Printable Savings Challenges: Transform Your Money Habits

Utilize a printable money saving challenge as a fun and engaging way to to develop strong savings habits. A key part of money management is saving money. Start a savings challenge to save extra cash, putting you one step closer to your financial goals!

Have you found yourself wondering why there is never enough money at the end of the month? Do you feel stuck trying to break the cycle?

If so, savings challenges are an amazing tool at your disposal to jumpstart your savings goals!

Benefits of Savings Challenges

A free printable money saving challenge has many benefits. To name a few:

- Visual reminder of progress. According to research , visual learning triggers emotions, improves comprehension, and sticks better in our long-term memories.

- Offers creative and specific ways to save money for unexpected expenses that come up during the year.

- Works whether you're on a tight budget or have a flexible budget. Everyone has a different financial situation. Here you'll find a savings challenge for every budget!

- Breaks down larger amounts into smaller, more manageable steps. When we look at the end goal, it can seem impossible to reach. However, if we break it down into small steps, it helps us stay motivated.

- Deters poor and/or impulsive spending habits, increasing financial literacy. Personal finance is 80% behavior and 20% head knowledge. If you can change your behavior, that is the most important thing!

There aren't many downsides to utilizing a savings challenge free download.

Where to Keep your Savings

You can keep your savings in a piggy bank, bank account, or even a high-yield savings account. Where you keep the funds will depend heavily on the total amount and time limit of the savings challenge. For small savings challenges, it's smart to keep the money in a basic bank savings account. For bigger savings challenges, take advantage of the above-average interest rates of high-yield savings accounts.

Free Money Saving Challenge PDF

Get my free savings challenge printables below! Simply sign up and get the

savings challenge printable pdf free download sent right to your inbox to start the instant download.

The free printable savings tracker includes a savings challenge printable for every money challenge listed below. To create your own DIY savings challenge, download the blank monthly savings challenge printable instead!

Short-Term Savings Challenges

$465 30-Day Money Saving Challenge

The 30 day savings challenge is a short but fun challenge that will give you a quick win and an easy way to save money quickly. By the end of the challenge, you'll have almost $500 to put towards your financial goals! Completing this challenge is the perfect way to set aside a little extra money when you're on a tight budget.

Download the free savings challenge template and start now!

$1,000 Emergency Fund

The baby emergency fund savings challenge is to save $1,000 as the first step of Dave Ramsey's 7 baby steps. This serves as a starter emergency fund. Save more money each week by multiplying your savings by 10 with this straightforward money-saving challenge.

Download this weekly printable money saving challenge to have your emergency fund complete in just 14 weeks!

100 Envelope Challenge

To complete the popular 100 envelope savings challenge:

- Start with 100 envelopes and label them 1-100.

- Put the envelopes in a basket, bin or other storage container.

- Everyday for 100 days, randomly pick an envelope and put the amount of cash that is on the label inside the envelope.

- Put the envelope somewhere safe and repeat the process for 100 days.

- Deposit your $5,050 dollars and decide what you will do with your cash! You can save it, invest it, pay off debt, or spend it.

Download the free 100 envelope challenge chart now!

No Spend Challenge

he goal of this challenge is to become more mindful of spending habits and cut unnecessary spending. You'll find you can save a significant amount of money by simply being more conscious of your spending choices. A prerequisite to saving money is being aware of you're spending it.

To complete this challenge, only spend money on necessities for a set amount of time. This means cutting out unnecessary expenses like eating out, buying new clothes, or indulging in entertainment activities.

The easiest way to successfully do a spending freeze is to not spend money on days you work. If you’re like me, and don’t work outside the home, a spending freeze can seem impossible. After all, how else am I supposed to burn another hour with the kids before dad gets home??

Here are some more tips for successfully completing a spending freeze:

- Exercise instead. When temptations arise, get on your workout gear. The endorphins from your workout will help curb impulsive spending behaviors.

- Take a food inventory. For moms, the biggest hurdle will be not going to the store for any groceries. First take inventory and build meals based on what you have at home.

- Make coffee at home. Instead of hitting the espresso stand, make your own at home for a week and save $25.

- Work on getting organized. If you find yourself with extra time, focus on getting your finances, meals, kids schedules/activities, etc. organized!

Don't forget to download the no spend savings challenge printable pdf to start!

Long-Term Savings Challenges

Classic 52-Week Savings Challenge

This classic money saving challenge allows you save money is a simple, easy-to-follow way. Simply save the amount that correlates to the week you are on over the course of a year. On the first week, save $1. On the second week, save $2, the third week save $3, and so on so forth for 52 weeks.

At the end of the year you'll have saved over $1k to put towards your financial goals!

The classic challenge is great for any budget, because you never have to save more than $52 in one week!

Download the free printable 52-week money challenge template shown below! Complete the blank 52 week money challenge printable by coloring in each week as you go!

$2,756 Double 52 Week Savings Challenge

The double classic 52-week money challenge is another version of the classic 52-week challenge. Instead of increasing the deposit each week by $1, the deposit increases by $2. For example, the first week you will save $2, The second week save $4, the third week save $6, and so on so forth.

By the end of this challenge (week 52), you will have saved $2,756.

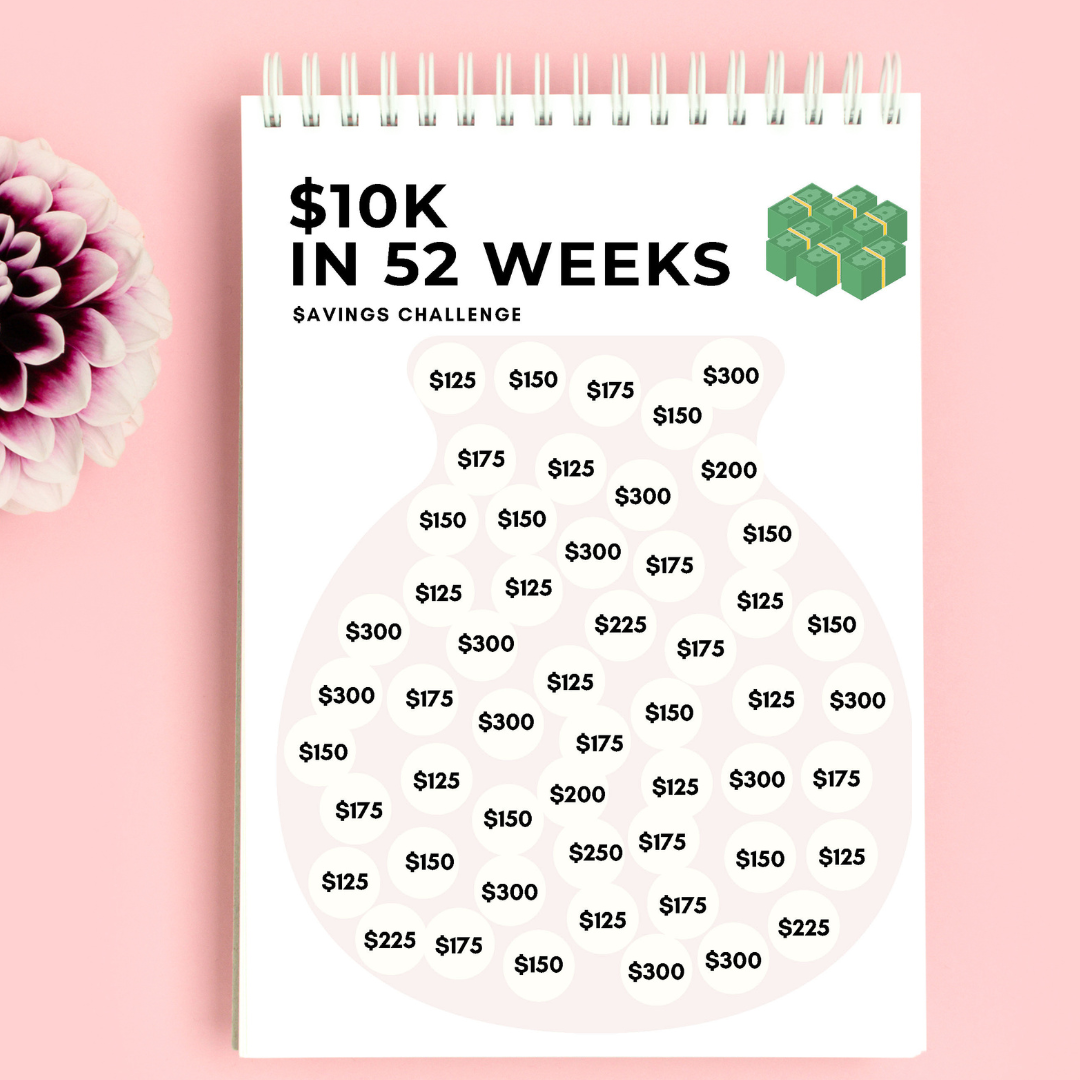

$10,000 Savings in 52 Weeks

If you're up for a tough challenge, try the $10k in 52 weeks challenge! Saving 10,000 might sound like an impossible feat, but with a clear savings plan you can achieve this lofty goal!

This is a great way to save for a new vehicle, kid's college, retirement, or a down payment on a home!

By the end of this challenge (week 52), you will have saved $10,000.

I recommend keeping your savings in a high-yield savings account, which boasts above-average interest rates (typically 4-5%). You can

lean more about them here.

Penny Challenge

Saving spare change through the penny savings challenge will give you $667.65 at the end of the year. To complete, simply save $0.01 on day 1, $0.02 on day 2, and so on so forth for 365 days.

In Conclusion

Utilize money challenge sheets to save money quickly, whether you have large or small income. Savings challenges start by putting our savings goals into perspective. Looking at the final goal can be discouraging. However, once we break our goals down into monthly, bi weekly, or even weekly amounts, they suddenly seem achievable!

Be sure to download the free savings challenge sheets!

Share this post!