How To Budget For Christmas In a Pinch If You've Procrastinated

It's almost Christmas guys! I'm sure you have ALL your Christmas shopping done and every expense has been budgeted.... right?

I know I'm always preaching budget, budget, budget, and plan for every expense. Obviously, it's better to start earlier rather than later.

However, we are HUMAN .

"Looks like everyone is just going to have to be reminded that I am a gift this year...."

For those of you who are thinking that right now, this post is for you!

Here are some ways that you can still meet your Christmas budget and cash-flow your Christmas while being pinched for time.

1) Eliminate Eating Out

From now until Christmas, eliminate eating out. Considering that the average family spends $250 per month (about $3,000 per year) eating out, that would give you a great start. You can buy quite a few Christmas gifts with $250!

Eat at home, and try to squeeze the grocery budget too! Most families end up throwing away a lot of food, so really make an effort this month to squeeze the grocery budget if you are looking for extra Christmas money.

You can also save on groceries using this $5 per month meal plan.

You pay $5 a month and you are sent a complete meal plan and ingredient list every week, and the best part is that most of the meals cost $2/person and in lots of cases even less.

As a busy mama, I don't have hours to spend meal planning.

This is a GREAT option for families that have both parents working full time, or even stay at home moms who want more time to themselves! They even have options for gluten-free people!

Trust me on this one- your time is worth more than $5 a month, this is an absolute steal.

2) Shop Sales

I think that people sometimes hesitate to get others gifts from the clearance section because they feel cheap.

I think of it as you're getting them MORE for your money.

If you shop the clearance rack, just be careful to be sure that you get something the person would actually want. In other words, don't get them something they probably won't use just because it's on sale.

3) Work Extra Hours/Earn Extra Money

Of course your biggest tool is your income.

If at all possible, put in some extra hours or find other ways to make some extra cash . Try babysitting, selling a few extra things on a swap site, or even.... start a blog!

You can make some money here and there if you put in effort. Plus, if you enjoy writing it will be relaxing/fun for you and a possible creative outlet if that is what you are looking for.

Related:

4) Cut Out Extra Gifts

A lot of the time we end up getting gifts for certain people just because someone else told us they were getting their boss, coworker, babysitter, etc. a gift.

These are completely unnecessary if you have a tight budget.

Just because another person is buying everyone and their mother a gift doesn't mean that you have to.

Get gifts for the important people in your life like your family and maybe a few friends Here's some of the best frugal gift ideas!

Keep it exclusive, and don't feel bad about it!

Related: The Best Frugal Gift Ideas Under $50

5) Use Cash Envelopes

I can't emphasize this enough!

You will likely make more impulse purchases if you are using a credit/debit card. Use cash instead. Statistics show that you spend less money when you use cash vs. credit or debit cards.

I designed some floral watercolor cash envelopes that make carrying cash fun!

Using cash envelopes will force you to think twice about every gift you buy and you'll probably end up buying more thoughtful gifts. I find that I put more time and effort into my gifts when I buy with cash, because I want to get the best bang for my buck.

It's a completely different shopping experience when you actually have to hand over the cash!

Related Posts:

6) Shop Online & Save A Few Trips

I used to go to the store and do all my Christmas shopping. This is a great option if you live close to shopping centers.

On the other hand, for those of us who have to drive at least an hour to get to major shopping centers, this is not a great option. In addition to the cost of the gifts you purchase, you will have added costs for gas and eating out.

Shopping online might not pay if you don't get free shipping, so make sure you shop sales!

If you can get the majority of your gifts at one store/site, then you will probably qualify for free shipping.

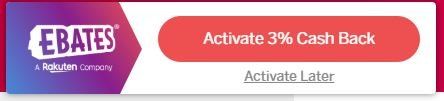

If you're smart about it, you can save quite a bit of money shopping online, including by getting cashback on purchases with online sites like Swagbucks, Ebates , and apps like Ibotta.

One of my personal favorites is Ebates , because you can install it on your internet browser. Then, if you visit a site that is eligible for Ebates cash back, it will notify you! Here is a snapshot of the notification I get when I visit Kohls-

It will pop up like this for ANY site that you visit that is eligible for cash back. They literally make it nearly impossible for you to miss!

7) Spend Less On Each Person

I personally think most Americans spend way too much on Christmas gifts.

Why would you want to put yourself in a position to have to pinch pennies for a month or two just so you can buy extravagant gifts?

It's hard to not succumb to the pressure when we are bombarded on social media with peoples highlight reels of the new washer and dryer they got their parents for Christmas, the car their husband got them for Christmas, and the list goes on and on.

Come January, those same people might be feeling the squeeze of their wallet.

If you can afford to buy your parents a new washer and dryer without making any significant dent in your checkbook, that's great! My point is if you really can't afford it, don't guilt yourself into buying it!

You'll be sorry in the long run.

Hopefully you can put some of these tips into action and be ready for the holidays!

Share this post!