The Best Investing Tips Millennials Need to Know

As a millennial myself, I want to share some of the best investing tips for millennials that I wish someone would've told me sooner.

The millennial dream is to have a one bedroom apartment and pay off your student loan debt before age 92, amen?

Many people, not just millennials, lack basic investing knowledge. It's not taught in high school, but thank goodness we all know how to calculate the area of a triangle.

Investing confuses many people and so most people just pick the default option for their 401k and forget about it.

As a fellow millennial, I'd like to share the best investing advice for millennials that most people don't know.

THE BEST INVESTING TIPS FOR MILLENNIALS

First and foremost, my advice is to do it. Invest. After that, here are some practical investing tips for millennials (and anyone really) to help you on your investing journey.

CALCULATE WHAT YOU NEED TO RETIRE

According to a Bankrate survey, 61% of Americans don't know what they'll need to retire.

Of those who did say they know, most of them had underestimated what they would need.

You need to start thinking about what you need to retire as soon as you start working.

>>> Click here to use Dave Ramsey's investment calculator and figure out what you need to save every month to meet your retirement goals <<<

If I'm being honest, I think much of the reason people (especially my generation) have not done the calculation is because they're scared of what they'll find.

They feel like it's a lost cause.

It's not about what you make, it's about what you save and invest in relation to your income.

You need goals.

SET SPECIFIC AND MEASURABLE GOALS & WRITE THEM DOWN

One of the best pieces of investing advice for millennials is quite simple, set and track your goals.

A goal without a plan is just a dream.

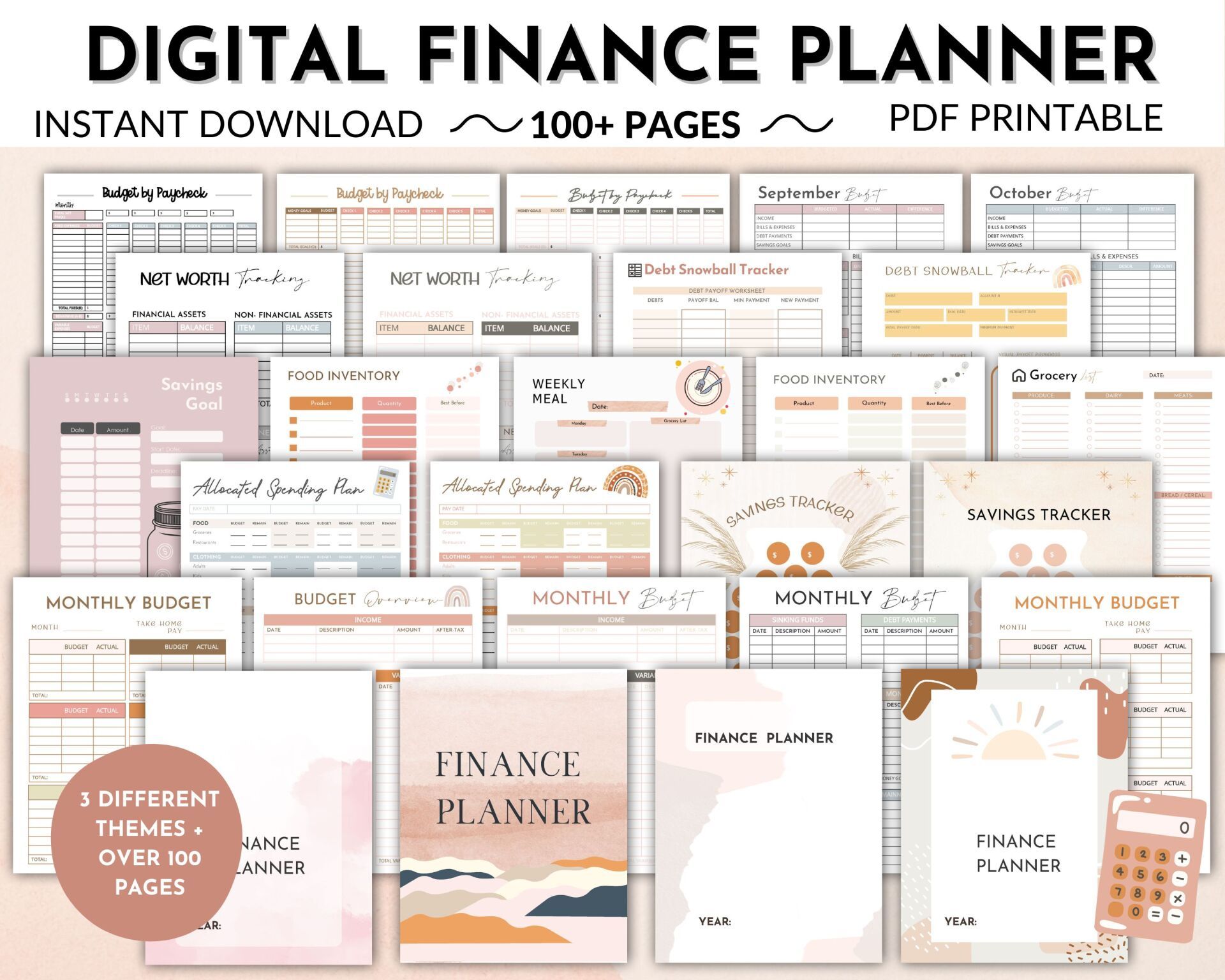

Pictured below are some of the worksheets I use to track my financial goals and to detail exactly how I'm going to reach them.

These worksheets are included in my Budget Bundle , my best-selling financial planning guide.

If you do any research on retirement goals/planning, the rule of thumb is to have your starting salary saved for retirement by age 30.

While that's a good goal to have, I want you to know that if you aren't quite there yet that's okay.

All hope is not lost, not even close.

Start saving today, calculate what you'll need to retire, and then start working towards it by setting goals and tracking your progress.

For us, one of our main goals is to always be investing at least 15% of of our gross income through our employer sponsored retirement plans and through outside investing.

By writing down our goals, we are able to better hold ourselves accountable!

DON'T INVEST IN WHAT YOU DON'T UNDERSTAND

Do not put your money into something that either confuses you or you haven't taken the time to learn about.

Investing is not rocket science, but if you don't understand some basic terms, you could get yourself into trouble.

Take time to educate yourself on the different types of investment portfolios and terminology.

HIRE A PROFESSIONAL

I have read just about every personal finance book out there, and I don't manage my own portfolio.

Although I love talking money, it's my financial advisors job to stay on top of news and trends and most importantly, to make sure our retirement goals are met.

A good financial consultant will work hard to understand your goals and needs and to explain your options thoroughly.

Run from any consultant who doesn't take the time explain what they will be doing with your money.

We found our financial consultant through Dave Ramsey's Smartvestor tool , check it out if you're interested (this is NOT an affiliate link).

DON'T FOLLOW THE CROWD

According to a Fidelity study, the average millennial is only investing 7% of their income.

When you see your peers traveling the world, having lavish weddings and celebrations, and purchasing homes and cars nicer than their parents, remember that statistic.

We live in a generation that is so obsessed with keeping up with the Joneses that they are willing to sacrifice their retirement to do so.

Be disciplined and please, do not follow the crowd!

INVEST BEYOND YOUR 401K

You should invest at least 15% of your gross (household) income towards retirement.

If that sounds like too much money for you, then you probably need to change your spending behaviors and get on a budget.

To get started budgeting, you can find the exact budget templates I use right here.

Most people don't realize that simply investing 3-6% of your income into your 401k will not sustain you in retirement.

We invest up to our employer match into our 401k plans, and then we invest independently outside of those plans to get us to 15% of our gross income.

USE MUTUAL FUNDS TO MITIGATE RISK

To put it simply, mutual funds allow you to invest in multiple companies at once, thus diversifying your investment portfolio and reducing your risk and hopefully increasing your returns.

Let's talk a little terminology, nothing too in-depth, just basic. Explained below are the popular investing alternatives to mutual funds.

- Single Stocks - I'm sure you've heard of those people who invested in Walmart or Apple in the beginning and now sip champagne all day from their mansion. To burst your bubble, investing in single stocks is risky because it depends on the performance of a single company. If you invest in single stocks, you're vulnerable to extreme highs and extreme lows.

- Bonds - A bond is issued by a government or corporation when they want/need to raise money. Essentially, these companies borrow money from you and you earn a fixed rate of interest on your investment. Bonds are safe because your interest rate is fixed, but the value of your bond decreases as interest rates rise. Bonds don't perform as well as stocks or mutual funds.

- Annuities - An annuity is a fixed sum of money paid to someone every year, typically for the rest of their life. Annuities are ok, but they tend to be very expensive.

Mutual funds are great because they reduce risk and ensure that you don't have all your eggs in one basket.

BE CONSISTENT

Don't let the market highs and lows scare you out of investing. In other words, don't be an emotional investor. Think long-term.

Warren Buffett has said that he decides a company is worth investing in because it will last, not because it’s doing well right now.

In fact, he says he doesn't base his investing decisions off of the news at all. If the market it down, that means stocks are cheap, and he 's ready to buy.

When it comes to investing, consistency is key.

If you're looking to buy and sell stocks all the time and be a day trader, you might as well just head to Vegas.

DELAY YOUR GRATIFICATION

One of the most important skills you can possess when it comes to money is having the ability to delay your gratification.

If you can't invest 15% of your gross income, you have other underlying problems and overspending is probably one of them.

Wait to make big purchases until you have the cash saved up, don't buy your dream house at age 22 (or dream car for that matter), live well below your means.

It's not rocket science, it just takes discipline and a mindset shift from instant pleasure to delayed gratification.

TO CONCLUDE...

Of all the investing tips for millennials, the best tip is to START NOW.

All the tips I shared are meaningless unless you start as soon as possible! Be sure to take a look at some of my other investing/retirement planning resources!

Related Content:

Share this post!