How to Prepare for An Emergency on a Budget

If you're an everyday person who wants to know how to prepare for an emergency without being overwhelmed, you're in the right place.

First, I'd submit to you that if you're a believer in Christ, we don't need to worry about what could happen and when . We have comfort that nothing in this world can thwart God's plan for our lives. That's not to say that we don't have any responsibility and don't need to take action. Rather, trust God to guide your steps and act in wisdom.

That being said, that's what I'd like this post to offer to you- a practical, helpful beginners guide to preparing for an emergency!

In a financial context, many fear financial disasters that take away their security blanket. For example, a stock market crash that never rebounds. There is an extremely low probability the stock market will plunge to zero. However, because of this, it's wise to have an emergency fund.

Similarly, while the probability of your family having to take cover in your basement for 3 weeks is extremely low, it's wise to prepare practically. The key word is practically.

One one hand, you can live carelessly with no plan. On the other hand, you can live like everyday is the apocalypse. Neither are great options!

The goal of this post is to be less scared , more prepared. Continue reading to learn how to prepare for an emergency on a budget!

THE BASICS FOR BEGINNERS

The goal of emergency preparation is to limit disruption to your life and recover quickly. That's it. The goal is not to have an underground bunker you can survive in for 10 years! You can certainly do this, but that is not the goal.

To start, you need answers to a few key questions. How much do I need? Where should my focus be? Where do I start?

Let's dive in.

HOW MUCH?

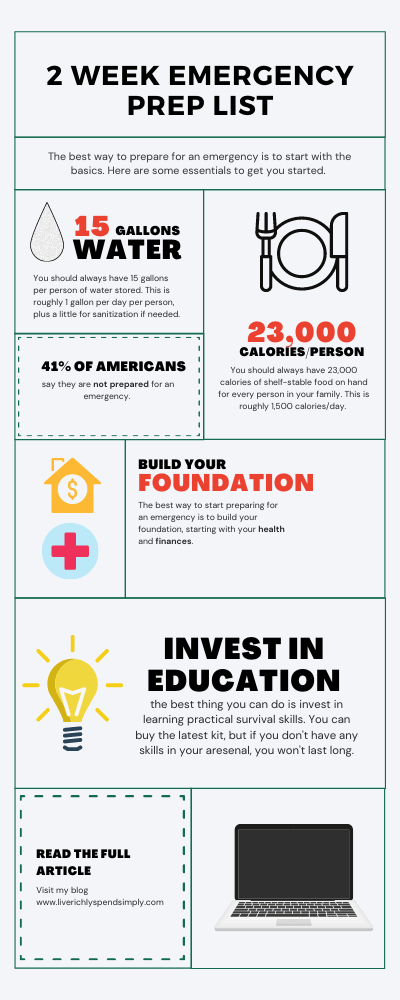

According to theprepared.com , you should have adequate supplies to survive two weeks. Furthermore, the goal is to survive with no outside help , including electricity, water, gas, communication, internet, etc.

This means you need supplies adequate for two weeks of survival. This translates to:

- Water: 15 gallons/person (1 gallon per day + a little extra)

- Food: 23,000 calories/person (1,500 calories per person per day)

Does that seem like a lot? You need more than you think you do! The good news is water is cheap. The bad news is food is not ;)

WHAT SHOULD I FOCUS ON?

You can survive weeks with food (though not recommended). On the other hand, you can survive only 3 days without water. Consequently, focus on water. Yes, water can be a pain to store! However, it's essential to survival.

WHERE DO I START?

Start with education . Next, build your foundation (finances + health). Last, build your supply .

The most powerful tool in your arsenal is knowledge. Instead of grabbing a checklist off the internet and spending $500 at Costco, research and learn from experts! What is essential, what skills can you learn, and what is the best route?

The best way to prepare for an emergency is to have the skills necessary to survive.

You're better off knowing how to hunt than knowing what to buy.

11 HACKS TO PREPARE FOR AN EMERGENCY

1. BUILD A SOLID FINANCIAL FOUNDATION

The truth is most emergencies are financial or medical . The probability of experiencing a financial or medical crisis is far greater than a natural disaster. Still, financial security is not a priority for Americans. In fact, studies show over 70% of Americans live paycheck to paycheck and could not cash flow a major financial emergency.

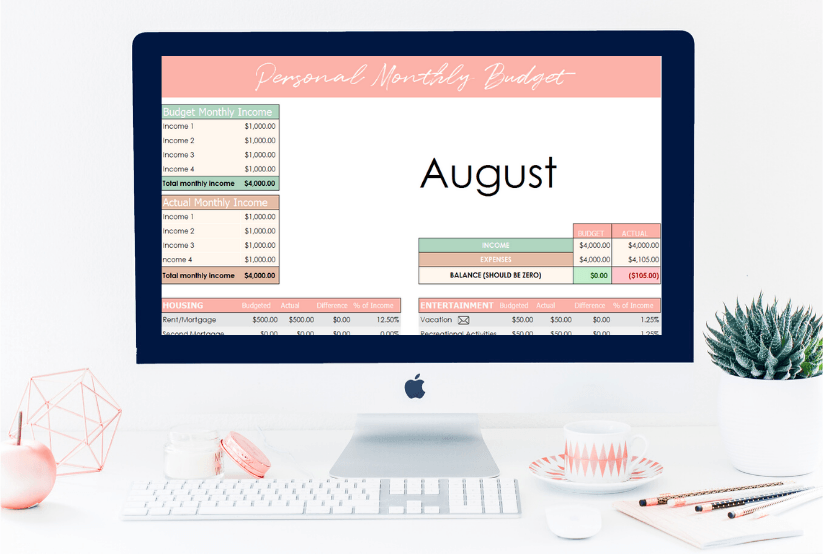

You NEED a financial plan that includes a budget, debt elimination, and saving for retirement.

PREPARING YOUR FINANCES

To prepare for an emergency, prepare your finances. Here's how.

- Create a monthly household budget. You must know where your money is going. Without this information, making a plan is nearly impossible. Be intentional about how much you are spending and where. Get started with a budget template here!

- Avoid debt at all costs. Your income is your most powerful wealth building tool. It's difficult to save and build wealth when you're a slave to monthly payments. If you have debt, pay it off aggressively using the debt snowball method.

- Set aside 3-6 months of household expenses in an emergency fund. With a stable income, 3 months is likely enough. In contrast, self-employed business owners will need closer to 6 months. It's not a question of if , but rather when a financial emergency will come.

- Plan for retirement now. Don't put it off! A potential financial crisis could be that you are not able to retire! Social security (if it's not bankrupt) is not adequate to sustain you in retirement.

- Don't bite off more than you can chew. Are you living within your means? Irregardless of your income, you need to live within your means. A large income does not equate to wealth. In the same way, a nice house or car doesn't equate to wealth. Rather, living on less than you make, and thus, giving yourself a lot of breathing room to save and invest creates wealth.

This list is overwhelming if you do not have a solid financial foundation. Rather than trying to attack all at once, focus on one step at a time.

What is your biggest financial hurdle?

Focus on that first.

⭐️ Get 20% off any of my budget tools when you subscribe to my email list

2. TAKE YOUR HEALTH SERIOUSLY

In addition to your finances, your health is an essential foundation to survival. Americans have extremely poor health habits, putting themselves at great risk of a medical emergency.

What's the best way to protect yourself from developing heart disease or diabetes? Eat healthy and exercise. In the same way, eating a healthy diet and exercising regularly essential to avoiding a medical emergency.

Furthermore, being healthy will increase your chances of surviving a non-medical emergency. If you struggle to walk up stairs, have addictions, and/or require a lot of prescriptions because of poor health, it will be hard to survive any emergency.

Make your health a priority!

If you have not made your health a priority, start with small, daily habits:

- Walk 20-30 minutes everyday or a few times per week

- Cut down your fast food trips

- Take a daily multivitamin

- Use the stairs instead of the elevator

- Drink 8 glasses of water or more per day

As you master small habits, challenge yourself to do more!

3. START SMALL

Small, simple steps will go a long way for emergency preparation. It's tempting to blow your savings spend a couple grand on emergency supply kits and call it good. This is not an effective way to prepare for an emergency! Take your time to research what you really need.

Then, start slowly purchasing supplies based on your research. Resist the urge to rush and buy hundreds of supplies in one weekend!

4. BUY IN BULK

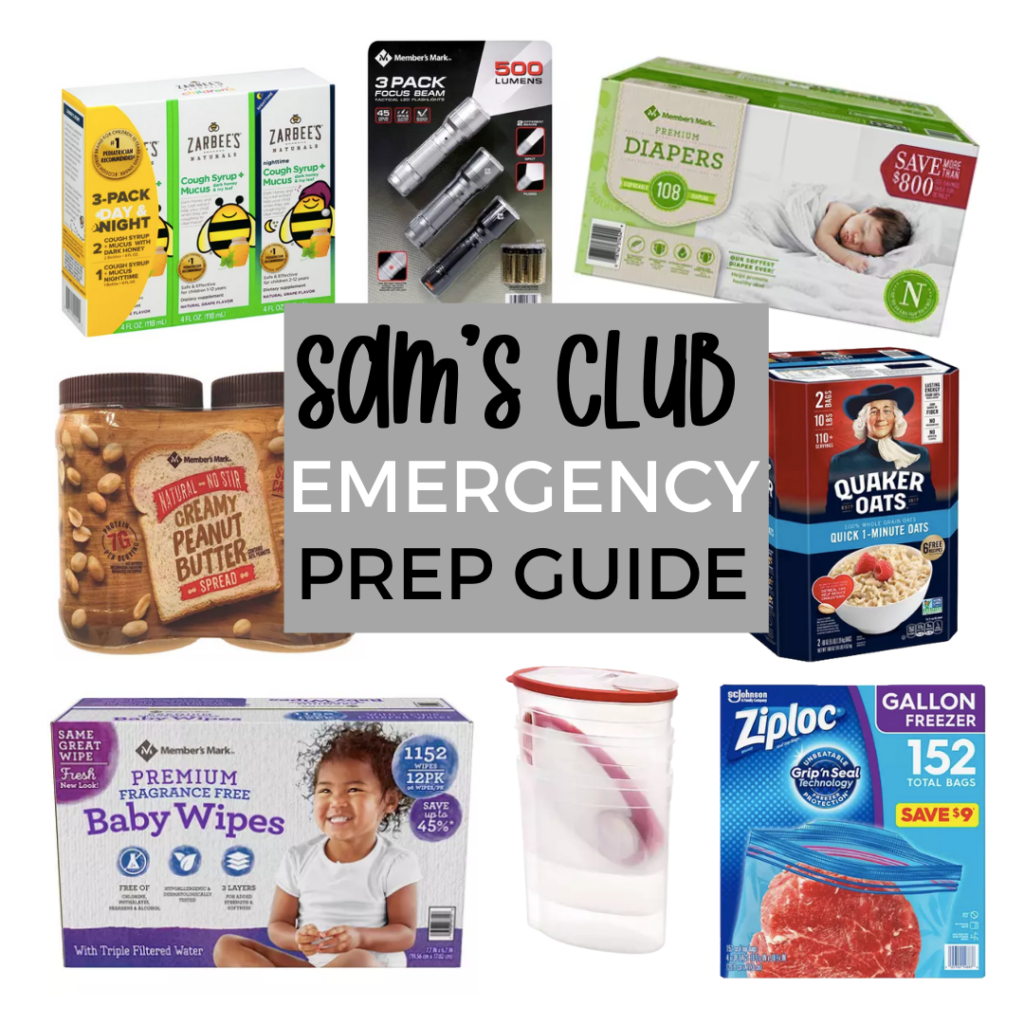

As a general rule, you save money buying in bulk. For this reason, I shop at large supply stores like my local Bomgaars, Walmart, Sam's Club, and Costco.

This is what I bought from Sam's Club for our emergency supply:

I budget for emergency supplies and only make purchases when the money is available. I do not EVER use money from our savings or a credit card.

5. CALCULATE & CUSTOMIZE TO YOUR FAMILY

Be sure to customize any checklist you use to your family size. Then, buy in bulk if necessary.

6. FOCUS ON QUALITY OVER QUANTITY

It is better to buy quality items that will work properly when you need them than cheap gear that doesn't work properly. If you are ballin on a budget, buy what you can afford.

Do not go into debt to build an underground bunker!

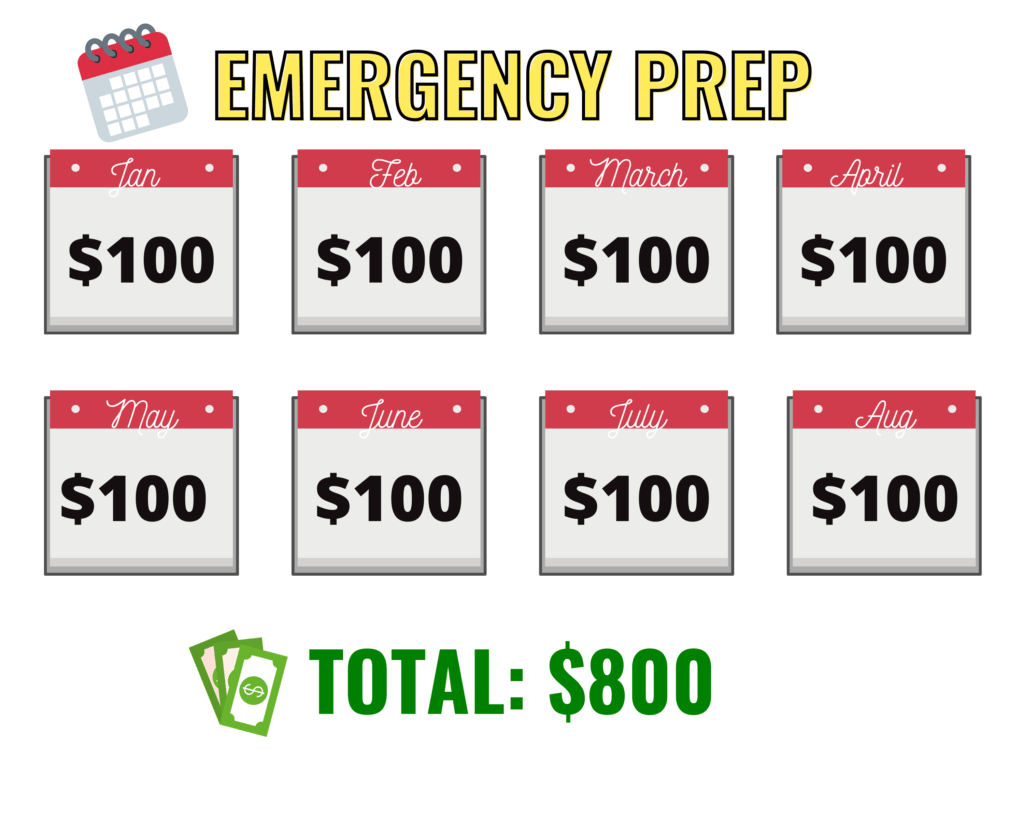

7. MAKE A SINKING FUND

When I started researching emergency preparedness, I quickly realized that I was very unprepared. Because of this, I started budgeting for the supplies and created a sinking fund.

A sinking fund is simply a specific and measurable way to save money for a period of time. For example, if your emergency stockpile is going to cost $800, set up a sinking fund with an $800 goal. To do this, add a line item to your monthly budget for emergency prep. If you have room for $100 per month in your budget, you start saving and in 8 months will have a fully funded sinking fund.

We set up sinking funds for any irregular or seasonal expenses. Examples of other expenses you can create a sinking fund for include car repairs, home repairs, annual or semi-annual insurance premiums, etc.

You can purchase items as you go, just don't spend more money than is in the fund at any given time.

8. KEEP IT SIMPLE

You're either going to be in your home, leave your home, or be away from home. Don't overcomplicate how you prepare for an emergency by creating a million different scenarios in your head.

Prepare for:

- 2 week emergency supplies for your home

- 3 day evacuation supplies

- Be able to leave on a moments notice

Prepare for these situations, not the zombie apocolypse.

9. START WITH THE MOST LIKELY SCENARIOS

Don't prepare for irrational, unlikely scenarios. You'll waste a lot of time. Instead, ask yourself key questions to prepare for an emergency in your area.

- Based on where I live, what kind of disaster am I most susceptible to (hurricane, earthquake, tornado, etc)?

- What supplies will I most likely be in need of in this situation?

- What is the best escape (or other) plan for my family if this were to occur?

Answers will vary based on geographical location. Start by preparing for scenarios that have the greatest likelihood of occurring.

10. PRACTICE MAKES PREPARED

Learn and practice survival skills. If you've never handled a gun before, take a gun safety class. Ask a friend to shooting at the range with you. Learn how to quickly and effectively load a gun. My parents taught us how to shoot and properly handle guns. As a result, now that I have my own handgun, I'm more comfortable than most.

The more survival skills that an individual has that have been practiced physically or otherwise, the better odds they have for those skills coming to the forefront during a stressful emergency.

CODY LUNDIN

If you don't know much about hunting or growing your own food, start learning.

Similarly, if you don't camp often, take a camping trip. Learn how to make food with only hot water. Practice making a fire.

Think of skills that are essential for survival and practice .

Learning skills will get you a lot further than a bucket of gear in the closet.

11. sHELF-STABLE FOOD LIST ON THE CHEAP

You can easily create an emergency food supply on a budget! Whether you're working with $500 or $50, you can start small and make your money go as far as possible when creating your emergency supply. Here's what you need.

I created this list from this article.

BUDGET EMERGENCY FOOD SUPPLY IDEAS

Grains:

Rice, rolled oats, all-purpose flour, pasta, quinoa, cornmeal, instant mashed potatoes

Beans:

Pinto, black, navy, kidney, lentils, lima, chickpea

Fats:

Olive oil, shortening, vegetable oil, peanut butter, coconut oil

Protein:

Canned tuna, canned spam, canned chicken, sardines

Spices:

Salt, sugar, honey, white vinegar, apple cider vinegar, soy sauce, garlic powder, Italian seasoning, garlic powder, chili powder, paprika, coriander

Baking:

Powdered milk, baking soda, yeast, powdered sugar, vanilla extract

Fruits & veggies:

Anything canned or dried

This is not meant to be a comprehensive list, but is a great place to start on a budget!

BONUS: EMERGENCY CHECKLIST IDEAS

While checklists are helpful, invest in education first.

This is not an exhaustive list. You know what your family needs better than anyone, this list is just a starting point.

EMERGENCY HOME CHECKLIST:

- Food & Water:

- 15 gallons water/person (you'll need some good water storage containers)

- 25,000 calories/person of shelf-stable food

- Manual can opener

- Water filter

- Fire:

- Lighter

- Matches

- Light:

- Batteries

- Flashlights

- Headlamps

- Power:

- Solar chargers (These are very affordable)

- Generator

- Heating & Cooling:

- Blankets

- Fan

- Shelter:

- Tarp

- Duct Tape

- Medical:

- First aid kit

- Prescriptions

- Tylenol & Ibuprofen

- Other:

- Cash

- Guns & ammunition

- Zip Ties

- Axe

- Work Gloves

- Wrench or pliers (to shut off utilities)

- Important documents (deeds, titles, birth certificates)

- Board games, cards, books, etc for mental health

Hopefully you now have a good place to start your prepping! This post is a rational, practical, guide for normal people who simply want to be more prepared. NOT scared.

Ultimately, I know that while it's helpful to prepare for an emergency, my days are already planned out by the sovereign Lord and ruler of the universe! This brings me tremendous peace. No matter what, his plans will not be thwarted. He sits on the throne, and nothing happens outside of His will.

Your eyes have seen my formless substance;

And in Your book were written

All the days that were ordained for me ,

When as yet there was not one of them

Psalm 139:16

Share this post!