How to Successfully Live on One Income

Today, I want to share with you how we (and how YOU ) can cut costs to become a stay at home mom or a part time working mom and how to live on one income.

If you're a mom who feels the tug on her heart to come home to be with her kids, I can resonate more than you'll ever know.

You drop your kids off at daycare. Again.

Go to work, worry. Miss them. Wonder what you're missing out on.

Convince yourself you're doing this for the "greater good."

Pick them up. Come home tired, stressed, with a short fuse.

When bedtime rolls around, wonder where the time went.

Dream about staying home. No, wait. You're doing this FOR them... right?

Have your nightly pep talk with yourself about how you HAVE TO go to work tomorrow.

This is the routine I would repeat every single day, until our family hit a breaking point. I was strung out, spread thin, and exhausted being a full-time working mom with a heart that was at home.

Then, we hit a breaking point. It just wasn't working.

We crunched the numbers.

What can we cut out? How will our budget look? Can we do this?

I now work two days a week, BUT I don't have to work two days a week. I'll share why I work two days a week at the end of the post!

Here is how to live on one income so that you have more freedom!

HOW TO LIVE ON ONE INCOME

While living on one income can be hard at times, it will bless you and enrich your life in more ways than you could imagine.

We've learned time and time again that we have far more than we really need, and we often live on far more than we actually need.

Before I start, I want to warn you that this post is not for those who want to stay home without making sacrifices.

Many people want to know how to live on one income without changing a thing about their lifestyle.

Life is full of trade-offs.

If a comfortable, luxurious lifestyle is more important to you, to be completely honest this post is not for you.

On the other hand, if you're willing to make some temporary sacrifices and TRUST God with your finances, He will be faithful to provide for all your needs.

1. CONSIDER WHAT YOU'LL SAVE BY BEING HOME.

Most working moms don't realize what it's actually costing them to go to work. Daycare might be $3-10 per hour, and most working individuals make more than that, so they automatically deem it worth it (financially) to go to work.

After factoring in the expenses listed below and of course, taxes, what you're taking home as working mom might not be as much as you initially thought!

Estimate what you'll save on the following expenses (and any other related costs):

EXPENSES YOU'LL POTENTIALLY SAVE ON

- Daycare - the average cost of Center Based Daycare in the United States is about $1,000 per month for one child . Depending on where you live, it could be more or less. This a huge cost for a lot of families, for some it's more than their rent/mortgage!

- Eating Out - with so much on their plate, a lot of working women either eat out often for lunch, and/or are more inclined to pick up something for dinner instead of prepare a meal. While working full time, I'd come home exhausted and the last thing I wanted to do was make dinner and lunches for the next day.

- Groceries - while I wouldn't say you have more time on your hands when you're home, you definitely become a better multi-tasker. We have saved a lot of money because I am able to meal plan on a more consistent basis.

- Transportation - depending on your commute, what you save on transportation could be significant.

In my case, it was more than worth it for me to work, BUT once I factored in these expenses what I was actually making on a per hour basis was lower than what I thought.

It made the decision to live on one income that much easier.

2. CREATE A MOCK BUDGET.

After you estimate what you'll save by staying home, create a mock budget with your reduced expenses and without your paycheck.

Married couples should do this step together so both spouses are aware of what the new budget looks like and both can agree on the budget.

Here is how to quickly make your budget:

- Total up expected monthly income

- List expected monthly expenses (based on cost savings from being home)

- Evaluate

Once you do this, if you are left with a positive number, woohoo! If not, don't lose heart. The next step is to reduce your expenses, make up some ground here!

If you've never lived on a budget before, you should total up your total spending by category from your previous month's bank statement.

Do not guess on your monthly spending.

Otherwise, once you do come home and get on a budget, you'll be really frustrated as you find what you *thought* you were spending and what you actually spend are very different things.

3. MAKE UP FOR A DEFICIT BY CUTTING EXPENSES.

Now it's time to cut the fluff. In other words, figure out what expenses are not essential , and cut them.

I know you're probably thinking, okay, but simply trimming expenses isn't going to cut it for us ( no pun intended ).

Trust me, IT. ADDS. UP. If there is one thing I've learned from being frugal it's that the small money decisions you make have a very large impact.

Restaurants/Dining Out

Make a resolution to only eat out once a month, or skip eating out completely and have date night in instead.

According to research , the average American family spends $3k eating out a year.

Even though we're debt-free, I now have a harder time dining out than I did before we were out of debt. It's funny how that works. I've started to learn the value in keeping my money, and eating out is such a waste.

If you're serious about wanting to stay home and you're on a tight budget, skip eating out.

Vacation

Staying home for you might mean cutting your vacations every year down quite a bit.

Remember, your vacation doesn't have to be elaborate to be fun.

Do a staycation, explore your hometown, plan five local things to do every day for your family and save on airfare/fuel.

One of my recent posts details 15 cheap vacation ideas for frugal families.

Mortgage (House Poor)

The one expense that eats up a good chunk of income is a high mortgage payment.

Evaluate what percentage of your monthly take-home pay your mortgage payment (INCLUDING insurance and taxes) will be if you live on one income.

If it's above 25%, that's too much and you probably need to look into downsizing or moving to a different area.

Utilities

Find ways to make your home more energy efficient and cut the cable.

Here are just a few ideas-

- be mindful of water temperature when washing clothes

- use fans first instead of turning on the AC

- line dry your clothes

- buy a smart power strip (this ensures if you forget to unplug something it doesn't use electricity)

- change your air filters

- lower your water heater temperature

- reduce shower times

I keep our house at 72 degrees during the summer when it's me and the baby home. We keep it a little cooler at night, but this has helped lower our utility bill.

Be creative and try some different things out!

Groceries

For our family of three, our grocery budget is $300 per month.

This includes all household items like cleaning supplies, bathroom supplies, and non-grocery kitchen items.

To be completely honest, the best way I've found to save money on groceries is by meal planning. It's the only way I'm able to keep our budget so low. You can my meal planning worksheet for free here!

As a busy mom, I don't have hours to spend meal planning, ya feel me?

I use a meal planning service called $5 meal plan. It costs $5 per month, has customizable meal plans, and it sends the recipes and your grocery list organized by ingredients right to your inbox.

Some other tips for cutting back on your grocery expenses:

- buy generic brands

- use online grocery pickup to avoid temptations in store

- plan every single meal and eat leftovers often

- make freezer meals for busy seasons/weeks

- shop at Sams's Club or Costco and buy in bulk if you're a big family

Groceries are one of the biggest monthly expenses in many households, but it's also one of the most adjustable.

You just have to be willing to put in a little work and be disciplined!

Recreation

Find free activities to do with your family. We rarely do anything that requires spending money with our little guy.

It will give you a new appreciation for the enjoyment of each others company without spending a bunch of money!

P.S. - it's OKAY for your kids to be bored. In fact, it's good. Let them use their imagination instead of constantly spending money to keep them occupied.

Memberships

Cancel all unnecessary subscriptions, memberships, etc. to save money.

I'm talking gym memberships, weight watchers, amazon prime, etc. If you total up all the money you spend on subscriptions, it's probably a lot more than you think.

The goal is to free up as much income as possible by cutting out all unnecessary expenses.

4. COMMIT TO LIVING ON A BUDGET.

You can cut all the expenses you want and live as frugally as possible, but if you don't live on a monthly budget you'll have a tough time living on one income.

Many people who make a lot less than some have more money than those who make double what they do. Why?

Because it's all about how you manage your money, not how much of it you have.

Money is about behavior. If you're bad with money, more of it won't help.

You have to commit to living on a budget if you want to win with money!

A budget is a PLAN for your money, and if you plan, you're much more likely to experience financial success and financial peace.

5. START USING CASH TO HELP YOU ADJUST TO LIVING ON ONE INCOME.

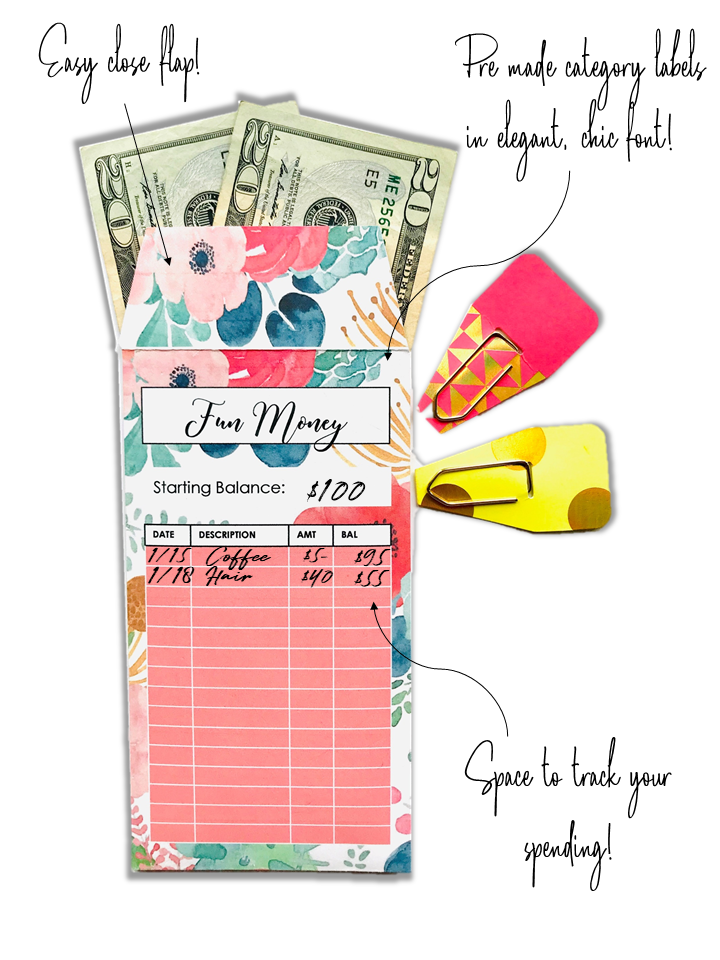

To ensure that you stick to your new budget, use cash when making purchases and leave the cards at home. If you don't use cash envelopes yet, snag my printable, editable cash envelopes pictured right.

For certain budget categories, like groceries, we use cash because I spend less when I use cash, and research shows there's a 99% chance you do too!

The problem many people have with sticking to a budget is that there is no one to tell them to stop spending.

This is why the cash envelope system works, because once your envelope is empty, that's it. No more!

6. IF YOU NEED THE INCOME CONSIDER A WORK FROM HOME JOB.

Many moms work from home to make extra money. The beauty in this is that you can make as. much or as little extra as you'd like!

Maybe you want to be able to take a few more vacations. Or, maybe you just want cushion in your checking account. Maybe you want to build up your savings.

Whatever your reason is, there is a plethora of work from home jobs for moms!

Don't think just because you're home doesn't mean you can't contribute in any way! Now, more than ever, it is possible to work from home!

7. SACRIFICE IS THE NAME OF THE GAME.

If you want to know how to live on one income, just remember it will require sacrifice.

I had my doubts about how to live on one income when we were so accustomed to living on two.

What is came down to was what we were willing to sacrifice to have me home more ?

How much sacrifice is required will be different person to person, but it might require a major lifestyle change!

Don't get too scared, you'll be surprised how much you can cut expenses and how little you can live on and make it work.

I highly recommend talking to other stay at home moms and asking them how they make it work!

WHAT I DO

I went from full-time working career woman and mother to a (mostly) stay at home mom who works two days a week.

The sole reason I work two days a week is to set aside money for a private, Christian education for our children.

We want more than one child, and we know that if we want to put them all through a private school it's smart to start saving now.

My income goes towards saving for this, and that's it!

WHAT I'VE LEARNED ABOUT HOW TO LIVE ON ONE INCOME

To sum it up in one sentence- God is always faithful to provide, I can't believe I'm not paid for this job, and don't let others opinions hold you back.

First, we have seen God's blessings poured out on us since deciding to take a step out in faith and have me come home!

Admittedly, even though I knew we could make it work, it still scared me to go down to one income.

Then I reminded myself that my mom did it, my grandma's did it, my sister in law does it, why the heck can't I do it?

I prayed about it, and I felt great peace from God that affirmed our decision.

Second, I can't believe i'm not paid for this exhausting job (kidding... kinda).

Third, who cares what everyone else thinks or says. Don't listen to all the noise.

Being a mom is such an important job, and your kids are worthy of all the sacrifices.

Share this post!