How to Use an Excel Budget Spreadsheet to Save Time!

Using an excel budget spreadsheet is a surefire way to save you time every month managing your finances.

While creating and perfecting your first budget takes time, updating it can be hassle free if you're willing to try something new!

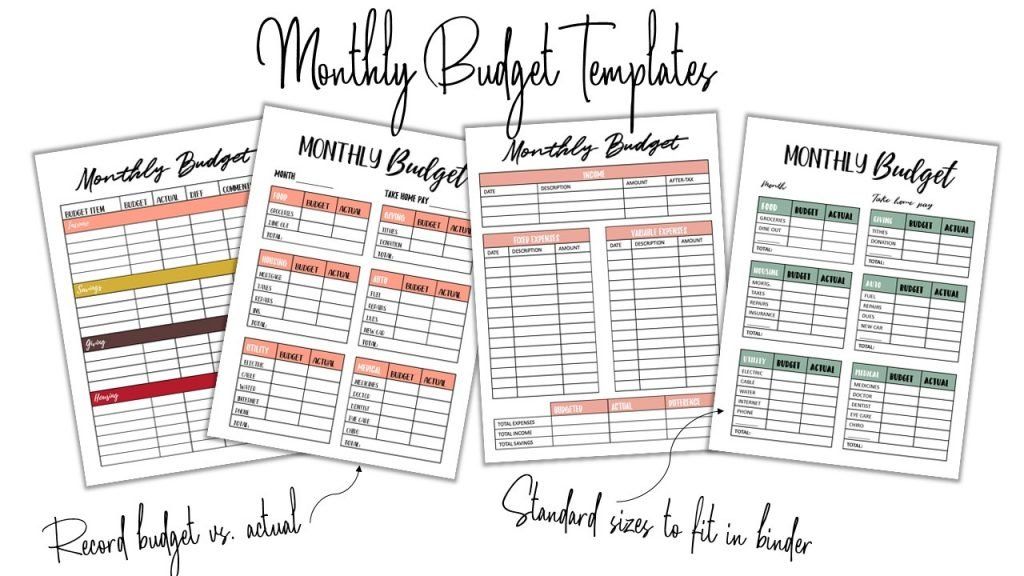

Even if you choose to use an excel budget template to help you with your monthly budget, I highly recommend having a budget binder to help you get a grip on your finances.

The disconnect we experience when we do things electronically changes how our brain responds and it can be tempting to become passive with your finances.

However, the efficiency of a digital money management is hard to pass up, and that's exactly why I keep a written budget binder that gets updated monthly AND a digital budget that gets updated whenever we have money come in!

If you're set on using a digital budget template, here's how to do it!

HOW TO USE AN EXCEL BUDGET SPREADSHEET

FREE GOOGLE SHEETS BUDGET

I have created a simple, easy to use spreadsheet, watch the video below to see how my free google sheets budget template works! Download a copy and get started. Alternatively, I have a detailed excel budget template with spending charts and built-in formulas to help you get your budget up and running!

The google sheets budget template utilizes the budget by paycheck method, breaking your monthly budget down into smaller, more manageable chunks.

DETAILED EXCEL BUDGET TEMPLATE

There are endless ways to use excel and that's what makes it great!

- Rolling over your budget from month to month is as simple as copying and pasting the spreadsheet into a new tab and updating the amounts for the next month.

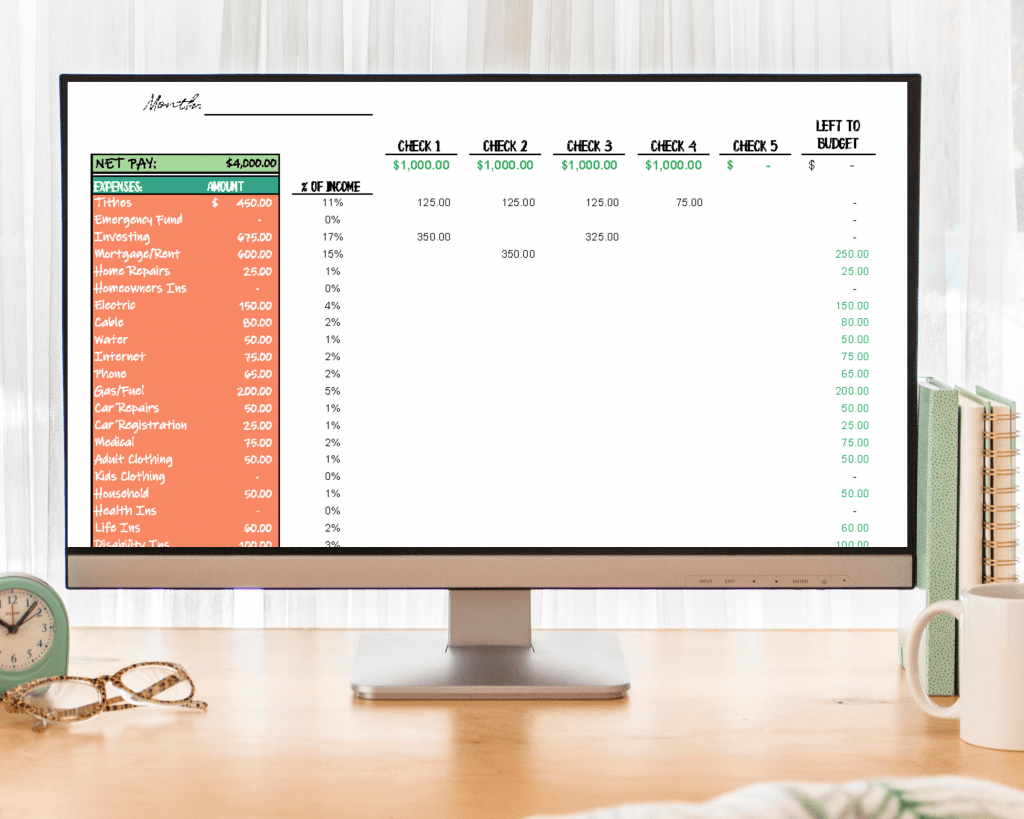

- Another great feature of using an excel budget template is being able to easily calculate what percent of your total budget different categories are taking up.

- Every month, I like to see big picture and know what percent of our income was spent on different categories. This spreadsheet contains a column that calculates what percent of your income every budget category takes up.

- Similarly, this excel workbook contains a tab that gives you a chart showing an overview of your budgeted vs. actual spending!

- Color formatted to show positive amounts in green and negative amounts in red, making it easy to spot areas of your budget that need adjusting.

- Comes with default Dave Ramsey budget categories set up!

HOW TO FILL OUT YOUR EXCEL BUDGET

BUDGETED EXPENSES

If you want to create a budget that actually works, you need to get a true picture of your expenses. This means you need to know what ALL your yearly expenses are so that you don't leave anything out.

Expenses generally fall into three categories - fixed, seasonal/irregular, and discretionary.

Fixed expenses are ones that typically do not change from month to month, for example rent/mortgage.

Seasonal/irregular expenses are expenses that are sporadic and do not occur every single month. Examples include annual insurance premiums, activity fees, real estate taxes, and Christmas spending. Furthermore, seasonal/irregular expenses include expenses that are unpredictable but probable.

Discretionary expense s are ones that can be easily manipulated. They are not fixed, but they occur regularly. Examples include personal spending money and dining out.

Review your last couple months of bank statements and brainstorm all your expenses that it takes to run your household.

Additionally, write down all expenses that are likely to occur at some point (seasonal/irregular), though they aren't predictable .

For example, you don't know when your car is going to need fixing next, but you know it's probable that at some point it will need repair.

Once you have these amounts, input them into the budgeted column.

ACTUAL EXPENSES

The key to getting an accurate picture of your finances is tracking your spending on a regular basis.

You can do this a couple different ways.

- Use an app (I recommend EveryDollar) to track your spending daily or weekly. At the end of the month, input your actual amounts into your budget spreadsheet to see how you did for the month.

- Track spending directly on the spreadsheet. Weekly or every couple days update the actual column based on your bank feed.

- Use an expense log to track your spending. Especially if you are new to budgeting, I would highly recommend going this route. We feel things more when we write them down. Just like it hurts more to spend cash, your transactions carry more weight when you are writing them out.

EVALUATING YOUR BUDGET

Update & evaluate your budget during the month. You don't need to spend hours analyzing every amount or anything like that, but as events happens and/or circumstances change, be sure to update the budget!

Once you get the hang of budgeting you won't have to do much updating, but it's important to keep the budget up to date.

For example, if you end up going to visit your parents who live a few hours away and you didn't initially plan on it, you'll likely need to update your budgeted gas amount. To do this, simply increase the gas budget and decrease another category.

While this seems counterproductive (like what are we actually accomplishing by budgeting then) , making these changes to your budget forces you to realize that there are trade offs with money.

Before budgeting, if you had to make this extra trip you likely wouldn't have done anything different financially.

Now that you have a budget, you know that it must balance to zero. You can't spend more than you make in a month!

So although our budget is always changing and needs some tweaking throughout the month, we are still accomplishing our goal- assigning our dollars to our priorities!

DON'T FORGET THE IMPORTANCE OF A WRITTEN BUDGET

I would like to give a word of caution that nothing can replace the importance of a written budget.

First, having a written budget it essential f or you to commit it to memory and stay motivated to stick with the process.

This is especially true if you are a beginner budgeter!

Second, having a written budget fosters a change in behavior, which is what we are ultimately after.

Just as using cash helps you connect to your money more and understand the pain associated with spending money, having a written budget helps you connect to controlling your money.

Third, a written budget sets the budget in stone. The monthly budget is like a contract with yourself (and your spouse).

Equally as important as creating the budget is sticking to it. Consequently, if you don't write your plan down, you're not as likely to stick to it!

BREAK IT DOWN BY PAYCHECK

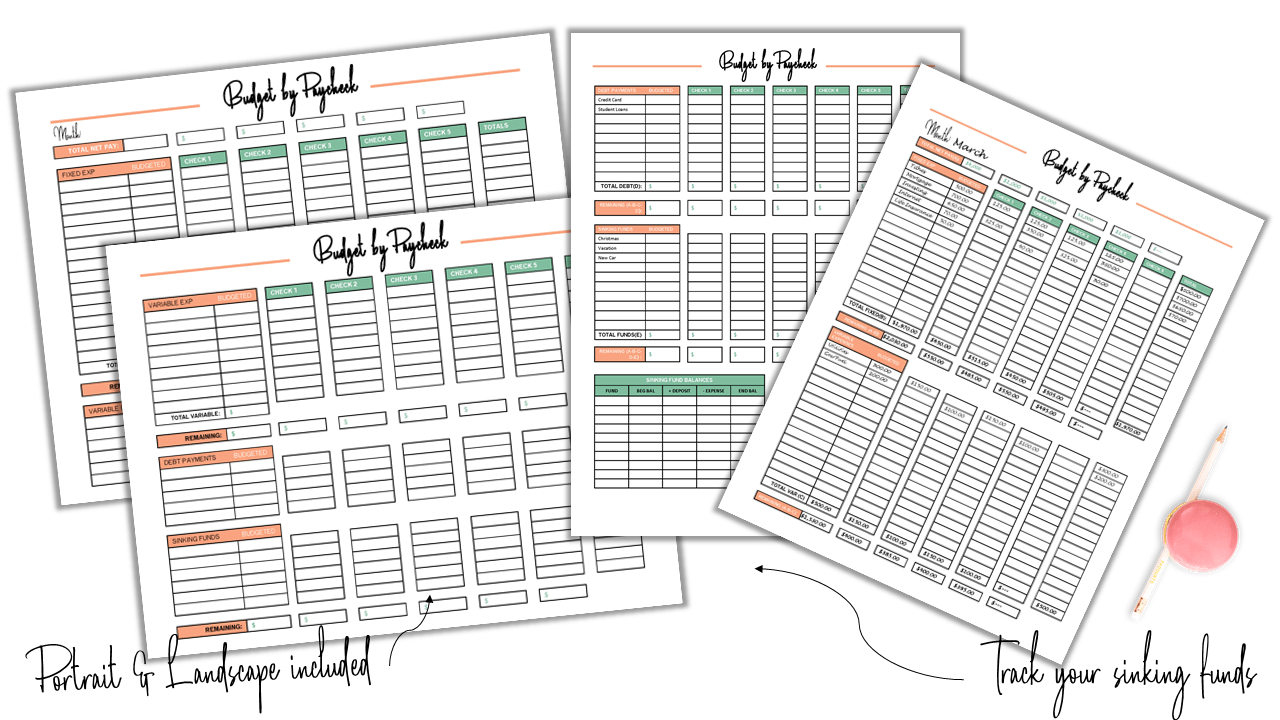

After you create your first budget , I recommend taking it a step further and breaking it down by paycheck.

This way, it's easy to allocate exactly where money needs to be assigned in light of the entire monthly budget.

Not everyone thinks this way, but I know I'm not alone!

I like every single process/plan in my life broken down into smaller, bite sized goals and actions.

Breaking your budget down by paycheck allows you to have a budget and bill pay schedule that fits your specific pay schedule.

One of the most frustrating things about budgeting to me when I first started was having a MONTHLY budget, but struggling to see how that fit our pay schedule.

This template has columns for every paycheck you receive and will allow you to break your budget down into smaller, more manageable amounts.

This will ensure you actually STICK to your budget.

If you're looking to save time budgeting, this excel budget by paycheck template can be saved to your computer or you can upload it to google docs!

I keep this exact template in my google docs so that I can access it from anywhere at anytime!

This spreadsheet will allow you to account for every dollar BEFORE the month begins and DURING the month as your income comes in.

It's important to not just create a budget forecast, but to create a budget and then actively manage it as the month goes on.

If you're into all things digital, you'll love this template!

Formulas automatically calculate.

OTHER TIPS FOR MAKING BUDGETING A BREEZE

USE EDITABLE EXPENSE LOG TEMPLATES

If technology is your jam, you'll love using an editable PDF template to track your monthly bills and spending.

I print these out and put them in our budget binder so I can quickly see what expenses have varied significantly month to month and by how much.

As the month progresses, I type our monthly bills into the PDF and then print when the month is over!

DOWNLOAD THE EVERYDOLLAR APP

I LOVE the EveryDollar budgeting app and if you are an app person, you will love it too!

The free version is all you need to make tracking your expenses a BREEZE.

You can track sinking funds, set savings goals, and set debt payoff goals all within the app.

The beauty of the app is that you can whip out your phone after you've purchased your groceries and enter the expense in a matter of seconds.

If you're always on the go I'd highly recommend using this app to track your budget throughout the month!

CONSISTENCY IS KEY

When it comes to expense tracking, consistency is key.

You're going to find yourself spinning in circles if you aren't consistent with creating a monthly budget. In fact, you'll find yourself more frustrated because you've put in SOME work, but you're not seeing results.

Updating your budget throughout the month is just as important as

This brings me to the next point, do it daily.

DO IT DAILY

In my own experience, I've found that tracking my spending daily works best.

This sounds cumbersome, but I promise I don't spend more than 5 minutes a day entering expenses. I use the EveryDollar app to track our spending as the month goes. Then, I transfer the totals from the app to our paper & excel budgets.

Yes, I'm a SUPER nerd and have three different ways I budget, but I love it.

If you have 5 minutes to scroll through Instagram (imagine if we all ONLY spend 5 minutes on social media), you have time to track your expenses daily!

It just depends on what you prioritize.

Share this post!