8 Things You Are Spending Too Much Money On

If you're looking to cut your budget, save some extra money, or pinch a few extra pennies, there are probably some things you are spending too much money on.

Many times we struggle to find ways that we can save money. However, if you can find small ways to save money, in total, the small expenses you cut will add up over time!

When we first started budgeting and were trying to aggressively pay down debt, we made a bare bones budget and took a hard look at our spending habits.

We found that we were spending A LOT more money than we thought, and it was on things that didn't even matter to us that much.

Ultimately, that is the goal - to spend your money on what is important to you.

Here are 8 things you are spending too much money on!

8 Expensive Habits

Coffee

Coffee is my love language. This one hurts the heart. Most of my good moods are sponsored by coffee , so why would I change that?! Well, my $5 white chocolate toasted marshmallow triple shot with no whip was adding up to $25/week, or about $100/month. OUCH.

Once I put I into perspective that I was on track to spend $1,200 per year on lattes, I had a mid-life crisis and broke the chains of slavery to the bean.

I now allow myself up to two latte's per week, and they have to be bought out of my personal spending budget (If you're not familiar with this, Joe and I allow each other $60/week to spend on whatever we would like). On days that I don't buy a latte, I use instant coffee (here is the one I use). It's about $4 at most grocery stores and you get quite a few cups out of it!

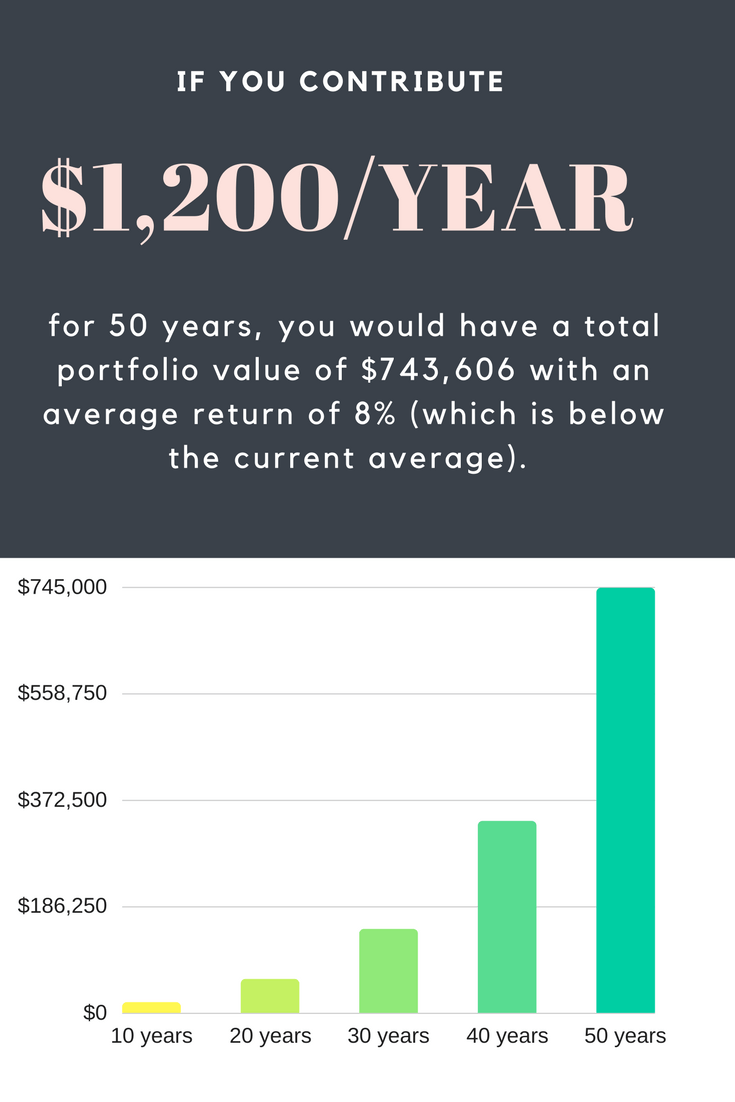

I illustrated below how cutting down on coffee can save you thousands of dollars over your lifetime using my example of buying a latte five days a week for $5, which totals about $1,200/year.

Extra Grocery Store Trips

Beware, these small but consistent expenses add up over time (to approximately $740k if invested)! It IS important to treat yourself every once in a while, so make sure you have money to do so in your budget!

My husband is a human trash can. He NEVER. STOPS. EATING. Needless to say, it's a little difficult to stick to a pretty tight grocery budget.

When we first got married, I was in tax season and Joe was in school, so it was difficult to plan meals and find time to make dinner at home so we ate out a lot and made frequent trips to the grocery store. Since we didn't plan meals very well, we ended up wasting a lot of food or eating out.

When we got serious about paying off debt, Joe and I revisited our budget and groceries was one of the categories that we decided to decrease to force us to plan meals better and use what we already had on hand.

Now, I try to only go to the grocery store once a week, unless I completely forget some items and I still have grocery money in my budget.

To curb impulse spending at the store, I use cash envelopes for my grocery purchases.

$5 MEAL PLAN

I also use a meal planning service , called $5 Meal Plan that sends a meal plan for dinner for every night of the work week (and a few additional meals for breakfast, a treat, a snack). I pay $5 a month, and every Friday my meal plan as well as an organized grocery list is sent to my inbox!

THIS IS THE BEST THING THAT EVER HAPPENED TO ME.

Using $5 Meal Plan , I cut the time that meal planning takes out while still saving money, because every meal costs under $5 to make.

FREEZER MEAL PLAN

The creator of $5 Meal Plan, Erin Chase, also created a freezer meal plan for extremely busy families, called MyFreezEasy.

MyFreezEasy is designed so you can create 10-12 freezer meals in ONE HOUR. Yes, you read that right. It also comes with preparation videos (in addition to instructions)!

Other features include:

- Mobile & tablet app. Create your grocery list in minutes from the store parking lot.

- Customize serving size for your meal plans. Easily customize the recipe & adjust serving size for your families needs.

- Sort shopping list by recipe or store section. Two different ways to sort your shopping list.

- Save your favorite meal plans. Favorite the best recipes and save meal plans for easy access.

- Build your own meal plan instead of using that months template.

You can get your feet wet with freezer meal cooking by signing up for Erin's FREE Freezer Meal Planning Success Guide workshop. You'll get...

- Free Freezer Meal Plan to Test Out!

- What to Freeze & What Not to Freeze List

- Printable: Freezer Inventory List

- Printable: Most Popular Meal Plan & Shopping List

If you feel like you don't have time to coupon, meal plan, or compare prices, this is a GREAT way to save money and reduce eating out every month.

Expensive Bar Tabs

An expensive bar tab is not something most people want to waste money on. However, most people also don't realize just how much money they are spending on entertainment and going out every month. When Joe and I finally added it all up, we were spending $500/month on eating out, bar tabs, and other entertainment!

Now we make our own drinks at home most of the time for less than half the cost. Even better, we don't have to tip ourselves for every drink we pour.

I'm not saying don't ever go out. Often times plans with friends include dinner and drinks. Opt instead to have drinks before or after at your house instead and BUDGET (seriously, it will change your life) for entertainment like going out for drinks and DON'T GO OVER your budget.

If you have trouble either sticking to a budget or setting up a budget, I have an awesome budget bundle that will allow you to instantly start tracking your finances!

It has 45+ pages of personal finance resources (see below)!

This Budget Bundle is for those who are sick of living paycheck to paycheck, running out of money at the end of the month, and feeling constant financial stress.

It includes...

- Monthly budget templates

- Expense logs

- Monthly bill checklists

- Debt snowball worksheets

- Financial goal planning worksheets

- To-do lists

- Meal planning templates

- Net worth template

- Motivational financial quotes

Don't wait another day to set up a budget, you will NEVER regret getting your finances in order.

Eating Out

I don't think this one comes as a surprise to anyone.

I think this is one that we know we spend too much money on, but we are scared to know exactly how much.

Statistics show that for the first time ever, Americans are spending more money at bars and restaurants that they do on groceries!

Dining out and takeout are becoming the norm, they are not luxuries anymore. Because of this, our wallets are hurting. In fact, recent data reveals that 69% of Americans have less than $1,000 in a savings account. Data also shows that they have no problem dropping on average $3,000 per year dining out.

I think the priorities are a little mixed up here?

While I do enjoy the finer things in life and love a good meal out, I knew that if we really watched how many times we ate out a month we would have A LOT more money left over at the end of every month and to save and invest for retirement.

Our rule is that we eat out once every two weeks.

Since we started doing this, I've noticed that eating out has again become a luxury, not the norm! I get way more excited to go out since we don't do it as often.

Buying New Clothes Every Month

I find myself buying way more clothes than necessary. I will find any excuse in the book to buy new clothes- I've had a rough week, I worked out for 5 minutes, I ate a carrot, etc. ANY EXCUSE.

Of course we all want updated, seasonal and stylish wardrobes. I don't know about you, but I consistently find myself rotating the same ten outfits and half of my clothes see the sun maybe once or twice a year.

Instead of buying new clothes for every season, I now buy more pieces that I can wear year-round.

I also stopped buying things just because they were on sale. This is my weak point. If it's on sale, my adrenaline runs. I get sweaty. My vision starts blurring. Just kidding. But you get the point- I'm a sucker for sales. It is okay to shop the sale rack if it's in your budget, but don't go over budget and justify it because it was on sale.

Lunch at Work

Two-thirds of working Americans buy their lunch instead of packing it, and it is costing them about $37/week on average. If you start working at 22 and work until your 65, and you are one of the average Americans who spends $37/week, you will have spent at a minimum approximately $83,000 on buying lunch during the work week.

Imagine what you could do with $83,000 over the course of your life!

I always bring a lunch to work. If you find that you either forget to make leftovers or forget your lunch at home often, it's a good idea to keep a few food items at work for those days. I always keep instant rice, oatmeal, granola bars, etc. at work for days I forget a lunch or I am too busy to make leftovers.

Not bringing a lunch to work is an expensive habit to get into.This is one simple and practical way that you can cut costs immediately.

Holiday and Seasonal Decor

My blood type is pumpkin spice. I am a candle-addict, I dream of white Christmases, and I also spend way too much money on those things if I'm not careful. The holidays can empty your wallet if you don't have a plan in place and a limit set beforehand on what you will spend.

If you don't have a plan, your wallet will be the gift that keeps on giving.... until there is nothing left to give.

I get most of my holiday decor from places like Shopko, Walmart, and Hobby Lobby. It's not extravagant, but it adds a nice touch to make our house warm, cozy and inviting. I have a lot better things to do with my money than spend $100 on some Christmas pillows and a sign that will be out for a few months.

Expensive Gifts

Along with the holiday seasons comes gift-giving. I LOVE to give other people gifts, and that is why I budget for them faithfully. Christmas and birthdays are not a surprise . Plan for them in advance!

Put aside $20-25 per month exclusively for Christmas gifts and by the time it comes around you will have the money and all you have to do is shop for the deals.

One thing I'd like to touch on is how MUCH you spend on gifts.

Your niece or nephew doesn't need that $50 convertible play car or that $20 reindeer outfit. Lots of times, kids end up playing with things that you already have on hand anyway, like tupperware, doors, your face, etc.

Don't spend a ton of money on kids!

Both Joe and my family do the 'choose a name' method for gift-giving.

This way, you don't feel obligated to get others gifts, you just have that one specific person you have to buy for. Of course I'd love to get my parents, Joe's parents, and Joe a nice Christmas gift, but for now they'll have to accept me with a bow on my head!

MAKE MORE MONEY

If you have already cut as many costs as you can, it might be time for you to find a way to MAKE more MONEY.

Your income is your biggest wealth building and debt-dumping tool.

Here are some practical ways that to make more money:

- Start a side hustle - a blog is a great option for a side hustle. I am so glad that I started my blog because while it is a job, it doesn't feel like one. I don't count down the hours until 5 o'clock so I can punch out. I LOVE blogging, and if you want time freedom, this could be the right choice for you.

- Sell your sh*t - Most of us have WAY more stuff than we need. You can make some quick cash by clearing out your home and closet.

- Babysit/Nanny - There is a lot of demand for babysitters and nanny's, especially on weekends. If you are serious about making more money, this is a great temporary option. If you love kids, give it a try!

- Become a virtual assistant - There is a HUGE demand out there for virtual assistants, as the blogging community keeps growing and growing. This is the future!

These are just a few practical ways you can cut some costs and/or make some more money!

It doesn't have to be forever, but if you are paying off debt, saving for a bigger purchase, or wanting to invest more, try cutting these costs and putting the extra towards your goal!

Share this post!