8 Sinking Funds I Always Budget for & How I Do It

Sinking funds are a great way to save for expenses that often catch us off guard!

Does it seem like certain expenses seem to pop up out of nowhere every single year and cause you endless money frustration?

You were planning on buying a new table because your kids have worn yours out, but you forgot about the fees associated with school sports. Looks like the table will have to wait another couple months.

The cycle continues. The next month, you FINALLY get to purchase your table.... but you weren't expecting your car to break down. I mean come on- didn't you just get it fixed a couple months ago?

If this cycle is one that you are familiar with, know that we go through the same thing- and that's why I've found a better way to deal with it.

You see, I know that murphy is going to hit us. It's not if - it's when.

Just this month we had a water pipe burst, our AC unit needs to be replaced, and we just had a baby last month!

Talk about a triple whammy!

I could choose to focus on what is going wrong and how much it's going to cost us and wallow in despair, or I can prepare and focus on the positive.

SINKING FUNDS

WHY THEY ARE IMPORTANT

The biggest reason I love sinking funds is because they take the stress out of budgeting. Before we started budgeting, I constantly felt like I was on the defense when it came to our money.

Expenses always snuck up. I'd have to put off something else I wanted to spend on in order to make up for the surprise expense. There was no plan. Stress levels were high because we couldn't save as much money as I wanted (and knew we could).

Finally, we started budgeting and in the process set up our sinking funds!

This is how they will help you:

- Unexpected expenses become an inconvenience instead of a crisis

- By breaking down big expenses into monthly amounts, they become more manageable

- Less money disagreements between you and your spouse

- Avoid going into debt (or further into debt) for major expenses by having the cash set aside

Doesn't this sounds great? It is! I can't wait for you to set up your sinking funds and see how it takes the stress out of your finances :)

[et_bloom_inline optin_id="optin_1"]

8 SINKING FUNDS YOU NEED IN YOUR BUDGET

While you can set up a sinking fund for anything you'd like, these are 8 sinking funds I recommend you have in your budget for sure!

- VACATION - Most families take at least one vacation every year. If this is you, have an ongoing sinking fund for travel.

- CAR REPAIRS - Car repairs are inevitable. Sure, you don't know when they will happen, but you know they probably WILL happen at some point!

- HOME REPAIRS - Is it just me, or does it seem like everything in your home breaks every month or maybe even all at once? Our repairs seem to come in three's. If the dishwashers broke, I can count on the washer and fridge also going out ;) Having a home repairs sinking funds saves us a lot of stress when these expenses do come up!

- INSURANCE + REGISTRATION DUES/FEES - All of our insurance premiums (car insurance, life insurance, vehicle registration fees) are due annually, so I add them into the monthly budget and have the money set aside to pay in full when they come due! No surprises!

- GIFTS/SPECIAL OCCASIONS - Weddings, birthdays, anniversaries, and holidays are always happening and always sneaking up on us! Create a sinking fund so you don't have to separately budget for everyone's special occasion (and remember them all ;) )

- CHRISTMAS GIFTS & FESTIVITIES - Christmas happens at the same time every single year, but it always trips people up with their budget! Have a year-round sinking fund for Christmas gifts. This way you don't end up loading up your credit card and paying for Christmas well into January!

- MEDICAL - We have a medical sinking fund because we have kids, and if you have kids, you know they often require lots of doctor visits! :)

- HOME REMODEL

- This is specific to certain situations, but we are in the middle of a basement remodel. I set up a sinking fund a couple years ago anticipating we would be doing work to our home!

This list is not exhaustive, if you have another annual or semi-annual expenses, set up a sinking fund for those as well!

Other ideas for additional sinking funds include:

- School activities/extracurricular fees

- Private school tuition

- Gym dues/fees

- Furniture

- Childrens' wedding

- Braces

- New car

- Babies

We will get more into this in the next part of this post!

HOW A SINKING FUND WORKS INTO THE BUDGET

LIST ALL YOUR IRREGULAR/SEASONAL/BIG-TICKET EXPENSES

Use the list above as a guide for getting started, and list all your seasonal/irregular expenses that come up throughout the year.

It might be helpful to look at 3-4 months of bank statements to get a good idea of what your true expenses are.

Be sure to include expenses that are not necessarily "due" at a certain time, but expenses that come up irregularly and catch you off guard.

Typically, these are expenses that are not predictable, but they are probable. For example, you don't know exactly when your car will need fixing next, but you can assume that it is probable your car will not go years and years without needing any work done.

Therefore, it would be a good idea to set up a sinking fund for car repairs. This way, when the car does need fixing, you have the money saved (or at least a good start).

This is a lot less stressful than having to figure out how you're going to foot the whole bill in a matter of weeks!

BREAK EXPENSES DOWN INTO MONTHLY AMOUNTS

Once you have a comprehensive list of all your true yearly expenses (to the best of your knowledge), convert each expense into monthly amounts.

Let's say your car insurance premium is $300, and is due semi-annually on June 30 & December 31. In order to have the funds saved up for this, you would need to budget and set aside $50 per month.

If you're reading this post and your car insurance premium is due in four months and you have nothing saved, then divide the total by four months rather than twelve months so you can get on track.

ADD TO YOUR MONTHLY BUDGET

Once you break down your sinking funds into monthly amounts, now it's time to take those amounts and add them to your monthly budget.

Be sure to add all your sinking funds to your monthly budget. If you find that after adding your sinking funds your budget is in the negative, you are going to need to adjust other categories downwards.

Can you cut your eating out budget? Personal spending?

Whatever the case, your budget should total zero. Every single dollar should be accounted for.

UPDATE (OR CREATE) YOUR INCOME ALLOCATION SHEET

I break my monthly budget down by paycheck. In other words, I allocate my income to each budget category.

This sounds confusing, but really all I'm doing is taking my broad monthly budget and breaking it down into smaller pieces, so I know exactly how to budget the income that flows in throughout the month.

⭐️ Read: Budget by Paycheck Method

You can see in the picture above that I have a monthly budget example on the left and each paycheck during the month is assigned a budget amount.

You do not have to do your budgeting this way, but it helps me stick to my budget!

Otherwise, when you create your monthly budget at the beginning of the month, you could be tempted to spend more than what you are in taking in during the month.

Even though in TOTAL at the end of the month you may spend less than you take in, your timing (when you actually get paid vs when you're spending) might be off. Then you risk having a negative (overdraft) account balance.

We do keep a "cushion" in our checking account because we are actually one whole month ahead on our bills at ALL times.

However, when I see those dollars in our account, I'm not seeing what they are actually "assigned" to.

Hopefully that makes sense :)

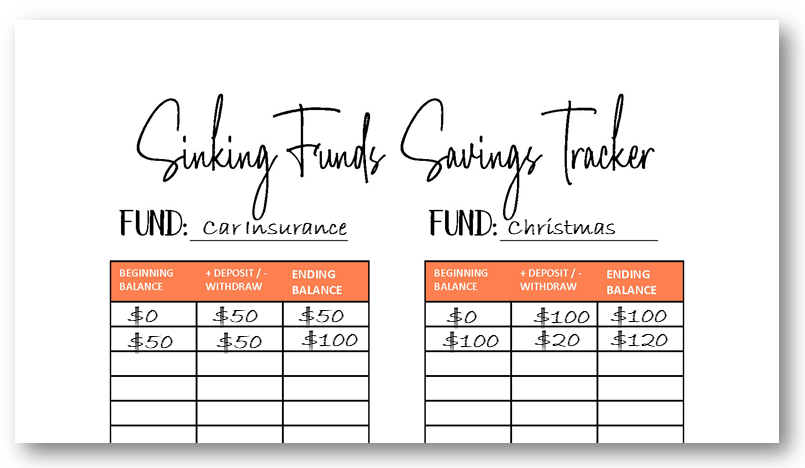

TRACKING YOUR SINKING FUNDS

There are a few different ways to track your sinking funds , while I recommend at least keeping them in an account separate from your regular checking, no certain way is right or wrong. Just make sure you're tracking the balances!

- Keep in your regular checking account.

- Transfer to your savings account & transfer money back to checking account when expense arises.

- Open a separate sinking funds bank account.

➡️Keep in regular checking account.

If you go this route, be super diligent about tracking your balances and reconciling your checking account every single month. You don't want to get sinking funds mingled into your regular, monthly expenses.

Additionally, you will be tempted to use your sinking funds to cover other expenses when your budget is short, don't do this (if at all possible)!

➡️ Transfer to your savings account.

If you've read my other content, you know that I recommend keeping your emergency fund in a savings account. You can add your sinking fund savings to this account, just be sure to once again, keep track of the balances of the sinking funds vs. your emergency fund.

➡️ Open a separate bank account specifically for sinking funds.

In my opinion, this. is the best option. This way, you deter any temptations to use your sinking fund money for other things!

If you struggle with financial self-discipline, this might be a great option for you!

Sinking Fund Resources:

Sinking Fund Resources:

Share this post!