Is Money The Root of All Evil?

I can’t count the number of times I’ve heard from another’s mouth; money is the root of all evil! Often this claim is based on a passage in 1 Timothy 6 that is, like much of scripture, misinterpreted.

However, I can count on one hand the number of times I’ve heard an in-depth sermon on how Christians should handle money. Part of it might be because the subject of money can be taboo

in Christian circles.

Many pastors tiptoe around the subject and stick to some general Sunday school principles. Don’t lust after money. You won’t take it with you when you go. Be content. End of sermon.

The vague nature of these principles has left many Christians confused, and thus creates more questions.

What about debt? Is it bad? Should I have a credit card? Is it financially (and therefore biblically) responsible to wait and save money before having kids?

While I’d love to dive into all these questions, because they are all questions that I’ve wondered about myself, today I’ll address one.

Is money the root of all evil?

Let’s dive into what scripture has to say.

➡️ Related reads:

IS MONEY THE ROOT OF ALL EVIL?

In short, no, money itself is not the root of all evil. When we ask this question, we are missing the point. The key variable that is left out of such a question is our personal responsibility —how we behave towards money.

If we love money and it becomes an idol that we serve, then our behavior and heart attitude towards the money is evil. The Bible reiterates this over and over.

Contrary to popular belief, the Bible has a lot to say about money!

Let's take a look at biblical money principles according to scripture.

1) MONEY ITSELF IS AMORAL

Money is neither good nor bad. Rather, the LOVE of money sinful and the root of all kinds of evil:

For the love of money is a root of all kinds of evil. Some people, eager for money , have wandered from the faith and pierced themselves with many griefs.

1 Timothy 6:10

The key word in this verse is love. It does not say that money is the root of all evil. Rather, the love of money is the root of all kinds of evil.

John Piper points out the significance of the phrase all kinds of evil, as this implies that not just one, but many desires stem from the love of money.

When we try to place blame on money, we completely miss the point. It’s like blaming cookies for making us gain weight. While it’s true that cookies don’t provide great nutrition, we are the one who decides whether or not to insert one into our mouths, and how many times.

2) GOD DOES NOT SHOW PARTIALITY BASED ON INCOME

The Bible is clear that God is just, and therefore does not show partiality to anyone.

He doesn’t show partiality to anyone based on sex, marital status, wealth, race, or occupation.

He will judge each person’s work on this earth impartially:

Since you call on a Father who judges each person’s work impartially , live out your time as foreigners here in reverent fear.

1 Peter 1:17

This means that whether rich or poor, God will judge your actions on the same basis.

3) THERE ARE GODLY RICH & GODLY POOR

If the Bible says money is the root of all evil, then we would have to conclude that those who have a lot of it are evil. However, it is very clear in the Bible that there were rich godly people.

Job was an abundantly wealthy man and the Bible makes is clear that he was also a very godly man (Job 2:3).In fact, when he lost everything but remained faithful to God, the Lord blessed him with twice as much wealth!

There are godly rich and godly poor as well as greedy rich and greedy poor.

4) SERVING MONEY IS SINFUL

God made it clear – you can’t serve both Him and money [or anything else]. We must choose whom we are going to serve.

No one can serve two masters. Either you will hate the one and love the other, or you will be devoted to the one and despise the other. You cannot serve both God and money.

Matthew 6:24

5) WE ARE NOT PROMISED WEALTH

First, godliness does not promise material wealth, but rather, spiritual wealth.

Nowhere in the Bible does it say that if you do x,y & z, God will bless you materially.

In fact, you can do everything right- budget, save, invest, and still experience great financial disaster.That is not to say that we shouldn’t budget, plan, save, and invest. These are very wise things to do according to Scripture.

However, these are principles (particularly in the book of Proverbs), not promises.

If you budget, save, and invest, you are 10x more likely to succeed financially than if you don’t.

This is a general principle .

However, that is not true for everyone. Some people don’t budget, save, or invest and end up very wealthy.God gives and takes away.

We have budgeted, saved, and diligently invested throughout our marriage and have experiences times of financial blessing and financial drought.

No matter where you find yourself on the wealth spectrum, one thing is certain-- we are called to steward what God has given to us.

6) CAUTIONS AGAINST DEBT

The Bible is clear- debt is not a good foundation to build your finances on.

The rich rules over the poor,

Proverbs 22:7

and the borrower is the slave of the lender.

If you’ve ever been, or currently are in debt, you know the weight of it. I felt this weight immediately after graduating college with $20k of student loan debt.

Following Dave Ramsey’s debt snowball method , we were able to pay it all off in about one year.

Debt causes personal stress, puts pressure on your marriage, and keeps you behind financially.

Because of debt, many people are putting off getting married, buying a home, and having children. All because they are crushed under the weight of debt.

Debt is ultimately a heart issue . In order to fill the gap between our wants and the funds available, we look to debt to fix the issue. Debt is a direct product of envy, greed, and lack of planning.

Steer clear of consumer debt! If you can’t pay cash for it, you can’t afford it!

7) MONEY REVEALS INTEGRITY

We should constantly be asking ourselves, if Jesus opened my checkbook, would I be ashamed?

Although money tends to be taboo amongst Christian circles, it’s important that we do talk about it. God doesn’t take the subject lightly, he says in His Word:

For where your treasure is, there your heart will be also.

Matthew 6:21

It is SO easy to make money our treasure and commit idolatry. Because of this, we need to talk about it and constantly be on guard!

8) GIVING

God makes it clear, if we don’t give with a cheerful heart we might as well not give at all.

Each of you should give what you have decided in your heart to give, not reluctantly or under compulsion, for God loves a cheerful giver.

2 Corinthians 9:7

Do you see the theme here? God is concerned with the attitude and posture of our hearts.

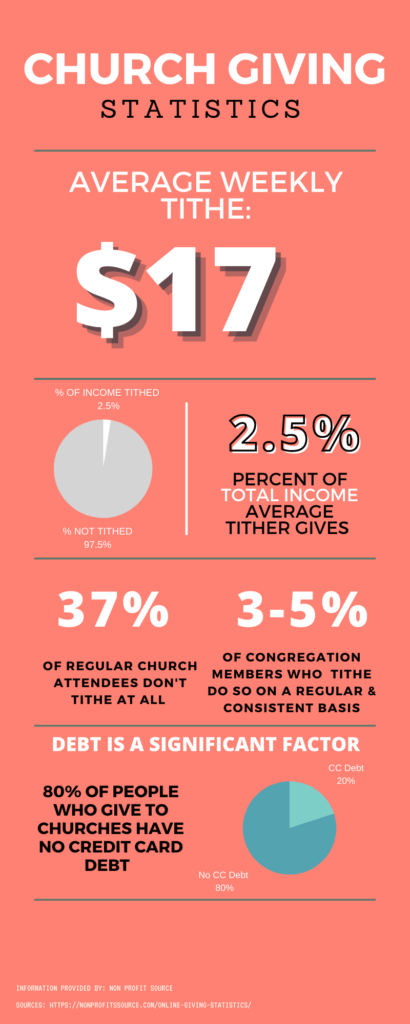

Naturally, the question of how much believers should be giving arises. It's an important question! After all, your church depends on your giving for sustainability!

At the very least, your pastor, church staff, and church amenities are supported with the giving of the congregation. However, beyond that, many churches also support various youth organizations, missionaries, and other groups within their church.

Research shows that only 10-25% of church members tithe, and 80% of them only give 2% of their income ( Nonprofit Source ).

I've heard it said that the last thing believers submit to God is their checkbook.

HOW MUCH?

The difference in opinions revolves around whether the 10% tithe is still required today, or if that Old Testament command is not applicable today.

While it’s true that the Old Testament rules are not applicable today (Jesus death on the cross fulfilled the covenant), in the new covenant everything is greater.

As a result, if the Old Testament command is to tithe 10%, the new covenant is greater. I think then, when we ask the question (do I HAVE to give 10% to my church??), we are completely missing the point.

We are HOPING there is a way we can get out of giving a small portion of our income and keeping it instead.

9) MONEY WILL NEVER SATISFY

We are human beings created by God to find satisfaction in Him. Have you ever heard a wealthy person say, more money doesn’t solve your problems! I have, and I remember thinking to myself, yeah, easy for you to say.

But it’s true, if you struggle being content with what you have right now, you won’t be content with more either. This is pointed out in Ecclesiastes:

Whoever loves money never has enough; whoever loves wealth is never satisfied with their income. This too is meaningless.

Ecclesiastes 5:10

Keep your lives free from the love of money and be content with what you have, because God has said,

Never will I leave you; never will I forsake you.

Hebrews 14:5

Whomever loves wealth will never be satisfied with their income. This is because money is not meant to satisfy us—Christ is.

Keep your eyes fixed on Jesus. Don’t let money distract you, deceive you, or control you.

10) IT ALL BELONGS TO GOD

Last, but definitely not least, everything you have belongs to God, including your money.

When we see our money this way, how much more should we care what we do with it?!

Every good thing bestowed and every perfect gift is from above, coming down from the Father of lights . . .

James 1:7

Remember, He is the giver of every good gift in our life- our spouse, children, family, friends, and monetary blessings.

He is also our provider.

While this may seem like a hall pass to get out of working diligently and just getting by, it’s quite the opposite.Rather, our motivation and understanding of work changes! We are designed to work, God made us that way.How we work then, it unto God and not unto man.

If this is the case, we go above and beyond instead of just getting by doing mediocre work.

PRACTICAL APPLICATION TO THE BELIEVER

PRUDENCE & PLANNING

PRUDENCE & PLANNING

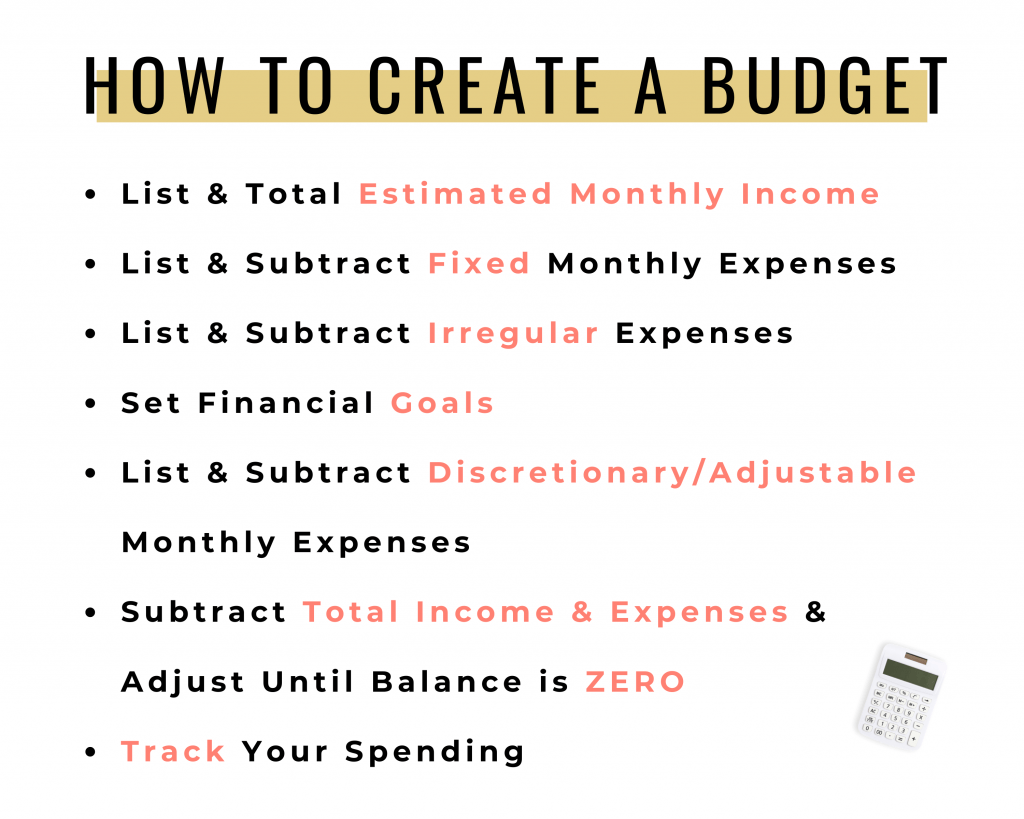

CREATE A HOUSEHOLD BUDGET

According to Luke, those who don't count the cost to build a tower before building are foolish.

If you don't know how much money you are taking in and spending every month, that is foolish. The wise man plans head and carefully considers his steps.

A budget is simply a plan for your money.

Many people get turned off to the word because it sounds restricting , cumbersome , and too smart-sounding.

What they don't realize is that budgeting is quite simple !

Budgeting is a simple process of planning your spending, tracking your spending, and adjusting as you go.

The beauty of budgeting is that rather than being restricting, it actually allows you more flexibility !

DON'T TRY TO GET RICH QUICK

If it sounds too good to be true, it is. In an effort to get rich quick, many end up losing whatever wealth they've built.

Behind any get rich quick scheme is greed. The Bible is clear that self-discipline and consistency are the key to any kind of long-term sucess:

Dishonest money dwindles away,

Proverbs 13:11

but whoever gathers money little by little makes it grow.

Larry Burkett says that trying to get rich quick leads to 3 errors-

- Getting involved in things you don't understand

- Risking funds you can't afford to lose

- Making hasty decisions

All three of these things violate biblical principles, which are principles believers are to live their life by!

BUILD WEALTH OVER TIME

The plans of the diligent lead surely to abundance,

Proverbs 21:5

but everyone who is hasty comes only to poverty.

LIVE WITHIN YOUR MEANS

LIVE WITHIN YOUR MEANS

Many times, the issue is not how much we make, it’s how much you spend. You don’t need to chase the next carrot to finally be satisfied. I can almost guarantee that you don't have an income problem, you have a spending problem.

The reason most people don't live this way is because they don't even realize they are spending more than they are making, or they don't care.

It's normal to spend more than you take in and use credit cards to fill in the difference between your income and expenses every month.

While I could write a whole post on why people live this way, it boils down to feeling entitled to what we can't have.

Live within your means, don't spend more than you make, and know where your money is going.

➡️ Related: How to Know if You are Living Within Your Means

RELY ON GOD ALONE

RELY ON GOD ALONE

Because we are sinful, we tend to rely on money when it is plentiful and cry out to God when it is scarce. Continually be evaluating where your treasure is. Pray for contentment in Christ, ask God to keep you from lusting after fleshly desires.

Your income may rise and fall, but God stays the same. This is why is exhausting to find your comfort in your finances! Every time anything remotely threatens your income, you'll be miserable.

It's a rollercoaster that isn't worth riding.

SO WHAT DOES THIS MEAN?

In summary. the kingdom of God is for both the impoverished and wealthy . God is just - he doesn’t show partiality to anyone.

He came for the fishermen and the tax collectors, the top 1% and the bottom 1%, the rich and the poor, and everyone in between.

Jesus didn’t come to just save a certain class – he came for sinners – the all-inclusive class.

Your heart attitude, which determines how you spend your money, is what He is concerned with.

Your wealth or lack of wealth doesn’t automatically determine your fruitfulness for Jesus.

How you steward what God has given you—whether a little or a lot – determines your fruitfulness.

Share this post!