13 Ways to Save Hundreds of Dollars Clothes Shopping

If you're anything like me, clothes are your weakness, so you NEED tips on how to save hundreds of dollars clothes shopping. If you don't, you'll have to start hiding bags from your spouse. Yes, I've done this before. No, he still doesn't know.

How you spend and handle money with the seemingly smaller expenses like clothing will reflect your priorities in life.

If you're dropping tons of money on clothing, chances are you are not forward-looking and don't have your money priorities in order.

I will admit, I enjoy the finer things in life. I enjoy the finer things that I can pay for with cash . I enjoy quality clothes, but I make an effort to save in any way that I can and tell myself no quite often. I do this to create a habit. A habit of controlling myself and prioritizing investing and saving money for my future over things like clothing.

That being said, clothes are still a necessity and it can be hard to find ways to get good clothes and not spend a small fortune.

Here are some habits that have saved me tons of money shopping that you should try out!

1. Shop With Cash

This would definitely be my #1 tip!

When I shop with cash, I think about my purchases way more than if I shop with my debit card. I talked often about the benefits of shopping with cash, so I will keep it brief here.

You WILL spend less with cash. The physical pain and agony you feel (or is it just me?) when you hand over $50-100 in cash is REAL. It's like my pet died. My pet named Uncle Ben.

It's much more difficult to let go of hard-earned cash than it is to swipe a credit or debit card.

Related: Why We Don't Have Any Credit Cards

2. Buy During the Off Season

I'm sure you've heard this before, but it's worth talking about because I have found some great deals on clothes for summer in the winter and vice versa.

The problem that I run into when I buy clothes for example for winter in the month of December, is that by the time the winter clothes go on sale in March, April and May, I tell myself I can't buy them even though they are discounted because I just spent a small fortune during December!

Of course it feels sinful to be buying a tank top when it's the frozen tundra outside, but it can save you some serious bucks. It pays to wait.

Delay your gratification a little, buy out of season!

3. Stick to A Strict Budget

Make sure you have a budget for clothes!

This way you have a specific, realistic amount set that you can spend before you even hit the store. Otherwise, you will end up making your budget as you go and it will only get bigger and bigger as you go from store to store.

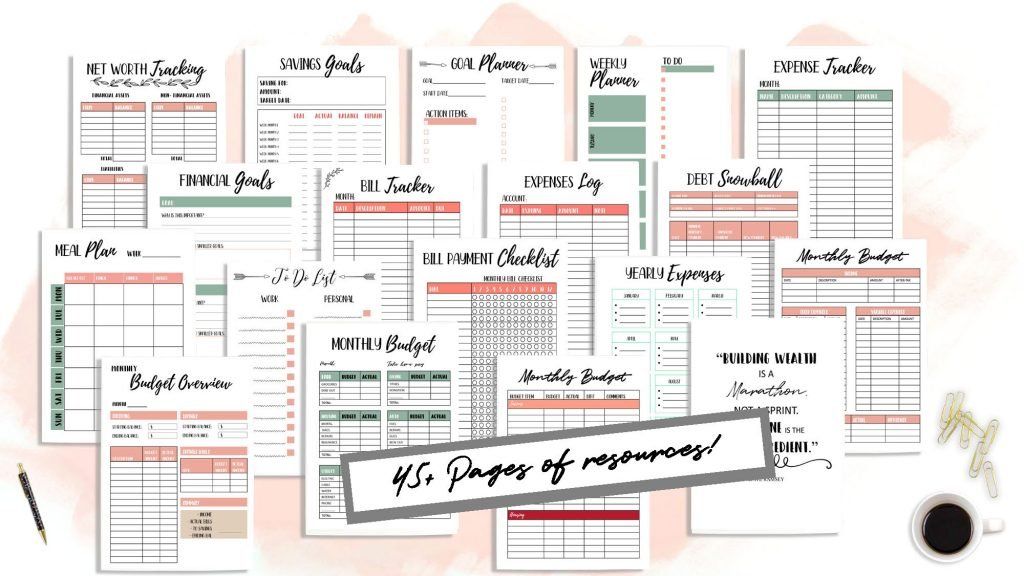

If you want to budget but don't know how, can't find the time to, or you want to be more organized with your finances, my monthly budget bundle and household financial planning guide has 45+ pages of personal finance resources!

For clothing purchases, Joe and I decided that they need to come out of our personal spending budget.

Our personal spending budget is the $60/week that we each get to spend on whatever we want. I put my $60 each week into my cash envelopes.

That may seem like a lot, but for me, all my makeup, lotions, clothing purchases, and activities with friends come from that budget! That adds up really fast.

Like I said, I do like nicer clothing that's a little bit more expensive, but I still have a cap for what I'll spend on jeans, shirts, or shoes. I have a really hard time paying over $30 for a shirt, even if it's in my budget. I can count on one hand the times I've paid over that.

Just remember, if it's not in the budget, you have to skip it.

Related Content:

4. Think About Bigger Purchases For A Few Days

I'm sure you can all relate to this- I'm in the store and I think to myself "Should I buy this?"

My wallet says no. My brain says no. My husband says no.

*Thirty seconds later*

"Sold."

Someone once told me that the best things in life are free, or at least reasonably priced.

What's the difference between a Patagonia jacket and an American Eagle jacket? Not much. You're paying for the brand. I'll admit, I'm obsessed with North Face. I have three rain jackets and two fleece that are the North Face brand, BUT I have never paid over $50 for any of them. I went home, thought about it, and then bought them 3-4 months later when they went on sale.

If you are contemplating buying a really expensive piece of clothing, go home, sleep and then re-evaluate. When I do this, 9/10 times I don't make the purchase.

If you think about making the purchase for a day or two, you are able to think rationally about whether you really need the item or not and whether it's worth the big price tag.

Don't be an impulsive buyer, especially when it comes to large dollar amounts.

5. Don't Window Shop

I realize that this might contradict what you've heard from others.

Some people will say you can still go out with friends if you don't have money to spend, just window shop and you'll be fine.

It's a trap. A trap you are setting for yourself.

You might tell yourself that you won't spend any money (and sometimes you may follow through), but unless you have a crazy amount of willpower you usually end up spending some money.

I'll be the first to admit I've found myself caving to pressure to spend money when I didn't have money to spend.

Whether it be because I didn't want to the the only one in the group not getting Starbucks, or because I caved to the pressure to get an item that my friends swore I couldn't live without, I've done it many times.

The problem is you feel like crap after either because you know you couldn't afford it, or because you know you just put yourself farther from your financial goals.

The problem is you feel like crap after either because you know you couldn't afford it, or because you know you just put yourself farther from your financial goals.

Only shop if it's in your budget to buy something!

7. Put It On Your Wishlist

If you really want something that you just can't justify buying yourself, put it on your Christmas or birthday wish list.

This way you'll be getting something that you actually want, and you don't feel guilty about the price!

If you get cash, even better then you can go out and buy it yourself!

Before I got married, I had pretty expensive taste in skin care products and makeup. Now, I buy drugstore skincare products and makeup. You have to pick your poison, and mine is clothes. I'll pay more for good quality clothes.

The other items I put on my Christmas and Birthday lists so it is a special treat when I get them!

8. Focus On Value, Not Quantity

I pretty much exclusively shop at boutiques, believe it or not. I like to support small businesses and I like good quality clothes.

I choose quality over quantity.

I don't have a ton of clothes, but I wear the crap out of them.

It's great to shop at thrift-stores, but if you're buying a ton of clothes and you only really wear a few pieces often, that's counter-productive.

I think I actually spent more money when I shopped almost exclusively at thrift stores, because I would buy in such large quantities because of the great deal.

It's okay to buy nice things as long as they are in your budget (and reasonable) and you get good use out of them.

9. Try to Buy Things You Can Wear Year-Round

In the last year, I was noticing that certain items that I bought for different seasons or occasions rarely made it out of my closet.

I did a purge and brought a ton of clothes to the thrift store.

While I was on my way, I started thinking about how much money that bag of clothes was worth- A LOT.

Consequently, I have started focusing on buying things that I can wear year-round.

This will obviously vary based on where you live. I'm from Washington state, so scarves and rain jackets would be things I could wear year-round at home (Yes, I still refer to WA as my home, don't hate me for it).

Now that I live in Iowa, there isn't a whole lot of things that can get worn year-round, but basic t-shirts and other neutral colored tops make up the majority of my closet!

My closet is a lot smaller, but I wear the things in it a lot more!

Added bonus- I save a lot more money this way!

10. Use Coupons, Ebates & Ibotta for Online Shopping

I get made fun of a lot for this one- I am a big-time coupon collector.

I have a box in my kitchen that is full of them. I use coupons for just about everything that I can, including clothes. A 15-20% off coupon might not seem like that much, but when you pay cash it makes a big difference!

Even if you only get $5-$10 off, that adds up after a few purchases!

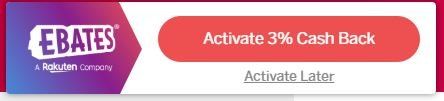

I do get mail coupons from a couple of stores, but I mainly use apps like Ebates and Ibotta. These apps have coupons for thousands of stores, so all you have to do is search for the one you are planning on shopping at and see if there are any coupons available.

I like Ebates because you can easily install it on your internet browser, and it will automatically alert you when you are on a site that has cash back available. This way you don't remember about the cash back AFTER the fact.

Here is a snapshot of what the notification looks like:

Ebates makes it SO SO easy to save money, and as a bonus they offer 5-8% cash back at most popular stores!

To me, using coupons is worth it. Many people think that the time you put in isn't worth what you get, but in our digital age it hardly takes me any time to search and save coupons!

11. Be Willing to Hunt

P A T I E N C E.

Something I don't possess.

I have a hard time with the word "wait." This is an issue especially when it comes to shopping. I always think when I see an item that I like that I'll never find anything else like it and I need it NOW.

Unfortunately, in the retail word that leads to instant buyers remorse.

If you are looking for a particular piece/style of clothing, don't buy the first one you see (unless it's a really good deal). If you look around, you can weigh your options and see what is the best value.

12. Borrow for Special Occasions

I've said this before, I am very talented at finding reasons to shop for new clothes. Ridiculous reasons. However, one that is not so ridiculous is buying clothes for special occasions.

It seems like a pretty reasonable reason to buy something new, right?

My answer would be sometimes, yes. Most of the time? No.

I think this excuse is used too often to justify unnecessary purchases.

Instead, try and borrow more clothes! I'm sure at least one of your friends has something that you can wear if you would just take the time to see.

13. Cheap Doesn't Mean Free

I LOVE DEALS.

The only thing I wish would go on clearance more is wine. I'd save a lot of money.

BUT, be careful to not buy things just because they are on sale. Sure, those free people boots on sale for $60 are tempting, but they are still $60. Are they something you need at the moment? Will you wear them enough to make it worth it? Is it in your budget right now, or are there other things that you should be putting money away for instead?

Those are all good questions to ask yourself before justifying a purchase simply because it's on sale.

Hopefully you can use these tips to help you save money on clothes!

For more money saving ideas, follow me on Pinterest!

Share this post!