How to Know if Christian Healthcare Ministries Is Right For your Family

After having our first child we were desperate to find a more affordable insurance option, and christian healthcare has been the perfect solution for us!

Let me back up. We paid right around $6k out of pocket for our first child. Yeah, ouch.

Additionally, it was going to cost us an additional $700 per month to have him covered with traditional insurance through my employer.

Now, let me be clear- a child is a blessing no matter what and I don't think the cost of having children should scare you out of having a family! In fact, in our experience, having kids has made us more financially responsible!

While we were prepared financially to pay for our first child, we figured it couldn't hurt to shop around and see if there was a better option.

Because after sending the check for our hospital bill and paying approximately $500 for simply breathing, I needed to receive the Holy Spirit.

I'm happy to report I have received the Holy Spirit and although I'm still being charged $500 for breathing, I now have private "health insurance" (you'll understand the air quotes later) that is affordable and has already saved us thousands!

I know many of you are wondering how to know what health insurance is right for you, so I'm going to give a detailed review of the private christian healthcare ministry we use called Christian Healthcare Ministries.

P.S. it's endorsed by Dave Ramsey and that made it all the more a good fit for us!

WARNING! This post is jam-packed full of information :)

KEY FEATURES OF CHRISTIAN HEALTHCARE MINISTRIES

Here are a few of my favorite things about CHM that I will go into detail about:

- Affordable healthcare alternative

- Generous maternity program (including pre-natal care, delivery, home births, midwives, postnatal care and birth complications)

- Choose your own healthcare provider

- Represents my Christian beliefs

- Join ANYTIME - no open enrollment period

- Different membership levels offer various levels of coverage unique to each family

- CHM has shared 100% of my eligible bills

- Submit all required docs through easy to use online member portal

Moreover, they are committed to offering quality assistance and meeting the needs of their members. I LOVE CHM.

I'll go over how it works, how it differs from traditional health insurance, the pro's, con's, the details, and how to know if it's right for you!

Let's get started.

WHAT IS CHRISTIAN HEALTHCARE MINISTRIES?

Christian Healthcare Ministries and other similar ministries (Christian Medishare, Samaritans Ministries, etc) operate by health cost sharing. Health cost sharing is when medical needs from members are shared using the predetermined, fixed monthly membership fees from other members.

Simply put, this means Christians share the medical needs of other Christians.

The non-profit organization exists to help it's members uphold their Christian beliefs and satisfy their medical needs while keeping their insurance costs low.

It's pretty neat to be a part of a program where hundreds of thousands of Christians come together to share each others needs. In fact, CHM members have shared over 4.5 billion in each others medical needs!

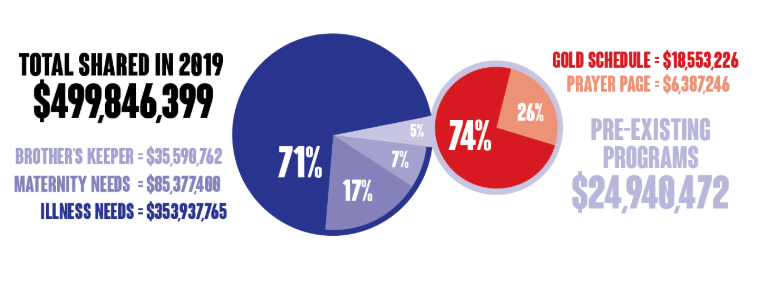

Here's a look at costs shared in 2019 alone:

Even more, CHM members are committed to praying for special needs of fellow members! What an amazing opportunity to come alongside our brothers and sisters in Christ!

THE COST

CHM has three participation levels. Each person in your household using CHM may be on different/varying levels of coverage.

For example, you could be a gold level member (to have maternity needs covered) and your husband (who has no underlying health conditions) could choose to be bronze level.

The cost for each membership level per person (unit) is as follows:

Gold level coverage - $172 per unit per month

Silver level coverage - $118 per unit per month

Bronze level coverage - $78 per unit per month

⚠️ NOTE: AFTER 3 UNITS (3 PEOPLE), ANY ADDITIONAL UNITS ARE NO ADDITIONAL CHARGE.

UNDERSTANDING UNITS

One unit is one participating individual within a membership.

For example, a single person is one unit. A married couple is two units. A married couple with four children is THREE units, based on the 3-unit max rule.

So, if you have four kids and you and your spouse are on CHM, and everyone has gold coverage, your total monthly bill would be $516 for all six of you.

If only one spouse participates with all the children, that would count as two units.

INCENTIVES

Another benefit that separates CHM from traditional health insurance coverage is that they offer incentives to their members.

First, they have a refer-a-friend program, where if you refer a friend, you will get one month of membership free!

Second, if you are a silver or bronze level member, any discounts you receive on your medical bills are applied to your personal responsibility amounts (essentially your deductible) - $2,500 for silver members and $5,000 for bronze members.

CHM places a heavy emphasis on obtaining discounts from healthcare providers.

Consequently, CHM is able to keep monthly membership fees low! :)

THE BROTHERS KEEPER OPTION ( AVERAGE OF $45 ADDITIONAL COST PER QUARTER)

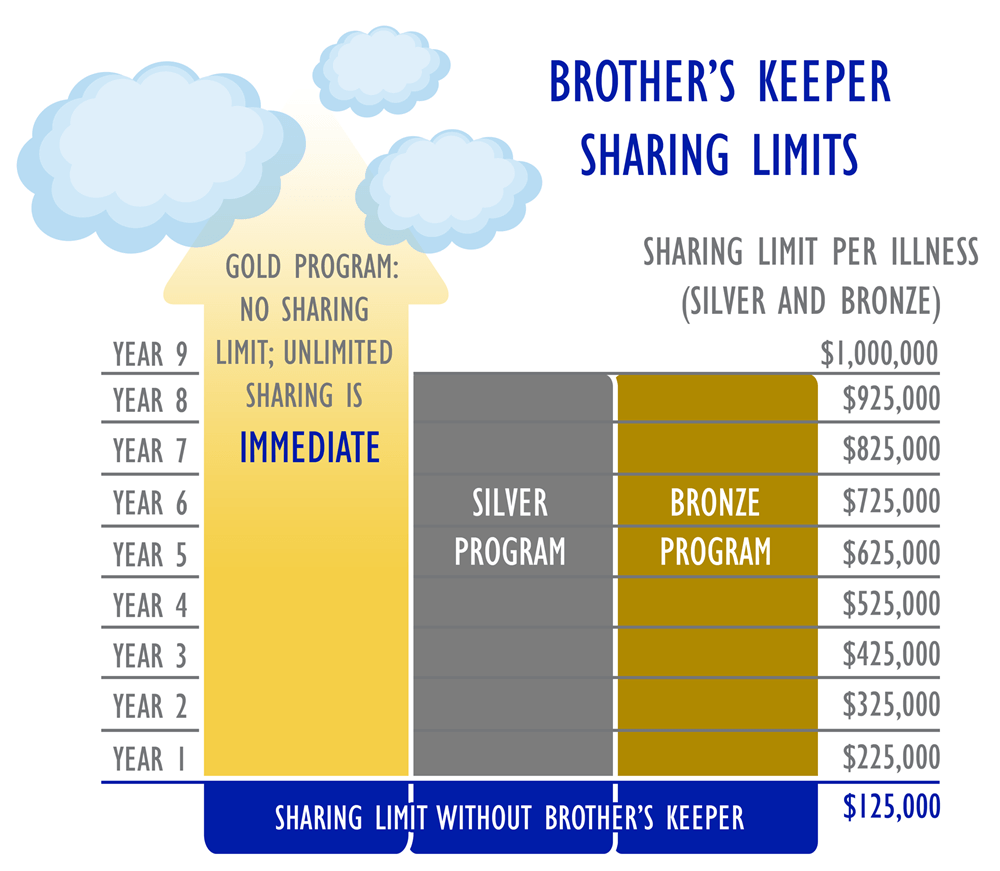

Brothers Keeper is a safeguard against catastrophic illness or injury, by enabling members to meet their medical needs past the $125,000 per incident sharing limit.

How much extra protection/sharing Brothers Keeper offers depends on your membership level and years of membership.

The breakdown by membership level includes:

Gold level members:

Signing up for Brother’s Keeper provides unlimited

cost support per illness (diagnosis).

Gold level members:

Signing up for Brother’s Keeper provides unlimited

cost support per illness (diagnosis).

Silver and Bronze members:

Signing up for Brother’s Keeper provides an additional $100,000 of cost support. With each annual Brother’s Keeper renewal, participants receive an additional $100,000 of assistance, up to $1 million per illness.

Silver and Bronze members:

Signing up for Brother’s Keeper provides an additional $100,000 of cost support. With each annual Brother’s Keeper renewal, participants receive an additional $100,000 of assistance, up to $1 million per illness.

You can see that without Brothers Keeper, the bill sharing limit per incident is $125k, regardless of membership level.

With Brothers Keeper, bill sharing per incident for gold members is unlimited.

By adding Brothers Keeper to your silver or bronze level membership, every year you increase your sharing limit per incident by $100k, up to $1 million.

This graphic hopefully makes it less confusing!

The Brothers Keeper option costs on average $45 extra per quarter, plus there is a yearly fee of $40 per membership.

In other words, it could cost you an additional $220 per year to "up" your coverage to this level.

COVERAGE

➡️GOLD LEVEL

For Gold members, CHM shares 100 percent of bills for any medical incident exceeding $500 (before discounts) as long as all other Guidelines are met. Keep in mind they share 100% of bills up to $125,000 per illness, UNLESS you are part of the Brothers Keeper add-on (scroll down to learn more).

- inpatient or outpatient hospital incidents* and surgery

- medical testing

- maternity

- therapy and home healthcare (up to 45 visits)

- incident-related doctor’s office visits

- incident-related prescriptions

Please note that the $500 personal responsibility (essentially a deductible) is PER INCIDENT , not per calendar year.

GOLD + BROTHERS KEEPER

By adding Brothers Keeper to your gold membership, the $125k cap for amount shared per illness is removed and the amount shared per illness becomes unlimited.

➡️SILVER LEVEL

For Silver members, CHM will share eligible medical needs exceeding $2,500 (your personal responsibility per incident) , up to $125,000 per incident.

Includes:

- Inpatient or outpatient hospital incidents and

- Surgery performed at any certified surgery center

Does NOT include:

- Testing and treatment outside a hospital do not qualify for sharing

- The Silver level excludes all maternity costs

SILVER + BROTHERS KEEPER

By adding Brothers Keeper to your silver membership, you get an additional $100k of cost support. Additionally, with each annual renewal receive $100k of extra support up to $1 million.

➡️BRONZE LEVEL

For Bronze members, CHM will share eligible medical needs exceeding $5,000 (your personal responsibility per incident) , up to $125,000 per incident. If you add Brothers Keeper, there is no limit on amount shared per incident.

BRONZE + BROTHERS KEEPER

By adding Brothers Keeper to your silver membership, you get an additional $100k of cost support. Additionally, with each annual renewal receive $100k of extra support up to $1 million.

COVERAGE EXAMPLES

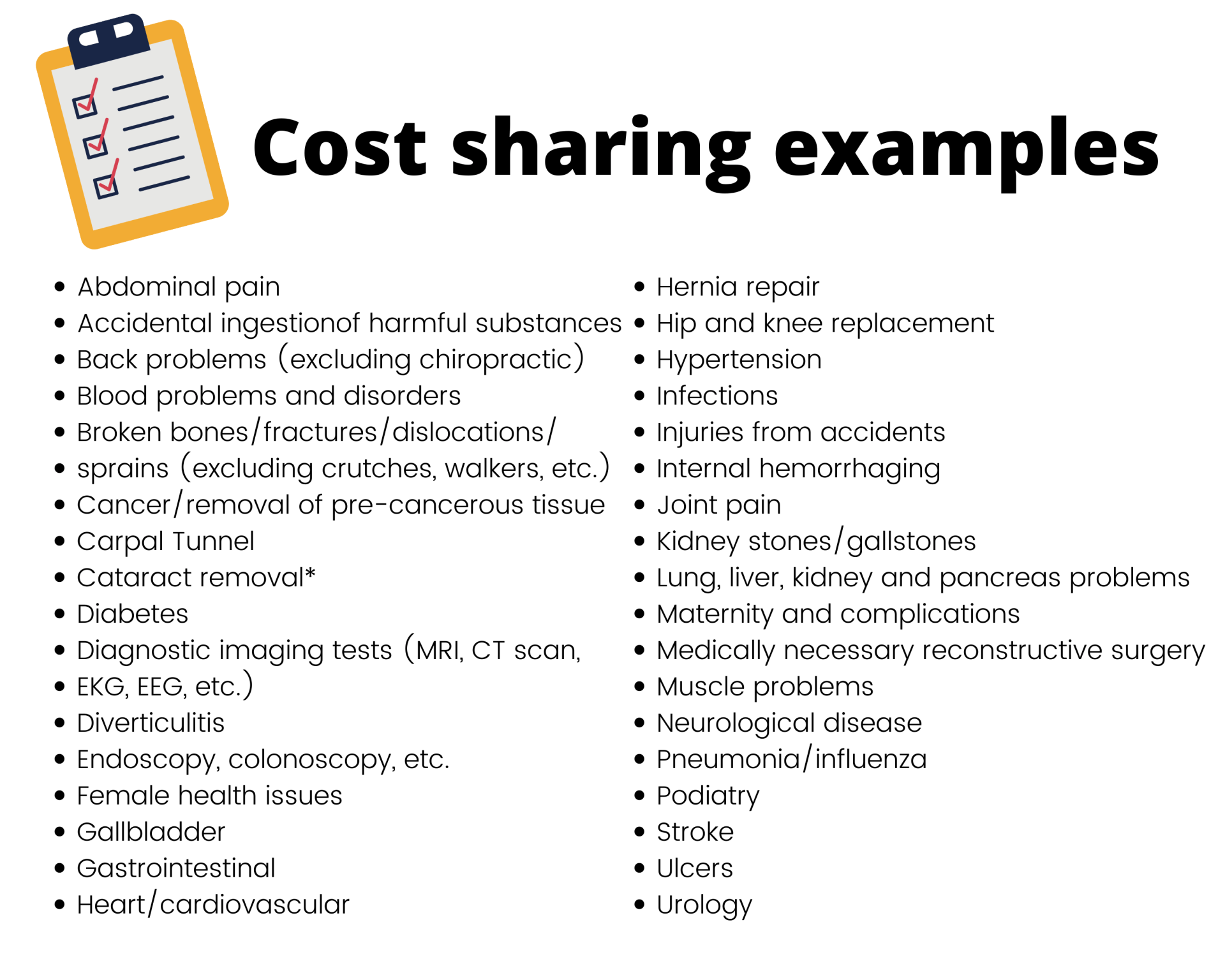

CHM routinely shares bills related to the following non-exhaustive list:

PER INCIDENT RULE

CHM calculates coverage per incident, which can be for one bill or multiple bills.

For example, if I go tothe doctor for a regular checkup, that would not be a bill eligible for sharing.

On the other hand, if I fall and break my leg, that would be an eligible need for bill sharing. Additionally, all bills related to this including x-rays, procedures, etc would be bundled together as one incident, and I would only be liable for my personal responsibility amount of $500 (on the gold program).

BILL SHARING PROCESS

HOW DO I SUBMIT A MEDICAL NEED?

After receiving care, you will need to ask your healthcare provider to give you an itemized bill that includes date of procedure, patient name, place of service, charge for each procedure,and procedure codes.

You can send submit bills online or via mail or fax.

If you are unsure of how to do this, CHM has various resources on their website to walk you through the steps.

CAN I VIEW THE STATUS OF MY BILLS?

When submitting bills online using the member portal, you are able to also view the status of those bills.

Below is a snapshot of my member portal and bills I've submitted for maternity needs.

You can see that all these bills have been received and filed!

WILL I HAVE TO PAY FOR THE BILL OUT OF POCKET?

CHM does not require you to pay the bill first before they share the cost.

Rather, you can pay if you'd like to and are able to avoid being billed multiple times by your healthcare provider, but if you alert your provider about your healthcare ministry, they will work with you regarding payment due dates.

HOW LONG DOES IT TAKE FOR CHM TO SHARE BILLS?

In general, bills are processed in the order received. However, if your healthcare provider offers a significant discount for paying within a certain time frame, CHM will give those bills priority.

On average, bills can take 30-60 days to be shared.

The bill "sharing clock" starts the day CHM receives and files your bill, not the date you mail it.

As a result, one downside to using a healthcare sharing ministry is bills typically take longer to get paid than if ran through traditional insurance. It's a more manual process!

WHO CAN JOIN & HOW TO JOIN

ELIGIBILITY

To join CHM, you simply must be a Christian who embraces CHM's statement of beliefs regarding alcohol, substance abuse, and sexual immorality (read more on that here).

✔️You will NOT be turned down for coverage because of a pre-existing medical condition. There are no restrictions based on age, weight, geographic location or health history.

✔️CHM can be used as a complementary option to Medicare. With this in mind, note that CHM is always a secondary to other payment sources.

✔️You can join anytime- no open enrollment period.

HOW TO JOIN

To join, simply fill out the online application and choose your starting date.

You’ll receive your welcome packet and CHM membership card within two to three weeks of submitting your application. You also will receive Heartfelt , CHM’s monthly magazine, around the 1st of each month your monthly bill around the 15th every month.

DETERMINING IF IT'S RIGHT FOR YOU

I know, all this information is daunting. Unfortunately, when it comes to insurance, figuring out the best option is not usually a cut and dry answer.

For us, while we are having children, it makes financial sense for me to be on CHM. Here's why:

- Our high deductible health insurance plan would expose us to liability of $10,000 per pregnancy. Our deductible for my husband and children's insurance is $10k ($5k per person maximum). On average, any pregnant woman will hit that deductible in no time with a hospital delivery.

If I take my monthly membership dues + yearly brothers keeper dues, the total for my healthcare coverage is $2,300 under CHM. Because they share 100% of eligible maternity bills after my personal responsibility of $500, I pay significantly less than $10,000 to have a child.

- I don't routinely go to the chiropractor, I don't wear glasses or contacts, and we have dental coverage for me through my husbands employer.

Even if I did go to the chiropractor routinely, it doesn't cost that much per visit- maybe max $50. I don't need insurance coverage for that, we save for medical costs on a regular basis.

- I don't have any known health issues. In other words, I'm a healthy individual (Lord willing I hope to remain that way).

If you have a medical condition that requires a lot of procedures, prescriptions and/or doctor visits, CHM might not be the best fit for you. Please note CHM WILL share for catastrophic medical events (car accidents, cancer, broken bones, etc).

REAL LIFE EXAMPLE - PREGNANCY & BIRTH COVERAGE

Paying a ridiculous amount of money for the birth and care of our first child is what prompted us to begin looking for an alternative to traditional health insurance.

After looking and doing a lot of research and number crunching, I signed up for the Gold Level Membership with the Brothers Keeper add-on.

I am the only member of my household using CHM, as it was cheaper for my husband and children to be on a high-deductible family plan through my husbands employer.

Here's a breakdown of how my maternity and labor/delivery bills have been shared by CHM.

MATERNITY & LABOR/DELIVERY BILL SHARING BY CHM

We paid around $1,000 out of pocket for the maternity/prenatal care and labor and delivery of our second child .

The $1,000 consists of our $500 deductible, and $500 for costs that were not eligible to be shared by CHM, which was primarily the cost of vaccines.

It's important to note that each hospital has their own policy on how they handle billing for maternity and labor/delivery.

Our hospital bills you for your regular maternity appointments after you deliver. It's a global charge, meaning that it is a fixed amount you pay for your prenatal care. Our global charge was approximately $3,800.

Approximately one month after submitting a document showing the global charge (this document came in my prenatal binder given to me at my first prenatal appointment), I received funds to pay the global charge.

Because our healthcare provider offers a 20% discount if a bill is paid in full within 30 days, CHM expedited the check for my global fee and thus I was able to pay the fee before I was actually billed for it.

In other words, I prepaid this charge using funds received directly from CHM.

LABOR/DELIVERY BILLS

At the time of this post, I have submitted by labor and delivery bills and expect to receive funds to pay those bills soon. However, I am still waiting! Consequently, I will update this post after the bill sharing process is complete.

I expect to receive funds for the full cost of my bills since I am a gold member and also have the brothers keeper add-on.

The new babe is will not be added to CHM, but rather has been added to my husbands family plan through his employer, as it was more cost effective for our family.

PROS & CONS SUMMARY

PROS:

- Affordable

- 3 unit max system for large families

- Generous maternity program

- Online portal access to easily submit & view status of bills

- Community of believers there to support and pray one another through medical needs

- Choose your own healthcare provider

- Enroll at ANY time

- No weight, age, pre-existing conditions exclusion

CONS:

- No dental, vision, chiropractic coverage

- Immunizations not covered

- Bills can potentially take a while to be shared

- Extra step of obtaining itemized bill from provider

- Routine/maintenance prescriptions not covered

- Checkups/ Well-visits not covered

MEMBER PORTAL

CHM offers a member portal to submit bills, view the status of bills, download information guides, update account information, etc.

Because of this feature, the manual process of obtaining and submitting itemized bills is actually rather easy! Moreover, having the option to submit and upload bills online drastically reduces the time it takes CHM to share those bills!

THEY HAVE TONS OF RESOURCES !

Without a doubt healthcare cost sharing is different than traditional forms of health insurance, but let not your heart be troubled!

CHM has TONS of resources for their members to help them navigate the process of submitting medical needs, using your member portal, and working with your hospital.

These resources include videos, pdf guides, health care provider letters, examples of itemized bills, etc.

Video Resources

The video resources pictured left are available for you to help you through every step of the process.

For example, there are videos on how to submit bills, knowing the terminology, maternity bill processing, the CHM guidelines, etc.

The videos are meant to be a visual tool to help you!

PDF Guides

In addition to the videos, the PDF guides are meant to help you understand the bill sharing process, what costs are eligible for sharing, and provide a more detailed instruction for members.

Other Resources

Together with the videos and pdf resources, CHM also has a blog, radio show, magazine, and legal documentation available to members.

Therefore, you should be able to have just about every single question you could have about CHM answered without every having to make a phone call!

I have been impressed with the abundance of resources available to help you learn the CHM member sharing process!

FINAL THOUGHTS

Ultimately, it is up to you and your family to decide what health insurance option/alternative is best for you.

I highly, highly recommend Christian Healthcare Ministries as an affordable alternative to traditional health insurance.

While I was skeptical at first, after being with CHM for a year now and going through pregnancy, I can say with 100% confidence it was the right choice for us.

The main reason we chose to go this route is because while in the season of childbearing, it is most cost effective for us to do so. If I were to be on my husbands high deductible plan, we would be liable for $10,000 per birth of child!

I am SO thankful for CHM and how they have lowered the cost of childbearing for our family! :)

Leave your questions in the comments and I'll be sure to try my best to answer them to the best of my knowledge.

FAQ'S

IS IT LEGAL?

YES! CHM is a non-profit federally certified exemption to the Affordable Care Act, and therefore is an eligible option under national healthcare laws.

CHM will provide you with a letter to give your healthcare provider if they are not familiar with how CHM works.

WHO IS ELIGIBLE TO JOIN?

Anyone who holds upholds the same belief system as CHM (and signs their document stating so). Additionally, CHM has no requirements regarding-

- Age

- Medical history

- Open enrollment (no waiting period)

WHAT DO YOU MEAN BY HEALTH CARE SHARING MINISTRY?

CHM is NOT insurance, this is important to understand.

However, it is a unique and affordable alternative and just because it's not technically insurance, that shouldn't make you afraid!

The mission of CHM is to glorify God and serve his people! They do this by providing an affordable healthcare option to Christians as a community of believers to rally around and encourage each other.

Yes! CHM is a great compliment to Medicare. Please note, if you have Medicare, you must have parts A & B. CHM will only share bills as a secondary option/resource to Medicare.

CHM knows that spiritual support is just as important as financial support. Because of this, CHM sends a monthly magazine sharing testimonies of various families/members of CHM. Additionally, CHM has a prayer page included in the magazine with specific prayer requests from members struggling with different medical situations.

No, no one is excluding from participating (so long as you agree to the CHM guidelines). However, there are a few ineligible treatments for sharing (immunizations, regular/routine checkups, non-incident related prescriptions, etc).

No! This is one of the things about CHM that seems "too good to be true!" Regardless of your income you are eligible to join and you will pay the exact same amount as everyone else.

Brother’s Keeper is your safeguard against catastrophic illness or injury. Brother’s Keeper is a low-cost, Bible-inspired program enabling CHM members to meet medical bills that exceed the $125,000 limit per illness specified in the CHM Guidelines.

Gold level members: Signing up for Brother’s Keeper provides unlimited cost support per illness (diagnosis).

Silver and Bronze members: Signing up for Brother’s Keeper provides an additional $100,000 of cost support. With each annual Brother’s Keeper renewal, participants receive an additional $100,000 of assistance, up to $1 million per illness.

Resources

OTHER HELPFUL CONTENT

Share this post!