The Ultimate Guide to Creating a Successful Family Budget

I created our personal family budget over 7 years ago, and the blueprint has allowed us to reach many of the financial goals we never thought would be possible, especially now that we are a one-income family.

Although the budget has evolved in many ways over the years, the security and stability it brings to our family–

no matter our income level or number of children in each season

— is a true blessing!

We’ve had seasons where we were living on an extremely tight budget, and seasons where money was plentiful– and in each season we’ve trusted the Lord’s provision but also understood it is wise to have a plan. Sometimes the plan derails and we have to improvise, but that is the exception rather than the rule!

Do you feel like there is never enough money at the end of the month? Does the word budget make you feel instantly overwhelmed? Is your financial situation really good but you'd like to be more intentional?

If you answered yes, then my hope is that this post will help you create a simple and practical plan for your family finances that gives you peace and freedom from the overwhelm!

What Is A Family Budget?

A budget is a roadmap, the tool you need to get where you want to go. A roadmap protects you from going off course. In the same way, a budget protects you from impulsive purchases and other financial habits and decisions that are going to put you off course.

A budget is

not

a straight-jacket, it’s for both the conservative nerd and the eclectic creative. It’s a crucial tool in the financial planning toolbox!

While I’m definitely the “nerd” in our marriage (I love spreadsheets, planners, lists, etc), my husband knows and values the importance of a budget just as much! He knows that without it we would quickly get off track, especially as busy parents of 3 littles.

Why is a Family Budget Important?

The degree of our frustration with our finances is often the gap between what our priorities are and what is actually happening.

A family budget allows us to define our priorities and make a plan so our personal finances reflect those priorities.

If one of your top financial priorities is to be able to bless others, it’s frustrating if it’s a challenge just to get all the bills paid during the month.

As a caveat, I would like to point out that having financial challenges does not necessarily indicate financial irresponsibility. The Bible is clear that the Lord tests us and gives us trials to continue our sanctification and prevent us from storing up treasures on earth that will pass away (Matthew 6:19-20).

However, there are many times when our financial hardships stem from a lack of financial responsibility. Ask the Lord to help you discern what is true in your situation.

In either case, having a clear plan for our finances– and being diligent in carrying out that plan– is good (Proverbs 21:5)

Free Monthly Budget Template

A monthly budget template is an essential part of a solid financial plan. Use one of my free monthly budget templates to quickly download and follow along as you work your way through the steps below!

How to Create a Successful Family Budget

1. Determine Your Monthly Income

The first step is (typically) fairly straightforward. List your monthly household take-home (after-tax) pay from all sources.

If you have

irregular income (small business owners, commission earners, etc), use a low average of the past 6-12 months, or use your lowest estimated monthly income to create your budget. With irregular income, you want to be conservative with your estimate! Just because the income isn’t as predictable, doesn’t mean you can’t budget. In fact, I’d argue that it’s all the more important that you budget!

2. List Monthly Expenses

Next, determine your monthly spending. Start by logging into your bank account(s) and going over your bank statements, listing out all your monthly expenses.

It’s important that you don’t try and estimate what you’re spending without looking. Rather, go over each and every expense; many times there's a big difference between what you think you're spending and in reality what's going out! To make your budget effective, you need to be working with actual numbers, not estimates without any data.

Some expenses will be straight-forward and easy to budget for, while others will require a little estimation. Regular expenses (fixed expenses) are those that don’t typically change month to month– think mortgage/rent, some utilities, subscription costs, insurance, phone, cable, etc. Conversely, variable expenses are those that do change month to month, such as groceries and gas/fuel. For these expenses, still set a maximum monthly budget amount based on an average.

3. Convert Non-Monthly Expenses to Monthly Amounts using Sinking Funds

This is where most people get hung up– they say budgeting doesn’t work because unexpected expenses always come up and bust right through the budget! But here’s the thing– are unexpected expenses really that unexpected?

For example, you don’t know exactly

when

your car or home will need repairs. However, you do

know

that at some point your car and home will need repairs. So when the car breaks down is it really

that

unexpected? Or is it reasonable to assume at some point as you put more wear and tear on the vehicle, it will need repair?

This is why we want to set aside a little bit of money every month for expenses of this nature instead of trying to cash-flow them in a single month! It makes these expenses a lot easier to swallow, and less likely that you’ll have to dip into your emergency fund to cover the costs.

We try to use our emergency fund as a very last resort. We do what we can to plan and prepare for unexpected costs by having a line item in our budget for things like car repairs, home repairs, etc, and carrying the balance over month to month. It doesn’t always cover the entire cost when these expenses do occur, but it at least gives us a good start!

- House maintenance / repairs

- Car maintenance / repairs

- Special occasions (birthdays, weddings, anniversaries, showers, etc)

- Christmas gifts / celebrations

- School supplies / extracurricular activities

- Annual, semi-annual, or quarterly expenses/dues (insurance, memberships, etc)

To

set up your sinking funds, simply take the total needed (or estimate) and divide by months until due. For expenses like house repairs and car repairs, estimate what you’ll need yearly and divide by 12. If your budget is tight, just set aside what you can, something is always better than nothing.

4. Create Budget Categories

After listing out your monthly (both fixed & variable) expenses and setting up your sinking funds, determine your budget categories. You can have as many or as little as you’d like, depending on your personality.

Some people like to have lots of

budget categories so their budget is more detailed, while others like to keep it simple with just a few major categories and sub-categories.

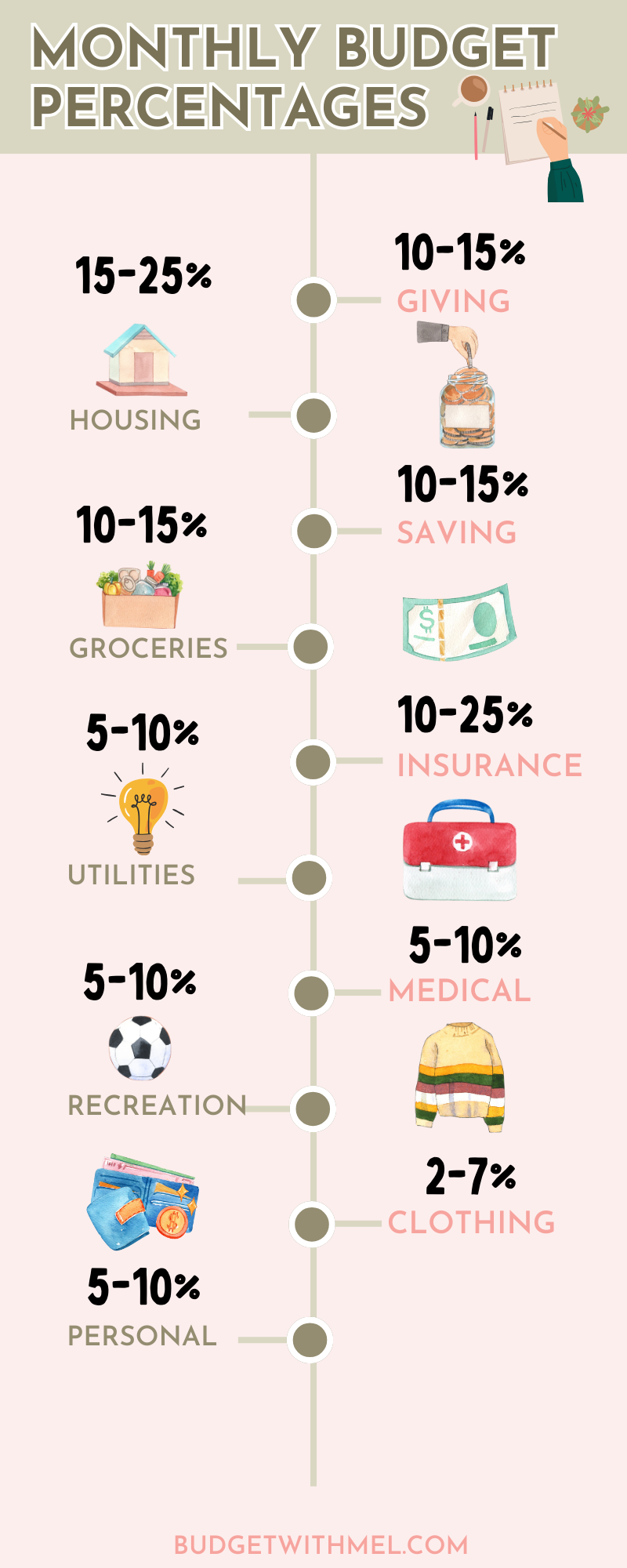

Use these general budget category guidelines to evaluate your own budget:

Keep in mind these are suggestions, not prescriptions. Every family’s budget will look different, and this should be so!

5. Put Financial Goals in the Budget

A crucial budgeting step is to put your financial goals as a line item in your monthly budget. Most people create a budget and decide if they end up having anything left over, that’s what they’ll put towards saving and investing. The problem is, there is never anything left! Budget for your financial goals before budgeting for other non-essentials.

Long-term & Short-term Goals

Putting your financial goals in the budget is crucial if you want to actually reach your goals. If you decide to just see what’s leftover each month, you’ll often find the money disappears quickly!

Savings Goals

Have a line item for your savings goals. Examples of savings goals that you might put in your family budget include:

- Fully funded emergency fund: aim to set aside 6-12 months of household expenses into a separate savings account for financial emergencies. This way, when larger, unexpected expenses arise, it is an inconvenience rather than a crisis.

- Family vacation: set a savings goal for your next vacation. Instead of putting it on a card and paying for it later, have the money set aside and the trip fully-funded before leaving!

- Vehicle replacement: it’s a good idea to always (if possible) be setting aside money for vehicle replacements.

- Baby fund: depending on your insurance plan, having a baby can be rather expensive. Set aside money (temporarily stop investing and putting money towards other goals) into either a separate savings account or your HSA, if applicable. You may also want to set up a sinking fund for baby supplies and furniture.

- Investing: a good rule of thumb is to invest 15% of your gross-income into tax-advantaged retirement accounts. If you can’t, do what you can! Developing the discipline of consistently investing on a monthly basis is important, so when you do have more funds to invest, you have already developed the self-discipline to do so.

- HSA (Health Savings Account): if you have a high-deductible medical plan, you can set up a health savings account either through your employer or on your own. The major benefit of an HSA is that you can save money for medical expenses on a pre-tax basis. In other words, any money you put into your HSA is tax-deductible, so use it to your advantage!

Break each savings goal down further into a monthly savings amount, then put it in the budget!

Emergency Fund

I think it’s necessary to talk about the emergency fund more in depth because it’s so important. If you don’t have an emergency fund, focus on this financial goal before any others. An emergency fund is your hedge of protection against financial crisis, giving you financial security.

In the past, I recommended Dave Ramsey’s guidelines of setting aside 3-6 months of household expenses, but I now recommend setting aside 6-12 months, or more. The reason being you can now put your funds in a high-yield savings account and earn 5% interest, instead of 0.01% through your local bank.

Obviously, it wouldn’t be wise to stockpile cash in your emergency fund if you can make more in the stock market. However, with

high-yield savings accounts, you can get a good rate of return and still have access to the funds, no maintenance fees, and depending on the account, potentially no minimum balance requirement.

Pay Off Debt

It’s hard to build wealth when your income is tied up in monthly payments. Student loans, credit cards, personal loans – add in a large car payment and your monthly debt payments could be taking up 25-50% of your monthly income.

It’s easy to see why so many people feel like money is always tight. When you’re in debt, you don’t have options. Lack of options will make you feel trapped. Not only will you

feel

trapped, but you

are

trapped if you have debt obligations every month.

Furthermore, consumer debt is a signal that the plan you're currently working isn't working. If you're using credit card debt to bridge the gap between income and expenses every month, then you're living in the red. You have to learn how to live in the green if you want to steward your financial resources well.

Make it a top priority to pay off debt quickly so you can free up income to accelerate other financial goals. Consider using the debt snowball method, which we found effective when we paid off over $20k of student loan debt in 12 months while living on one income.

6. Create a Zero-Based Budget

After including your financial goals in the budget, adjust and re-work until every single dollar of income is budgeted. Income - expenses should equal zero. If you have money left over, be sure to assign it to a purpose too.

Over-Budget

If you subtract your total expenses from your income and you’re in the red, you’ll want to find a way to either increase income or cut costs. Start with the easiest expenses to adjust and cut, such as groceries.

Groceries

One of the first things you can do to cut costs is reduce food waste and plan meals. Make your shopping list after you’ve made your meal plan, starting with trying to use up ingredients you already have at home. Grocery spending tends to be a big budget-killer, because of convenience meals and lack of planning. If I'm honest, when we’re super busy as a family, meal planning is one of the first things to go. As a result, I see the lack of planning reflected in our food spending at the end of the month! My biggest tip is to shop your house first before heading to the grocery store; making as many meals as possible with what you already have on hand.

Subscriptions

Paying for convenience has its place, so I’m not going to tell you to cut every single subscription service you have to cut costs. However, if you evaluate your monthly subscription services and determine there are a few that you either aren’t using or don’t provide enough value for the cost, get rid of them to free up funds in the budget.

Cash

Cash budgeting sounds like a lot of work— and it can be— but it pays off, no pun intended! If you struggle with impulsive spending or have a hard time keeping a few budget categories under control, try using cash envelopes to curb spending.

Studies show that when we use cash it affects our brains differently than when we use credit cards or debit cards, and as a result we spend less with cash. The bottom line is it hurts more to use cash, because we feel the transaction immediately as we hand the money over the counter, as opposed to swiping our plastic money.

Cash envelopes work great for groceries, personal spending, clothes, restaurants/entertainment, and gifts. You don’t have to use them forever, but using cash envelopes temporarily will help you reign in your spending and really think about your purchases.

Family Activities

The great thing about family fun is that it doesn’t have to be expensive. Especially with younger kids, they can be entertained by just about anything. My kids love to go to the park, do crafts, help me cook, play games as a family, go to the library, go on walks, etc. Get creative and make it a challenge to see how many free activities you can do together!

Under-Budget

If you’re under-budget after assigning income to all your expenses, give the money a job! Brainstorm some more sinking funds you may need, increase your savings or investing, or create a miscellaneous category to use as a buffer for smaller, unexpected expenses during the month.

7. Track Your Spending & Update Budget Accordingly

I use a budgeting app called EveryDollar to track our spending. It has many different features, but I personally like to use it exclusively for tracking spending.

Our actual monthly paycheck budget I plan out and set in google sheets. I’ve found an excel spreadsheet is the best method for budget planning, because I can copy & paste my budget into a new tab as a starting point for the next month!

There are a plethora of digital budgeting tools available, but don’t get lost in the sea of options. Keep it simple, you don’t need all the bells and whistles to effectively track your spending. In fact, making it too complicated will discourage you from sticking with it!

Figure Out What Budgeting Method Works

As a family, we use the

zero-based budgeting method,

and I highly recommend giving it a try! However, each family is different and has different circumstances and needs. Here’s a brief overview of the different budgeting methods and advantages/disadvantages of each.

50/30/20 Budget

A major benefit of the 50/30/20 budget is that it gives a simple, clear framework for breaking up your expenses. Specifically, expenses are broken down into needs (50%), wants (30%), and savings (20%).

The major advantage of this budgeting approach is the simplicity of an easy formula to follow, which is what many beginner budgeters are looking for.

The major disadvantage is that it is a one-size-fits-all approach, with no consideration for circumstances. For instance, if a family with four kids and zero retirement savings follows this approach, they will be under-funded in retirement. If an older couple with no children at home follow this approach, they will not be saving as much as they probably could.

Envelope Budget

The envelope budget method refers to utilizing cash envelopes for most budget categories by labeling the envelopes with a particular expense, then stuffing the envelope with the amount of cash you budgeted for that category/expense.

The major advantage of this method is the habit training and behavior modification it produces. As mentioned earlier, we not only spend less with cash, but our

willingness to pay for an item is lower with cash than a card. In other words, we’re willing to pay more for the same item with a card than we are with cash. Simply changing our payment method affects our behavior! This is a simple switch you can do to help with overspending.

Without a doubt the major disadvantage is the inconvenience of using cash– it’s not as efficient as using a card. First, you have to remember to take your cash out of the ATM and bring it to the store. Additionally, keeping your envelopes organized can be a learning curve at first.

All that said, I still highly recommend using the cash envelope method,

especially

if you’re just getting started with budgeting. It’s a simple way you can start saving more (without cutting costs) right now.

Irregular Income Budget

All the small business owners and commissioned employees are thinking there is no way this is going to work for me. It will! The process just looks a little different.

- Base your budget on your lowest expected monthly income.

- Always cover necessities first.

- Cover financial goals next.

- Make adjustments when paid.

- Track your spending diligently.

The key with irregular income budgeting is to estimate income conservatively and base your budget off this amount. Be sure to cover your necessities first (food, housing, utilities, transportation), then financial goals (saving and investing), then non-necessities.

In months income is higher than expected, start by catching up on anything you’ve had to put off– like saving, investing, vacation funding, etc.

In months income is lower than expected, stick to the necessities and make a note of how much you’re “behind” on things like investing, saving for upcoming, larger expenses (like a new car, house down payment, etc) so you can quickly determine how much to allocate in higher months to these categories.

Tips for Family Budgeting Success

Envelope Budget

We all do it. Impulse purchases can seem nearly impossible to get under control when we’re bombarded with constant advertising almost everywhere we go– on our phones, in the middle of the podcast we’re listening to, on the radio (if that’s still a thing), every website we visit, it’s nearly impossible to escape!

I can’t be the only one who’s on social media to see what friends and family are up to only to find myself on three different websites checking out products some person I follow “can’t live without.”

If you struggle with impulsive spending, or if there are budget categories you know you need help reigning in; consider trying the cash envelope budget.

Simply put, whenever your budget resets for the month (or whenever you’re paid if you’re using the

paycheck budget method), take out of the ATM the amount of cash equal to what you have set as your budget for that category. It may be helpful to split the budget. For example, if you budgeted $800 for groceries for the month; instead of taking out $800 on the first paycheck, withdraw $200 per week.

Read in detail how I have used the cash envelope method to reset my spending habits.

Family Meeting

Especially if you have older kids, having a family meeting about things that need to change or goals that you want to achieve together may be beneficial. Include your kids in the process, helping them to understand why it’s important to budget and showing them how you're making the household budget. Don’t underestimate their ability to comprehend budgeting. It’s always a good idea to include your kids in what you’re doing– that’s how they learn! Even if you have young kids who might not quite understand money management, monthly budget meetings may be beneficial for you and your spouse.

Adjust to Changes

Many people treat budgeting with the set it and forget it method– they create a rough budget and don’t look at it again until the end of the month. Then, at the end of the month, they become frustrated because there’s no money left and the budget obviously didn’t work.

The problem is just like any plans in life we want to succeed, budgeting requires us to be active and engaged in the process; adjusting to changes, working through the weeds, rejecting complacency.

Prioritize Your Expenses

An important step in the budgeting process is prioritizing your expenses. Some will have to prioritize more than others, depending on income and circumstances. Chances are a family with six kids living in a high-cost area will have to prioritize a bit more than a family with two kids living in a low-cost area.

Prioritizing is a good exercise for us, because it forces us to decide what’s

really

important.

We always want to cover our four walls first: food, housing, transportation, and utilities. In the hierarchy of expenses, these should be at the top.

Next, budget for other essentials– just be picky about what expenses are truly essentials.

After essentials, budget for financial goals. In my unconventional budgeting formula, I put these in the budget before discretionary spending, because they are important to us as a family. We want to build the savings muscle so it becomes second nature. We’re okay with saying no to a few things now, so we can say yes later.

Budget for non-necessities (“wants”) last. The hope is that as time progresses you will be able to allocate more funds to these things! Of course, that’s not always the case. The Lord might have another plan in store. Whatever His plan– adjust accordingly!

Share this post!