9 Creative Money Challenge Ideas [ + Free Savings Trackers ]

If you're looking for a creative, fun, and inspiring way to reach your money goals, a money saving challenge is the perfect solution! From the penny challenge to the $10k savings challenge, find a unique savings plan that fits in your budget.

Completing a savings challenge will give you some extra cash for breathing room in your budget, help you overcome impulsive spending habits, and put you one step closer to your money goals!

You can start a savings challenge at any time, you don't have to wait until January to hit the reset button. Maybe you have an unexpected expense coming due in the near future, or you're working the debt snowball plan and need some more cash for momentum. A savings challenge is a great way to stay focused and motivated on your goal.

9 Money Saving Challenges for Every Budget

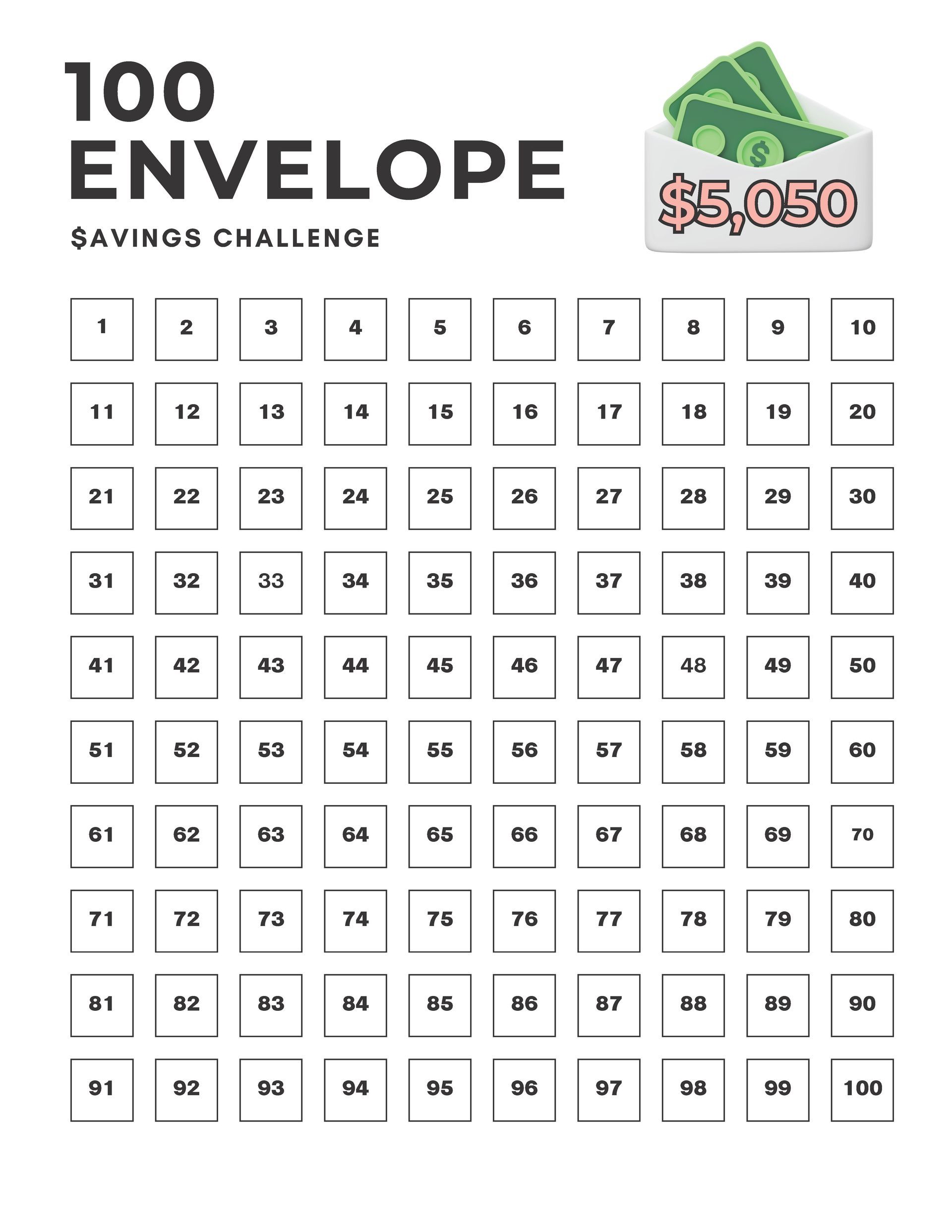

1. 100 Envelope Challenge

The 100 envelope savings challenge offers a simple and creative way to pile up cash over 100 days! Before starting the challenge, decide where you'll keep your funds. You can keep your cash in the envelope, make weekly deposits, or complete the challenge digitally. Ultimately, it depends on your spending habits and what you are comfortable with.

After determining where to keep your cash, follow these steps to complete the 100 envelope challenge:

- Grab 100 envelopes and label them 1-100. If completing the challenge digitally, open a separate savings account to deposit your funds into everyday.

- Put the envelopes in a bin, basket, or box and shuffle them.

- Randomly select an envelope from the basket, or go in order.

- Find a way to fill the envelope with cash, either by increasing income or cutting expenses.

- Repeat the process for 100 days.

- Determine what to do with the $5,050 savings!

100 Envelope Challenge Chart

2. 52 Week Money Challenge

Spin Off: Biweekly Savings Plan

Alternatively, if you have a biweekly pay schedule, you can complete the classic savings challenge in 26 weeks instead! To complete, you will save every other week instead of every week, in order to line up with your pay schedule. To do this, follow this savings pattern:

3. $1,000 in 30 Days Challenge

4. $10k Savings Challenge

5. Penny Challenge

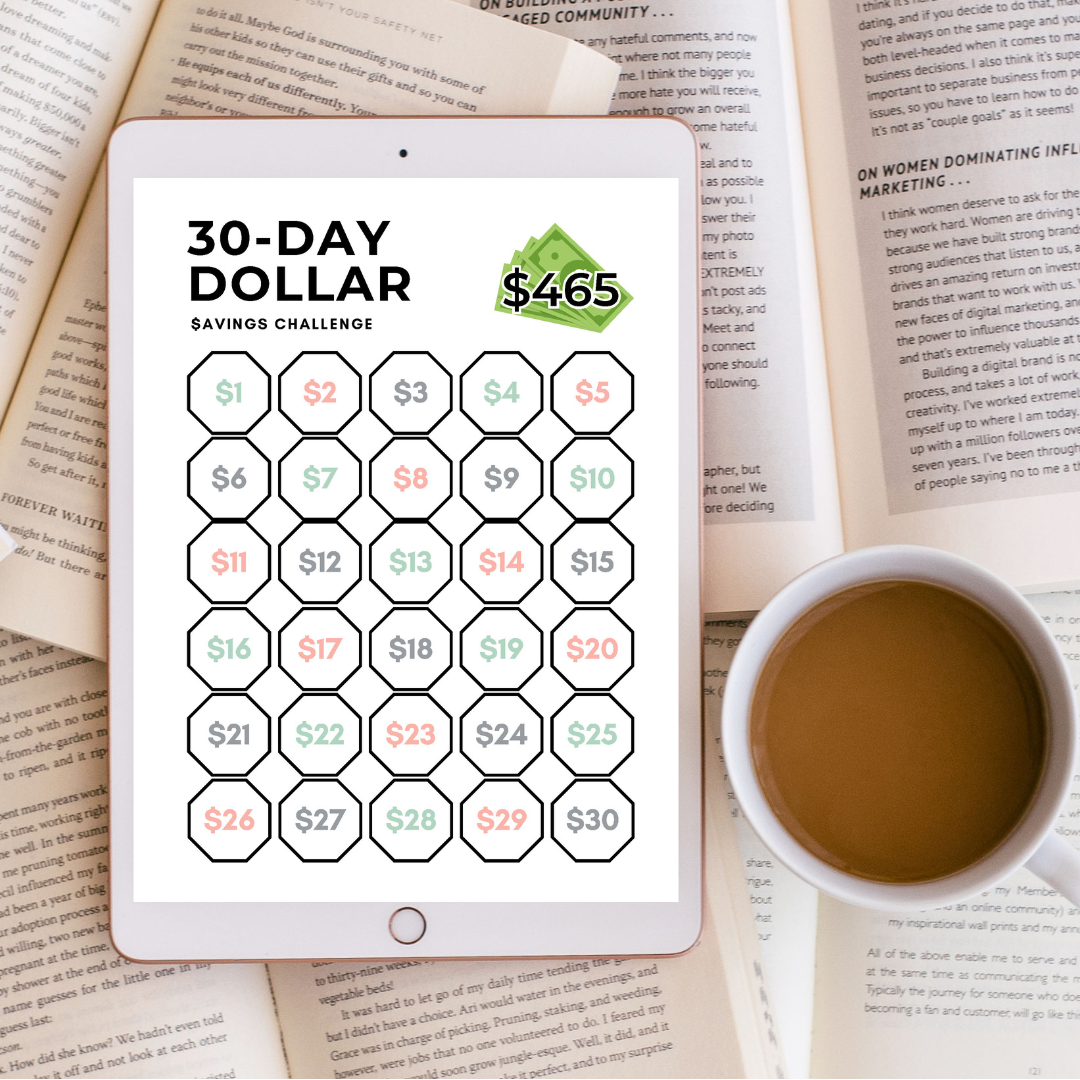

6. 30-Day Dollar Savings Challenge

7. $5k Bi Weekly Savings Challenge

8. No Spend Challenge

- Food (groceries)

- Transportation (gas/fuel, parking passes, insurances, etc.)

- Housing (mortgage, taxes, insurance, HOA fees, etc.)

- Utilities (electric, gas, sewer, water, trash, internet, etc.)

- Childcare (as required for work)

- Medical care

Obviously, more items will be on the necessity list for some people. The goal isn't to see how many items you can do mental gymnastics to move them from the non-necessity category to the necessity category. The goal is to challenge yourself and change poor spending habits! You know better than anyone what areas you struggle with impulsive or unorganized spending- don't cheat yourself.

9. Trim Your Salary 1% Challenge

Just as it sounds, to complete this challenge, determine what 1% of your annual income is, and set a goal to save that amount! The idea is to give yourself a 1% raise without making extreme budget cuts. Instead, break it down into smaller chunks by month.

For example, if you make $60k per year, 1% of your annual income would be $600. To save $600 in one year, you need to save $50 per month. Brainstorm and make a list of one or a few expenses you can cut each month of the year to save $50. Maybe one month you don't buy any new clothes. The next month, go out to eat two times instead of three. You get the idea!

You can cut the same expense every month, or you can change it up and cut/trim a different expense each month. Whatever works best for your personality and situation!

Tips for Success with Savings Challenges

Saving money doesn't have to be complicated. Some of my favorite ways to save money quickly include:

- Create a monthly budget. If you're not budgeting your finances every month, the first time you create a monthly budget it will feel like you got a raise! This is one of the simplest, quickest ways to find money to spare.

- Curb impulsive spending habits with cash envelopes. Studies show when we use cash to shop, we spend less than when we use debit or credit cards, because our willingness to pay goes down.

- Use a visual motivator. Keep a visual motivator like the savings challenge printable templates to help you stay focused on your goal. Fill in the shapes as you go so you're reminded of your progress.

- Cancel subscriptions. One of the quickest ways to save money is to evaluate all your monthly subscriptions and cancel any that you don't use or that aren't worth the return on investment. In our digital age it's easy to let these expenses slip under the radar without realizing how much you're spending on them every month! Automatic renewals, apple pay, and other conveniences come with a price, they are designed for a passive consumer.

- Shop your pantry. Instead of making your meal plan and grocery list from scratch, start with what you already have on hand and focus on using it first. This reduces food waste and drastically reduces grocery spending on a monthly basis.

Share this post!