How to Make a Budget in Excel + Free Template

Creating an excel budget not only saves you time, but it gives you flexibility to open and see your budget no matter where you are! Excel is an extremely handy tool, but it can be intimidating. Don't give up just yet- I'm going to walk you through how to make a budget in excel step by step.

You don't need to be good with numbers OR technology. Budgeting is for everyone- and I truly believe if you stick with the process, you will end up loving budgeting in excel. Once I started, I never went back!

I keep our personal monthly budget in google sheets, and you can get the exact template I use here.

Why a Budget is Important

Budgeting is a crucial part of financial planning, giving you control over your money instead of your money controlling you. While it sounds restricting, it's the exact opposite-- it gives you freedom to spend your money without guilt knowing you have a plan for every dollar.

If you've found yourself guessing how much money you have left to spend until the next paycheck, or you're using a credit card to fill the gap between income and expenses everything month, it's time for a budget!

A budget allows you to align your priorities with your finances. Many times, the level of our frustration with our money is the difference between what we want our money to do and what it's actually doing. Budgeting will help you bridge the gap between the two!

How to Make a Budget in Excel (Step by Step)

1. Get the Free Excel/Google Sheets Budget Template

First, get the download link to my free excel/google sheets budget template by signing up above, or clicking this link. Either way you will be able to download the free spreadsheet.

Next, we're going to get down to business and start customizing the template to fit your needs!

2. Fill in your income.

First, list your total expected take-home pay for the month you are budgeting for. This is relatively straightforward-- simply write your total household income at the top of your spreadsheet/worksheet.

If your pay is irregular-- like if you're a business owner with unpredictable income-- budget based on your lowest expected take-home amount. The key with irregular/unpredictable income is to be conservative with your estimate!

3. List all your fixed monthly expenses.

Fixed expenses are expenses that don't change month to month, typically your bills. You know exactly how much they will be and when they are due. Examples include:

- Mortgage/rent

- Insurance

- Internet

- Phone

- Cable/TV subscription

- Car payments

- Student loan payments

Total your fixed expenses and subtract from your expected income. This is what you have left to budget with for your remaining expenses.

4. List all your variable monthly expenses.

Variable expenses are expenses that do change month to month, based on usage or another metric. List all your variable expenses on your budget worksheet and determine a max spending amount for each. You might need to review bank statements to help you get an idea of what you've been spending on each category. Don't guess! You want an accurate picture of your expenses.

Examples of variable expenses include:

- Groceries

- Gas/fuel

- Restaurants

- Recreation

- Personal

- Beauty

- Toiletries

- Household

- Babysitters

- Daycare

- Clothing

Most variable expenses are also considered discretionary, meaning they are wants rather than needs and therefore very flexible. You might want to note which expenses in your budget are discretionary so you can come back to them later and adjust if necessary.

5. Brainstorm and budget for non-monthly expenses using sinking funds.

You know those annoying expenses that you completely forgot about that come up at the worst possible time? Like your car needs new tires, then your annual insurance premium you forgot about is due, and your kids have sports fees due next week? When you're unprepared, everything seems to be happening to you. However, when you're prepared and unexpected expenses come up, it's just an inconvenience.

There is a way to plan for both expected and unexpected irregular (non-monthly) expenses. A sinking fund savings account is a strategic way to set aside money for future expenses by converting the expense to a monthly amount.

Here's how to set one up (follow along on Pinterest)

Related posts:

6. Put finance goals in the budget.

Saving and investing goals need to be a line item in your monthly budget. If you don't put them in the budget, they won't happen. If you bank on just using whatever you have left at the end of the month for saving and investing, you'll soon find there is never anything left over! Make it part of the plan. Automate it. This is an essential self-discipline to have with your finances if you want to build wealth.

7. Tweak and budget down to zero.

Give every single dollar a purpose on paper before the month begins. Don't leave any 'slush' funds. Purpose, purpose, purpose. Every single dollar has a purpose.

8. Establish a bill pay schedule.

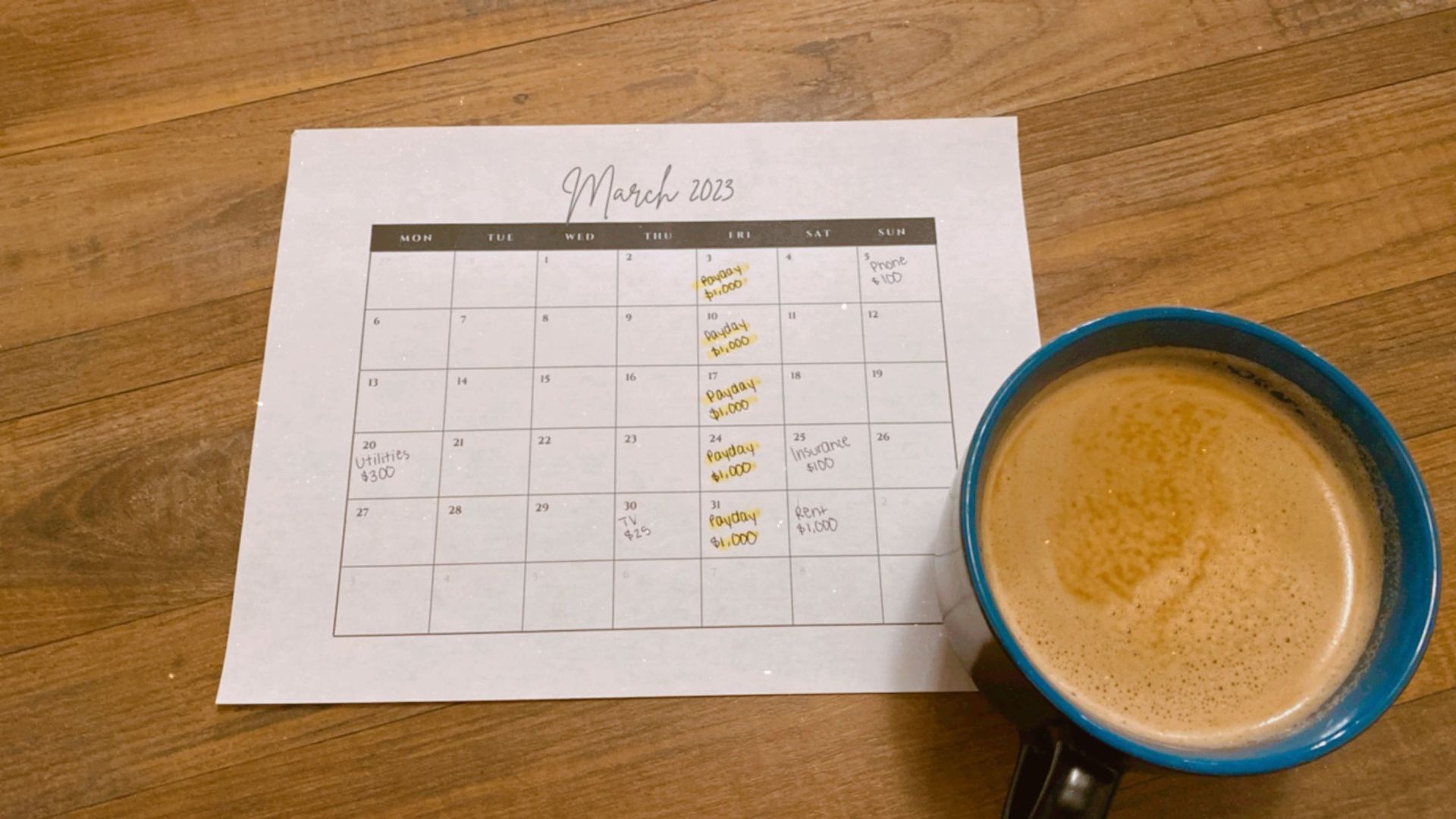

List all your monthly bills, the total amount, and due date on a blank calendar. Then, fill in all your paychecks on the date you expect to receive them. Highlight each paycheck a different color.

9. Assign each expense to one or multiple paychecks.

Take your budget a step further and allocate each expense to one or multiple paychecks. The paycheck budget method works great for anyone who is paid more than once a month. It helps take the big picture and break it down into smaller, more manageable chunks. If you're paid more than once a month, your expenses can't all come out of a single paycheck. You have to utilize a bill pay schedule to ensure you aren't spending money before you are paid.

- Step 1: Make a separate column for each paycheck at the top of your budget worksheet. If you are paid bi-weekly, you'll have two columns. If you are paid weekly, you'll have 4-5.

- Step 2: Refer to your calendar with your bills and paychecks on it. For each expense that has as due date, assign it to a paycheck before that date. For larger expenses (such as rent/mortgage), break it up into multiple paychecks to keep even cash flow. For variable expenses (groceries, restaurants, gas/fuel, etc.), it might be helpful to break these down into weekly amounts.

- Step 3: Allocate discretionary/flexible expenses last. Simply plug those into wherever they fit.

- Step 4: Budget every single paycheck down to zero.

- Step 5: Once you are paid, consult your budget for that paycheck. Pay expenses that need to be paid with that paycheck, and earmark the rest of it for other expenses/goals.

- Step 6: Update your budget for every single transaction, so you know exactly how much you have left for each budget category. It might be helpful to do this on a daily or weekly basis.

- Step 7: Keep a reconciliation of your budget balance to your bank account balance. This is especially important if you aren't using a budgeting software that automatically pulls in your transactions. When I was using the free version of the EveryDollar app, I kept a spreadsheet to reconcile my bank balance to my budget balance to ensure I didn't miss transactions.

For a more thorough explanation of this method, read my step by step tutorial of the paycheck budget method.

10. Track and adjust as you go!

Track your spending regularly. If you make a budget and don't look at it until half-way through the month or when the month is over, it's useless. A plan is only good if you execute it. Part of execution is daily or weekly tracking of your spending- and I mean tracking every single transaction. I recommend using an app to help you do this. The EveryDollar app has a intuitive, easy-to-use free version that works great for this!

Budgeting Pitfalls and Tips for Success

Many people quit budgeting because they become frustrated that it doesn't seem to be working as they hoped. However, usually all it takes is a few adjustments to get the budget in working order and have success. Below are the most common budgeting pitfalls I see. Be aware of them so you can assess whether you need to make some changes to the budget!

- Not having a clear picture of expenses. Review bank statements in detail as you're putting your budget together. You want a really clear picture of what it actually takes to run your household every month. Write down every single expense and categorize it. Don't leave any expense unaccounted for!

- Forgetting to budget for non-monthly expenses (both expected and unexpected). If there is one thing that's certain with budgeting, it's that you'll have expenses every single month that are unexpected. So are they really unexpected? For example, you can safely assume that at some point your home and car will need repairs, you just don't know exactly when. Instead of waiting for the expense to hit and bracing for impact, make a budget category for car repairs and put aside money for it every month, carrying the balance over month to month. This way, you don't have to attempt to cash flow the expense in a single month. If it's a really large expense, you'll probably end up using your emergency fund (see next pitfall).

- No emergency fund in place. Like budgeting, a healthy emergency fund of 3-6 months of household expenses is essential. If you have a large, unexpected expense, your emergency fund will turn a financial crisis into an inconvenience. Be sure to get this funded as quickly as possible- put it in the budget!

- Not updating the budget throughout the month. Successful budgeting requires you to be proactive in the budgeting process throughout the month. If you make a budget and don't look at it again until the end of the month, you'll be frustrated! Update your budget at least weekly for actual spending. This way, you know exactly how much you have left for each budget category until the end of the month.

- Being unrealistic. When people first start budgeting, they are often tempted to drastically cut their spending. As a result, they wind up frustrated when they are constantly over budget. If you're spending $800-$1,000 on groceries every month and you try to cut it to $350 in one month, you'll end up frustrated. Don't set yourself up for failure by being unrealistic.

- Spouses not being on the same page. If you're married, its important to be on the same page with your spouse. The budget won't work without them on board. You need to have a shared vision, goals, and mission. You can't budget alone and hope for the best.

- Impulsive spending struggles.

Whether you're a saver by nature or a spender, budgeting is for you! Don't think because you fall into either camp that you don't need a budget. It's essential to a healthy financial situation.

Share this post!