Create a Budget You Can Stick To (5 Best Hacks)!

Maybe you've tried the whole budgeting thing, and you were even pretty dedicated, but you found yourself unable to create a budget you stick to.

No matter what you try, nothing seems to work and you're about sick of all this budgeting talk.

There always seems to be more bills than money, and if there is anything left over, it's nothing to write home about.

Today I want to share why your budget isn't working, and how you can fix it!

Budgeting hacks/tips:

5 WAYS TO CREATE A BUDGET YOU CAN STICK TO

1. FACE YOUR FEARS

This first tip is very simple. You need to face your fear of finding out where your finances are really at and stop making excuses.

I'm not a money person. It sounds complicated. I'll figure it out later when I'm older. I don't have time, I'm too busy at work.

You're literally telling me that you're so busy making money that you don't have time to manage the money you're working so hard to earn?

Everyone is busy. If you don't make time for your money, you'll just be a hampster on a wheel constantly trying to earn more money in hopes of keeping up with your spending and lifestyle increases.

In order to create a budget you can stick to, you need to face your fears.

2. TREAT IT LIKE A BUDGET NOT A FORECAST

One of the biggest mistakes people make when budgeting is setting up their budget and treating it like a forecast.

Budgeting requires being proactive in your finances, not passive. You don't set your budget and then turn on autopilot mode. If you do, you'll likely end up frustrated at the end of the month.

At this point, you realize you've overspent on groceries, you didn't save as much as you thought you could, and things didn't necessarily go as planned.

You painted a picture of how you wanted the month to go, it didn't go that way, and you feel immediate failure once you realize real life didn't align with your predictions.

At this point, many people give up and think what's the point anyway?

The problem is that although you might always have money in your bank account without a budget, you likely aren't prioritizing and making your money work for you.

You're simply getting by , which is what causes money stress in the first place, and thus making you consider budgeting.

CHANGING HOW YOU THINK ABOUT THE BUDGET

Changing how you think about budgeting requires changing how you think about your money- as a finite resource.

What many people don't realize is that the feeling of scarcity isn't necessarily a bad thing.

In fact, I think the opposite feeling is more harmful and detrimental to your finances- the feeling of always having enough when all you're actually doing is scraping by and living paycheck to paycheck.

TAKE THIS EXAMPLE:

Let's take a quick example.

You have $800 in your checking account today left until payday.

Your $200 electric bill, $80 phone bill and $100 car insurance bill are due before you get paid again. You also now you'll need groceries before payday, you estimate $120 worth. Even though you don't have a budget, you know that in your head.

You think to yourself, wow, we're in pretty good shape! That leaves you with $300 left until payday! You're delighted knowing that you can either use that $300 towards your goal of paying down debt or putting it into your savings for a down payment on a home. Life's good.

Except the next day you realize you're almost out of diapers for the baby, those will cost $40.

Then you look at the calendar and realize your extended family from out of town is visiting and you're all supposed to go out to a fancy steak restaurant tomorrow.

Well shoot, I guess that $300 towards your goals will have to wait until next month.

Sound familiar?

THE SOLUTION

The feeling of scarcity will either drive you to quit or drive you to make better decisions with your money.

If you want to make better decisions, give every dollar a function before the month begins based on your goals. Then, be proactive and ADJUST your budget as money actually comes in and expenses actually go out.

So how does this work with my previous example?

It's likely that when you got your prior paycheck, you immediately started spending some it (without sticking to any real budget).

You went out to dinner with friends, stocked up on groceries, and bought your spouse a birthday gift.

No feelings of scarcity, because it was payday!

However, if you had known that your savings goals wouldn't happen this month you might have planned your meals and grocery shopping more carefully. You might have invited your friends over instead of going out.

If you had made a budget before the month began based on your priorities, things might look (and feel) differently!

3. MAKE IT REALISTIC

If you're constantly adjusting your budget for overspending in certain areas, you're probably not being honest with yourself when setting your budget in the first place.

My grocery budget for our family of three is $300 per month, but if you have a family of 5 that probably isn't realistic.

Just like unrealistic diet cuts, unrealistic budget cuts don't work.

Base your budget on reality, but as a word of caution, don't use the reality of your poor spending habits to justify budgeting more than you should for certain categories.

For instance, if you're single and you look back at your bank statements and realize you've been spending $600 per month on groceries and dining out and haven't saved any money, don't set your grocery budget at $600 when you first make your budget.

That's confusing reality with stupidity.

The same goes for paying off debt. If you have a goal to pay off your student loans ASAP and you and your spouse have been spending $500 per month going out, don't set that budget at $500.

Rather, challenge yourself to set it at $150 (which is reasonable) and change your stupid money behaviors instead.

4. THINK OF IT AS A CONTRACT BUT BE FLEXIBLE

Yes, this tip sounds like a huge contradiction- how can you think of the budget like a contract but also be flexible ??

The goal of budgeting is to make what's actually happening in your finances and your priorities align by creating a plan you can stick to.

So your budget should be thought of like a contract between you, your spouse, and your money.

This way, when you are tempted to have frequent dinners out instead of taking time to meal plan so you can stick to your grocery budget- you are reminded of your contract.

However, there are times that require flexibility. Because life is unexpected!

5. ADAPT & CHANGE

When I have to adjust our budget for changes in our life, it's nearly impossible for me to have a slight feeling of failure, and that's not how it should be.

You can and you should shift your budget around for different stages of life and as your priorities change.

When you have long-term goals, it's normal to have to make adjustments as you go. This doesn't mean you've failed, it means you are living and breathing.

HOW TO ADJUST WHEN OVER OR UNDER BUDGET

On a monthly basis, you'll likely end up either over budget or under budget in certain areas. That's normal- as long as these amounts aren't consistently fluctuating by $50 or more.

Read closely, because this is a key budget concept that many don't quite get.

KEY CONCEPT EXAMPLE 1: ADJUST AS THE MONTH GOES

If you predicted $1,000 of cash per week coming in to your bank account based on your salary and halfway through the month you've only brought in $600, you need to bring out the budget and adjust it.

Adjust your discretionary expenses so that your budget balances again- i.e. what is coming in is exactly what is being budgeted.

If you set up your budget correctly for that month, you would have assigned every single dollar of the predicted $4,000 to a budget category.

As a result, if you don't adjust the budget, you'll have budgeted $4,000 for the month when you only brought in $3,600.

You'll find yourself over budget and frustrated if you don't adjust.

Thus, you'll never feel like you are able to create a budget you can stick to.

KEY CONCEPT EXAMPLE 2: RECONCILE BUDGET BALANCE TO BANK BALANCE (MONEY IS FINITE)

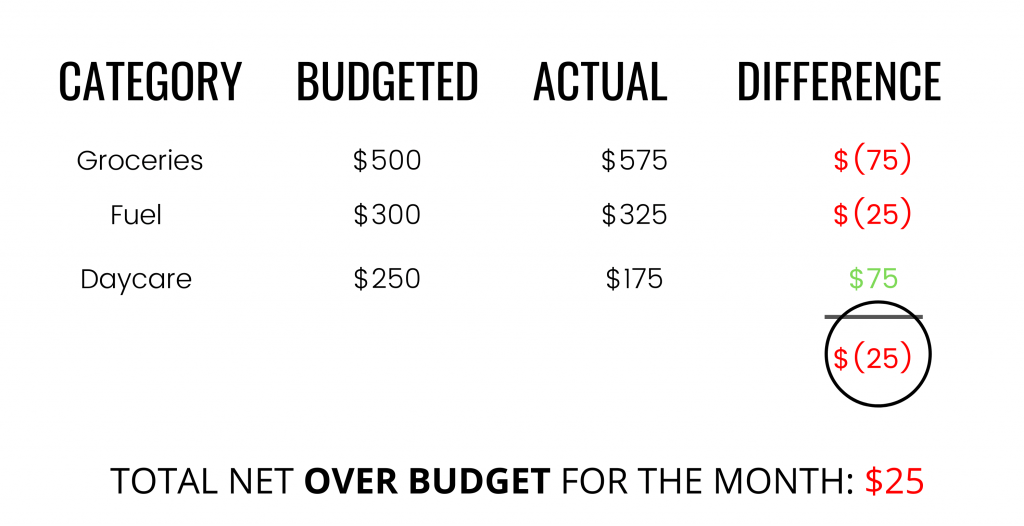

Let's say that you did pretty good on sticking to your budget for the month, but you had some discrepancies.

For simplicity sake , we will only look at a couple budget categories and assume on the rest you were spot on.

In this example, you're only $25 over budget, not a big deal. However, if you budgeted $2,000 of cash coming in for the month, and you end up spending $2,025, when your next paycheck comes (let's say it's $1,000), your bank balance will only show $975.

If you create your budget for the next paycheck based on $1,000 and forget the amount you were over budget from the prior month, you'll wind up $25 over budget again (considering you were spot on with all your budget categories).

Can you see how this snowballs? Pretty soon, you'll be wondering why your budget isn't working and here's why.

When you're over budget in any given month, that amount that you overspent doesn't just disappear and you have a clean slate the next month.

You actually, physically spent more money than what came in.

To fix, you can either start your next budget with $25 less than what you expect to earn, or pull from a sinking fund.

GETTING STARTED WITH BUDGETING

In order to create a budget you can stick to , you need to actually create a budget!

I have tons of budgeting resources that I've created to help you (FINALLY!!) take control of your money.

Here are some templates perfect for getting started with budgeting:

If you're wondering when the right time is, it's now, friend!

Trust me, if you're stressed about money now, you'll be more stressed later.

Once you perfect and create a budget you can actually stick to, you'll feel a weight lifted off your shoulders.

Don't fall into the trap of neglecting your finances, take control now and pursue financial peace.

Share this post!