How to Create a Budget in 7 Easy Steps

To set yourself up for financial success, you need to know how to create a budget.

I get it, it sounds restricting, confusing, daunting, and time-consuming.

Stick with me here.

What you do today- create a budget- will be a turning point in your finances.

Some people think that a budget is simply writing down your monthly bills so you don't forget to pay them. A budget is way more than that, it's a PLAN.

Maybe you have spending habits that you can't seem to break, maybe you have debt you want to attack, maybe you have things you'd like to save for, maybe you'd like your finances to be more organized. Or, maybe you simply wonder where all the money goes every month.

YOU DON'T HAVE TO BE GOOD WITH NUMBERS

Let me set something straight right away- you DO NOT have to be a CPA, financial planner, or even good with numbers to create a simple and effective budget. That is a HUGE misconception.

In fact, I know many accountants who don't track their personal finances in any way.

If the time factor keeps you from budgeting, let me assure you that you don't have to find hours and hours every month to squeeze into your already busy schedule.

Our budget takes me less than 30 minutes to make every month!

Put simply, a budget is a plan.

Budgeting gives you peace , knowing that YOU are in CONTROL.

Budgeting allows you to have freedom. You know where your money is going, and you have a plan for it.

When you budget, it will suddenly seem like you have more money!

ZERO BASED BUDGETING

I'm going to show you how to create a zero-based budget. What this means is that every month your income less your expenses will equal ZERO.

That sounds bad, right? It's not!

Having a zero-based budget simply means that every single dollar coming in every month has a function.

If you make $2,500 a month, with zero-based budgeting everything you save, spend, invest & give will add up to $2,500. This way you will know exactly where every dollar that comes in is going.

That being said, let's get right to it.

HOW TO CREATE A BUDGET

First, download one of my free budget templates by subscribing below, or purchase some in my shop!

Next, grab a pencil, a calculator, have your monthly expenses handy, and settle in!

Here's how to create a budget!

1. Write Down Your Monthly Income

The first step to create a budget is determining what your income will be for the month .

This includes ALL income- your regular pay, any bonuses, cash gifts, alimony, child support, etc.

If you are on salary, you already know what you will be paid for the month and you should write your net pay for the month on the total income line.

If you are paid hourly or have irregular income, do your best to estimate what you will make for the month, and then we always adjust the budget for actual income as we are paid.

Go ahead and write your income on the budget spreadsheet line by line. This is what we will subtract our expenses from.

That's it for step 1!

2. Write Down Your Fixed Monthly Expenses

Calculating expenses is the tricky part.

This is where many people get confused and frustrated because we not only want to calculate our fixed monthly expenses, but we also want to calculate our total variable expenses in the next step.

Write down all your fixed monthly expenses.

Fixed expenses are expenses that typically do not change from month to month and they are absolutely due.

Fixed expenses include rent/mortgage, utilities, tithe, food, gas, debt payments (car, credit card, student loans) , and any other expense you can think of!

If you are unsure of any of these amounts, go online or look at your bill from the past 3-6 months and use an average.

Here's an example of some of our fixed monthly expenses:

- Utilities: $200 (average)

- Food: $300

- Gas: $400

After you've completed this, continue below to the trickier part.

3. Write Down Irregular/Seasonal Expenses and Convert into Monthly Amounts

Have you ever had an expense that is irregular (think property taxes, health insurance, medical bills, insurance premiums, annual gym dues, school supplies, registration fees) sneak up on you?

In this step we want to make sure that we plan for all those expenses so that when it comes time to pay them, we already have the money set aside and there are no surprises.

It will feel really good to know that you have these expenses covered and don't have to pinch pennies when the time comes!

Write down all your seasonal or irregular expenses.

Most of these will have to be estimated, so look at what you spent last year on these items and do your best to come up with an accurate estimate.

Next, convert these expenses into monthly amounts.

For example, if you have annual insurance premiums of $1,200 a year, you'd take $1,200/12 = $100 to be saved every month. So you would list out the $100 as a monthly expense that is now included in your monthly budget.

4. Set Financial Goals

This step might seem out of order (like it should be after step 5), but I want you to consider your financial goals into your monthly budget BEFORE you set your budget for discretionary expenses (things like eating out, clothes, entertainment, recreation, etc.)

This is KEY to successfully reaching your financial goals and staying on track.

Some financial goals to consider include:

- Invest 15% of take-home pay into retirement accounts

- Have 3-6 months of expenses in savings

- Pay off all debt as quickly as possible

- Save for a down-payment on a house

- Save for a new (used) car

When I first made our budget, I listed our income less our fixed monthly expenses (ONLY THE ESSENTIALS) and irregular expenses (only things that were ABSOLUTELY due), and then I set an amount that I wanted to shoot for to put towards my student loans every month.

This was on average around $2,000 - $3,000 per month (See my post about how we paid off $20k in 1 year ).

So, let's take my example from Step 2 of fixed monthly expenses and let's pretend your monthly take-home pay is $2,500. Let's also say your goal is to put $500 per month into savings and to invest $500 per month into retirement accounts.

So far, your budget would look like this:

Total income: $2,500

Less fixed expenses:

Utilities: ($200)

Food: ($300)

Gas: ($200)

Total fixed expenses: ($700)

Subtotal: $1,800

Less irregular/seasonal expenses:

Insurance: ($100)

Subtotal: $1,700

Less financial goals:

Savings: ($500)

Investing: ($500)

Total goals: ($1,000)

Subtotal: $700

In this example, we have $700 left to budget for discretionary expenses.

Onto step 4!

5. Write Down Discretionary ("Adjustable") Monthly Expenses

Now with what is left over, we will budget for discretionary expenses.

Discretionary expenses are expenses that you will have every month, but they are not necessities.

This includes things like eating out, recreation, entertainment, blow money, clothing, etc.

After you have listed out all your income and all your expenses (both fixed and variable) and your financial goals, subtract them and see where you end up.

If this number is positive, you are off to a good start! If this number is negative, you will need to either decrease your spending or increase your income.

6. Subtract Total Income and Total Expenses

After budgeting in the previous step for discretionary expenses, your income less your expenses should total zero.

This means we have assigned every single dollar to an expense before the month begins, and we know exactly where it will be going. Don't leave any dollar unassigned!

With that... congratulations! You've made a budget!

7. Track Your Spending

Now that your budget is set up, you need to track your spending throughout the month.

This seems daunting at first, but it doesn't have to be!

There are plenty of free apps that will help you track your spending. I personally use the EveryDollar app (it's free), and I know many people who use the Mint app (also free) and love it!

What is nice about Mint is it automatically pulls in your transactions from your bank account if you connect your account. That makes tracking your spending extremely simple.

Just make sure that you actually DO THIS step throughout the month.

I also track our budget on paper throughout the month using the templates included in my budget bundle!

BUDGET TEMPLATES & WORKSHEETS

BUDGET BY PAYCHECK

I break our broad monthly budget down by paycheck so that every single dollar is allocated on a budgeted AND actual basis.

So, if what we have coming in for the month is more or less than what I originally planned, this budget by paycheck worksheet helps me update and adjust the budget so I'm not left with a mess when the month is over.

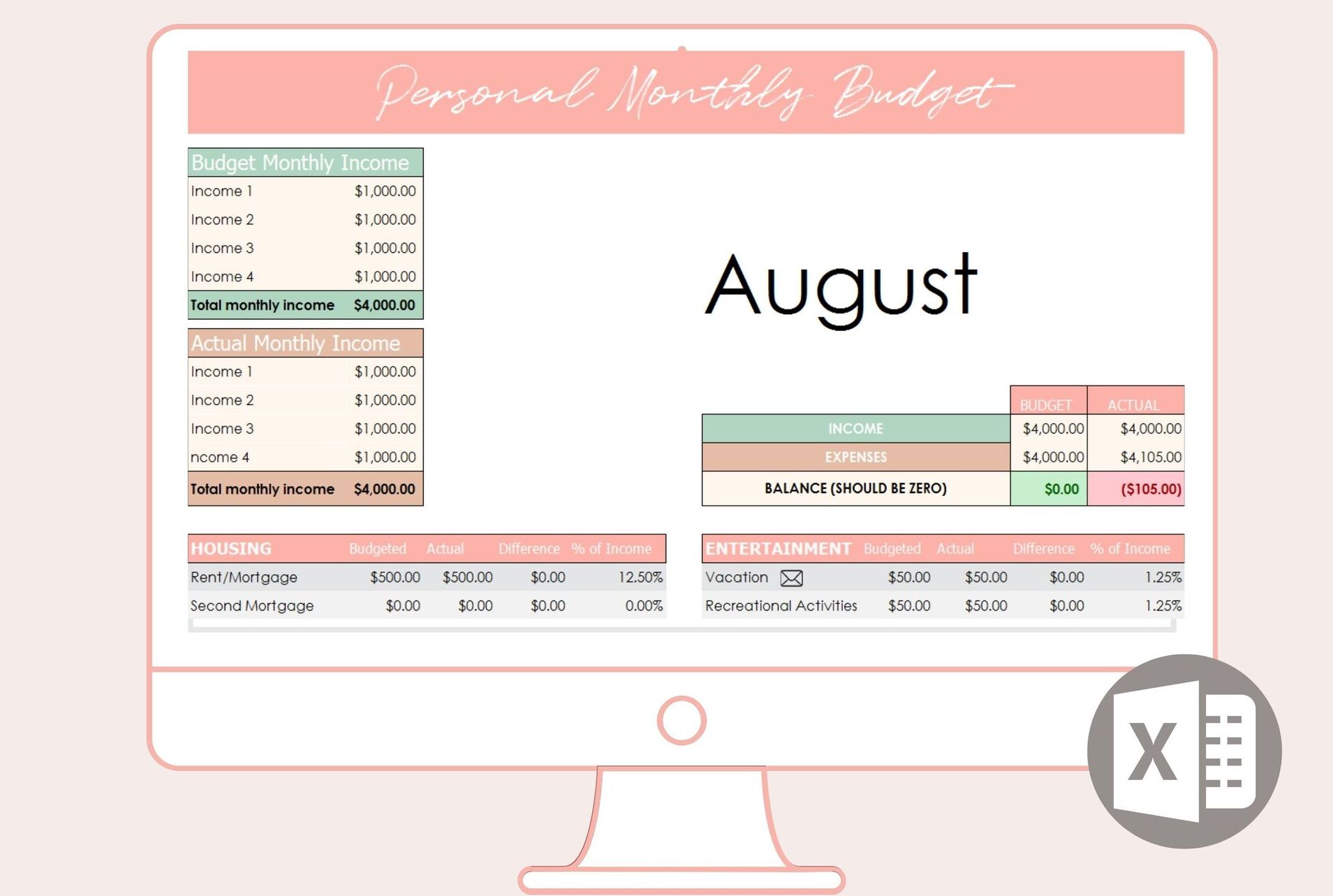

EXCEL BUDGET TEMPLATE

If you prefer to have a digital budget rather than a written budget (I'd recommend ALWAYS having a written budget in addition to digital), I created an excel budget template that's intuitive and easy to use!

Pictured to the left, simply copy and paste your budget from month to month so you can easily update!

Cells automatically calculate and are formatted to be red if you're budget is negative and green if you're budget is positive!

EXPENSE LOGGING & BILL TRACKING

Track your bills and expenses using these editable PDF templates.

I ALWAYS keep track of what bills are taken out of our account on what date so I can use it to update our budget as the month goes.

While lots of bills are fixed amounts, it's important to update your budget as the month goes on for bills that are variable, like utilities!

EXCEL INCOME ALLOCATION TEMPLATE

I'm a visual person, so I like to see our budget broken down into smaller, more manageable chunks.

I use an excel spreadsheet to take our monthly budget and allocate the budgeted amounts to our income as we receive it throughout the month.

This way, I actually STICK to our budget! That's often the hardest part :)

For instance, our grocery budget is $300/month. I break this down into $75 per week. I do this for almost all our budget amounts on the left.

However, it's not as simple as taking every single budget line item and converting it to a weekly amount, because you also have to address the TIMING of certain budget line items.

For example, I budget $200 per month for utilities, but our utilities are paid mid-month, so converting that amount to a weekly amount doesn't work.

Rather, I budget $100 out of the first two paychecks of the month (my husband is paid weekly), so when the bill is due, the cash is there.

Keep in mind we do (and it's a good idea to do this if you haven't already) keep a month's worth of expenses in our checking account.

In other words, we are always one month ahead on our bills and using the prior months income to pay the current months bills.

ON A FINAL NOTE

Now that you know how to create a budget, commit to living on a budget.

When the month comes to an end and it's time to look at your spending, grab a cocktail and a tissue!

You will probably be amazed at how much money you actually spend compared to what you thought you spend.

If at the end of the month your budget was WAY off, don't fret. That's normal. Commit to working on sticking to your budget the next month.

Adjust as needed after the first month and make sure you keep your goals in mind!

If you work through this post, you'll be able to do all the above!

Share this post!