the advantages and disadvantages of each, read this post.

If you’re employer has a Roth option, you can keep the full 15% there! You should at least defer the amount of the employer match available (regardless if you have the Roth option), because this is FREE money. You never want to leave free money on the table.

For example, if you’re employer doesn’t offer a Roth option (very uncommon), but will match up to 3% of employee contributions, you would want to contribute 3% to your Traditional 401k. For the remaining 12%, if would be advantageous to open a Roth IRA (if you meet the eligibility requirements) and get to 15% total contributions that way.

Kapeesh?

A NOTE ON STOCKS

Personally, we do not invest in single stocks. Rather, we buy mutual funds (groups of stocks designed to diversify risk).

Investing in single stocks means you buy a single share (stock) of a company in hopes of making a short-term profit. The goal of stock trading is to buy the shares of the company at a low price, and then sell at a high price.

Because you are chasing a short-term profit with stocks, you will have to bear a lot more risk than mutual funds.

You might make a big-time profit with one stock, but then lose your butt on five others.

It’s more of a gamble with your money. I refuse to gamble with money I’ve worked so hard for. I’d rather build wealth slowly but steadily and learn patience and the value of consistent discipline.

In my humble opinion, playing the single stock game is just another get-rich-quick scheme.

Be leery of these schemes. The Bible warns against hastiness:

The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.

Proverbs 21:5

I’ve heard it said the best way to get rich quick is little by little. Proverbs reiterates this:

Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.

Proverbs 13:11

While people do get rich quickly, they are often the exception to the rule. For example, those who put their life savings in Netflix or Walmart when they were start-up companies aren’t hurting for money right now. However, they made a gamble. They put all their eggs in one basket. While a few make it big, the majority end up worse-off or just break-even.

How Do I Save 15% When It Seems Impossible?

Ok, now you might be thinking... how in the world am I supposed to save 15% of my gross income? Don’t you know the government takes half of it?? Yes, I do know, by the way 😉

If your gross household income is $80,000 per year, 15% of that is $12,000 per year, or $1,000 per month.

Ouch! Depending on your location, family size, and current lifestyle habits, that can seem nearly impossible.

It's not! As our family grows in size, hitting the 15% mark every year sometimes gives me anxiety! But we've decided (my husband and I) that saving for retirement is a top priority.

We're willing to do without right now so we can have more later.

Here are some tips to help when it seems like an impossible task:

- Live on a household budget. An important step to creating a plan for retirement is to create a plan for right now. If your monthly spending is a free-for-all, it’s going to be really hard to hit your 15% retirement savings goal.

- Set up an automatic withdrawal. This is one way to hold yourself accountable. Make your retirement contribution an auto-withdrawal from your checking account and/or paycheck.

- Pinpoint what is taking up large chunks of your income. Do you have an expensive vehicle with a large monthly payment? Are you house-poor? What’s suffocating your finances?

- Where can you trim down? Identify budget categories that can be easily manipulated or trimmed down. Start with groceries. Most families WAY overspend and/or are extremely wasteful when it comes to food. Begin meal planning, buying in bulk, price comparing, etc.

- Make incremental changes. If you currently save $100 per month, but 15% of your gross income is $600 per month, don’t try to make the swing at all once! It will be hard to stick with the plan if you do it this way. Instead, make small changes every month, giving yourself time to deal with adjustments.

Remember, getting to 15% savings may require significant sacrifice and major behavior changes. If you’re used to spending 85% of your paycheck, it’s going to be a hard adjustment!

Share this post!