10 Practical Money Skills You Should Know

One thing I’ve learned from being a CPA, money blogger, and friend, is that common-sense, old-fashioned, practical money skills are just as much (if not more) useful and applicable today than in the past.

Even further, I believe because many lack practical money skills today, they find themselves living paycheck to paycheck.

Why is this?

Consumer money behaviors have changed drastically over time in response to a changing marketplace, culture, and generation.

A recent survey by BigCommerce found that online shopping (led by Amazon) has turned us from after work and weekend shoppers to 24/7 shoppers. The study reported 43% of consumers shop while in bed, 23% shop at work, 20% shop while on the road, and 20% shop while in the bathroom.

We’re ALWAYS shopping.

Additionally, because we live in a culture plagued by instant gratification, as a byproduct, we naturally have a sense of entitlement.

We want a nicer car than our parents, a bigger house than our parents, and a fancier vacation than our parents, RIGHT NOW.

Don’t fall for it. Our culture is screaming at you something that will destroy your finances.

So how do you set yourself up for success financially?

Follow these practical money skills outlined below to get your money under control.

10 PRACTICAL MONEY SKILLS

Outlined below are 10 practical money skills that will help you become financially literate.

1) HOW TO BALANCE A CHECKBOOK

First, let’s get one thing straight, checking your bank account balance and balancing your checkbook are not the same thing.

Today, many people simply check their bank balance every so often just to make sure they aren’t over drafting. If they don’t spend more than what’s in their account, they think they’re in a good place financially.

WHY RECONCILE?

Consider this example:

It’s Monday. You quickly login and check the balance of your checking account before rushing off to do your daily tasks. You have $2,000 to work with until next week. Great! Should be more than enough, you think to yourself. You know there’s one or two bills that will automatically come out of your account between now and then, so you take that into account.

Come Saturday morning, you login again and check the balance. $500?? How did it get so low so quickly?? Uh oh. The two bills that are due haven’t even been processed yet! What in the world?? You scroll through the transactions.

Oh, yup. Forgot about our semi-annual insurance premium that automatically comes out of the account. Oops, also forgot about the check you wrote the babysitter two weeks ago that she finally cashed. Looks like your husband ate out a few times on his lunch break at work.

Well, shoot. You were thinking you’d FINALLY be able to buy that new couch that’s long overdue.

Guess it will have to wait until next paycheck, along with so many other things!

Rinse, repeat.

STEP BY STEP

This example shows the practical benefit of reconciling your account. Additionally, there are psychological benefits, you think and behave differently with your money when you know where it’s going.

A common misconception is that because most people don’t use checks anymore, account reconciliation is not necessary. This couldn’t be further from the truth!

In fact, I’d argue in our digital age, it’s even more important to reconcile your account.

Here’s how to do it.

It’s up to you how often you want to reconcile your checking account.

If you have a nice cushion in your account, you might only do it weekly. If you’re meticulous like me, you do it at the end of every day.

You’ll find that as you get the budgeting process down, it’s easier to reconcile your checking account daily since you’re updating your budget daily for actual expenses that occur.

Reconciling your checking account is simple:

- Start with your bank balance.

- Record pending transactions that are not reflected in your banking activity.

- For expenses that have not been reflected, subtract these from your bank balance. For example, subtract checks you’ve written that have not been cashed.

- If you have outstanding deposits that have not been reflected, add these to your bank balance. For example, if you make a mobile deposit that takes 2-3 days to show in your online banking.

- This is your true account balance.

The reason this is your TRUE account balance is because at any time, the checks you’ve written could be cashed or deposits recorded.

If you make financial decisions based solely on your bank balance, you are making decisions that are not based on reality.

Keep track of your TRUE account balance at least weekly, if not daily!

2) THE DANGERS OF DEBT

Although debt is often touted as something that can be ok (even good) if managed well, it is dangerous. Here’s why.

- Debt tempts you to overextend yourself financially.

Our culture has redefined affordability. Rather than having enough cash to make a purchase meaning you can afford something, now it is having a big enough credit card limit.

- Many people never pay off their balance. In fact, nearly half of all credit card users only make the minimum payment, carrying the balance over to the next month.

- Using credit affects our brain differently.

Research shows that when we used credit to purchase, we tend to spend more. Why? Because it doesn’t hurt as much to swipe a card as it does to hand over cash. When we use cash or a debit card, we know that the money will immediately leave our account. However, when we use a credit card, the money doesn’t immediately leave our account. Because of this, our brain doesn’t feel asl much “pain” when making a purchase with credit.

- We’re willing to pay more for the same object when using a credit card.

One psychologist

warns that retailers advertise credit cards so heavily because they know the psychological affects it will have on their consumers. For example, if you know that you will get airline miles for every purchase you make, you might not think twice about paying a few extra dollars for it. It’s reverse psychology!

- You end up paying more for an item than it’s worth. For example, let’s say you bought a brand-new vehicle for $30,000 on a 5-year loan. The second you drive off the lot, the car loses 20% of it’s value. Additionally, as you put miles on the car, the value deteriorates quickly. After 3 years, let’s say

Remember, the convenience of a card is costly . Debt creates enough risk to offset any potential benefit.

If you’re currently in debt, it would be wise to get out as quickly as possible. We paid off over $20k of student loan debt in 12 months while living on one income!

Learn more about how we followed D ave Ramey’s debt snowball.

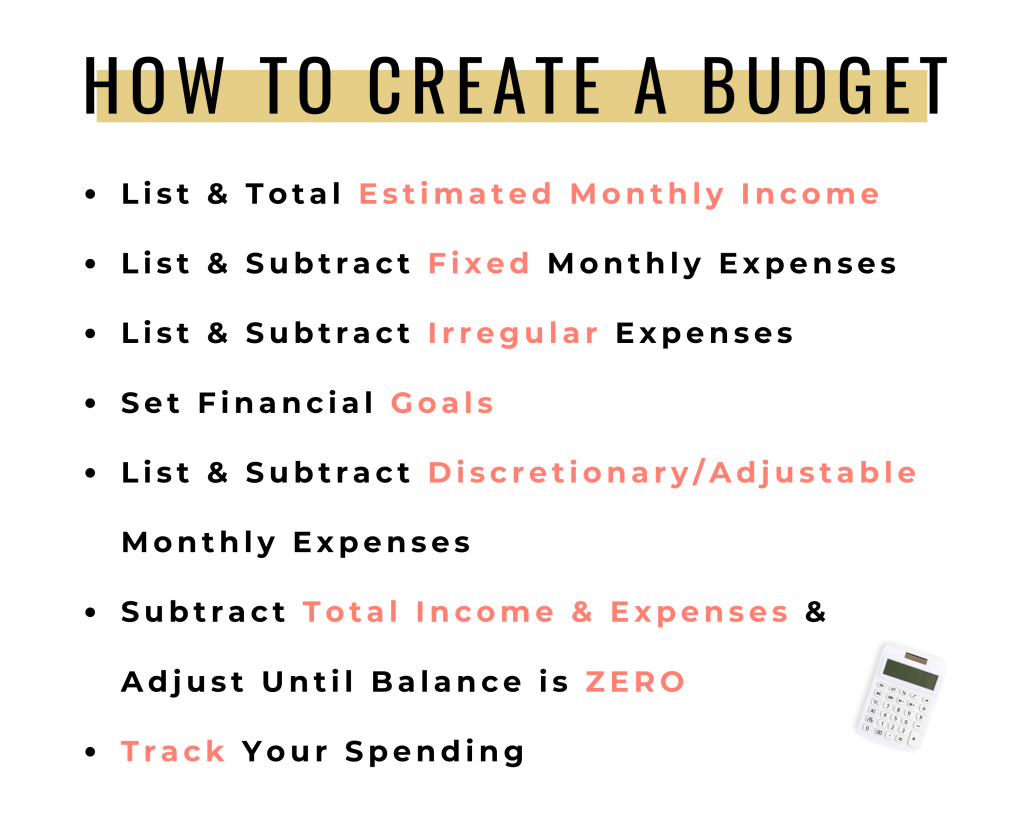

3) HOW TO BUDGET

If you learn one old-fashioned skill, please learn how to budget.

A budget is a safeguard against all kinds of financial turmoil.

The reason many people always feel so out of control financially is because they don’t have a plan. Or, they have a plan- ish.

While not having a plan might work in the good times, it doesn’t work in the bad times.

A good plan will work in both the good and bad times and will help you be ready for both!

The beauty of a budget is that because you are intentional with what you do with your money, it takes the stress out of your finances!

The goal of budgeting is to assign and spend every single dollar on paper before the month begins.

Don't think of a budget as a bunch of rules and restrictions. Instead, it's freeing because you give yourself permission to spend without guilt knowing that you have a plan!

To get started budgeting, I have TONS of resources. You can start by downloading my free monthly budget template.

BUDGETING HELP:

BUDGETING TEMPLATES:

4) COMPOUND INTEREST (A LITTLE GROWS TO A LOT OVER TIME)

The secret to becoming an everyday millionaire is to understand and utilize compound interest. If you commit to learning. more about any of the practical money skills laid out, let it be compound interest. It's that important.

Simply put, compound interest is interest earned on interest. The best way to explain is by example:

If you deposit $100 into a mutual fund and earn 5% interest on your deposit during the year, you will have $105 at the end of the year. The next year, if you again earn 5%, you will earn interest not only on the $100 you initially deposited, but on the $5 you made the previous year as well.

Therefore, you will have $110.25 at the end of the second year ($105 x5%).

This example shows the power of compound interest and time! If you start investing early, you are way ahead of the game because your money has more time to compound!

Therefore someone who invests $1,000 at age 20 and doesn’t touch it until age 60 will have more money than someone who invests $20,000 at age 40!

Time makes a huge difference. TIME IS MONEY.

Now that you know how compound interest works, use it to your advantage!

5) HOW TO SAVE

The ability to save money is an invaluable skill. By saving money, you are setting yourself up for success in the good AND bad times.

Ants are creatures of little strength,

Proverbs 30:25

yet they store up their food in the summer;

You need two major savings accounts at the very least.

First, you need a savings account with 3-6 months of household expenses in it. This is called your emergency fund. The more unpredictable your income, the closer to 6 months you should have in the bank.

Second, you need a saving (s) account for large, upcoming purchases and irregular but predictable expenses. This includes, but is not limited to, major household repairs, a new car, major car repairs, college funds for your children, vacations, etc. Often times, these savings accounts are called sinking funds.

A major complaint amongst Americans is that they feel like various expenses are constantly sneaking up on them. If you want to feel more prepared, budget and save for these expenses year-round with sinking funds.

Be sure to keep track of your sinking funds so you know exactly how much of your savings is earmarked for what.

This is the template I use to track my sinking fund balances!

Learn more about how to set up sinking funds from the posts below:

Although these seem like common sense tips (because they are), the statistics show that most people are not following them. Studies show that 8 out of 10 Americans are living paycheck to paycheck and would not be able to cover a major financial emergency!

6) TAKING CARE OF WHAT YOU OWN

We live in a disposable world. What I mean by this is that if something has any minor defect, we don't like it, etc., we simply throw it out and get a new one. Because of this, I think we've lost motivation to take GOOD care of what we own.

I love buying quality products that last a long time, but the product itself is only half the equation. Part of the responsibility for the longevity of the product is on me, the buyer.

Take good care of your things that you work hard to pay for and you won't have to replace them as often.

Practical money skills are not new, hard to comprehend ideas. Rather, they are old-fashioned common-sense skills. Sometimes. we just need a refresher :)

7) GETTING THE MOST BANG FOR YOUR BUCK

One of the most important money concepts you can learn is value . By definition, value is t he importance, worth, or usefulness of something.

Value is what you need to take into consideration before every purchase you make.

A good exercise to help you gauge the value of an item is to convert the purchase into hours worked.

For example, if you make $25/hr and there is a sweater you really want for $50, you had to work 2 hours to pay for the sweater. Is that worth it to you? Will the sweater give you enough value in return?

Managing money well isn’t about buying the cheapest things possible to save money. Rather, it’s about spending your money in a way that you get the most value for your money.

You work hard for your money, you want want you purchase to reflect that.

8) DELAYED GRATIFICATION

There is an opportunity cost to everything.

While I would LOVE to have the latest and greatest vehicle, furniture, etc., I’m not willing to sacrifice my future for it. The opportunity cost to buying outside our means is saving for retirement.

That’s not to say there is something inherently wrong with having expensive things. Rather, we are going to live within our means so we can save diligently for retirement.

DELAY GRATIFICATION BY LIVING WITHIN YOUR MEANS

Keep in mind everyone’s means are different.

We recently bought a used 2018 van and paid cash. That was within our means. For someone else, it might be within their means to buy an Escalade and live in a 5,000 square ft house.

You can gauge whether you are living within your means by assessing three major things:

1) Do you have a good chunk of money left over at the end of every month that you can save and/or invest? A good rule of thumb is to save 15-20% of your gross income every month.

2) What is your net worth?

You can calculate this by taking your total assets – your total liabilities.

Assets

include the current selling value of your home, vehicles you own (not lease), cash on hand, retirement account balances, etc. Liabilities

include any debt (credit card, student loans, vehicles, home mortgage, payday loan, etc.)

you have outstanding.

3) What does your retirement savings look like? You should have at least half of your total annual income saved in retirement accounts by age 30. How are you doing? Are you on track? If not, why? It’s likely a problem stemming from not living within your means.

9) STEWARDSHIP

When thinking of practical money skills, stewardship probably doesn't come to mind right away. However, ultimately, everything you do with your money reflects how good of a steward of it you are.

As a Christian, I know that ultimately my money belongs to God, and he entrusts it to me to steward well.

When we think of our money this way, we treat it differently. Our behaviors change.

Constantly remind yourself that you are merely a steward, everything you have been given belongs to God.

How much more does this cause us to be careful , prudent , and generous with our money?!

10) THE JOY IN GIVING

The Bible tells us that is more blessed to give than to receive. While most of us know this to be true, we still struggle to give to others because of our selfish human nature. We all have a natural tendency to look out for our own well-being first.

The same is true with how we handle our money.

In principle, we’d like to think that we’re generous because after we do our duty to tithe, we’re in the clear! Game on. Time for the new furniture, new vehicle, or whatever else suits our fancy in the moment.

Let me be clear, owning expensive things is not inherently bad! Having a nice car or nice furniture is not sinful. We become sinful when we don’t follow God’s command to steward wisely what He gives us, including our wealth.

So, while there is no magic number or equation for how much you should give, seek to have the heart of a giver.

Remember, what we do is who we are. Are you generous with your money? Has someone ever given generously to you? How did that feel?

I’ve heard it said that our wallet is a scalpel that God uses to perform heart surgery- our giving reveals the condition of our hearts!

WHERE TO START

By now you're probably feeling a bit overwhelmed by all the things you SHOULD know.

I have good news- the best way to get from where you are to where you want to be is by taking small, consistent steps :)

Master one of the practical money skills mentioned above. Then, master another. So on and so forth.

Remember, Rome wasn't built in a day!

YOU CAN DO THIS :)

Share this post!