5 Ways to Avoid Money Problems in Your Marriage

In honor of our third wedding anniversary today, I'd like to share five key ways you can avoid money problems in your marriage!

The number one cause of divorce in America is attributed to money fights.

The good news is that if you and your spouse can work as a team and agree on your finances, you can set up a healthy safeguard against conflict.

I promise you will still have disagreements about money. However, when you are on the same page about your finances these disagreements are resolved quickly and in a healthy way.

To avoid money problems in your marriage, read on!

Other marriage & money tips:

5 HELPFUL TIPS FOR BEATING MONEY PROBLEMS IN YOUR MARRIAGE

1. TALK ABOUT MONEY OFTEN.

Larry Burkett said "Money is either the best or the worst area of communication in marriages."

Work to make money one of the BEST areas of communication in your marriage!

If you avoid talking about money with your spouse, you're just building pressure for a big blow up.

Chances are you might avoid talking about money because it always ends in a an unresolved fight.

If you refuse to discuss your finances with your spouse, you are creating an opportunity for resentment against your spouse for certain money behaviors to build.

One spouse might be frustrated by their lack of inclusion in the money process but they are afraid to speak up because every time they do they are insulted.

Or, maybe you're frustrated with your spouses bad spending habits. Do they run to the store in response to strong emotions?

In either situation, the issue needs to be discussed openly without fear of insult.

2. USE A BUDGET FOR ACCOUNTABILITY.

Having a written, agreed upon

monthly budget creates an exponentially higher likelihood of you to work together with your spouse.

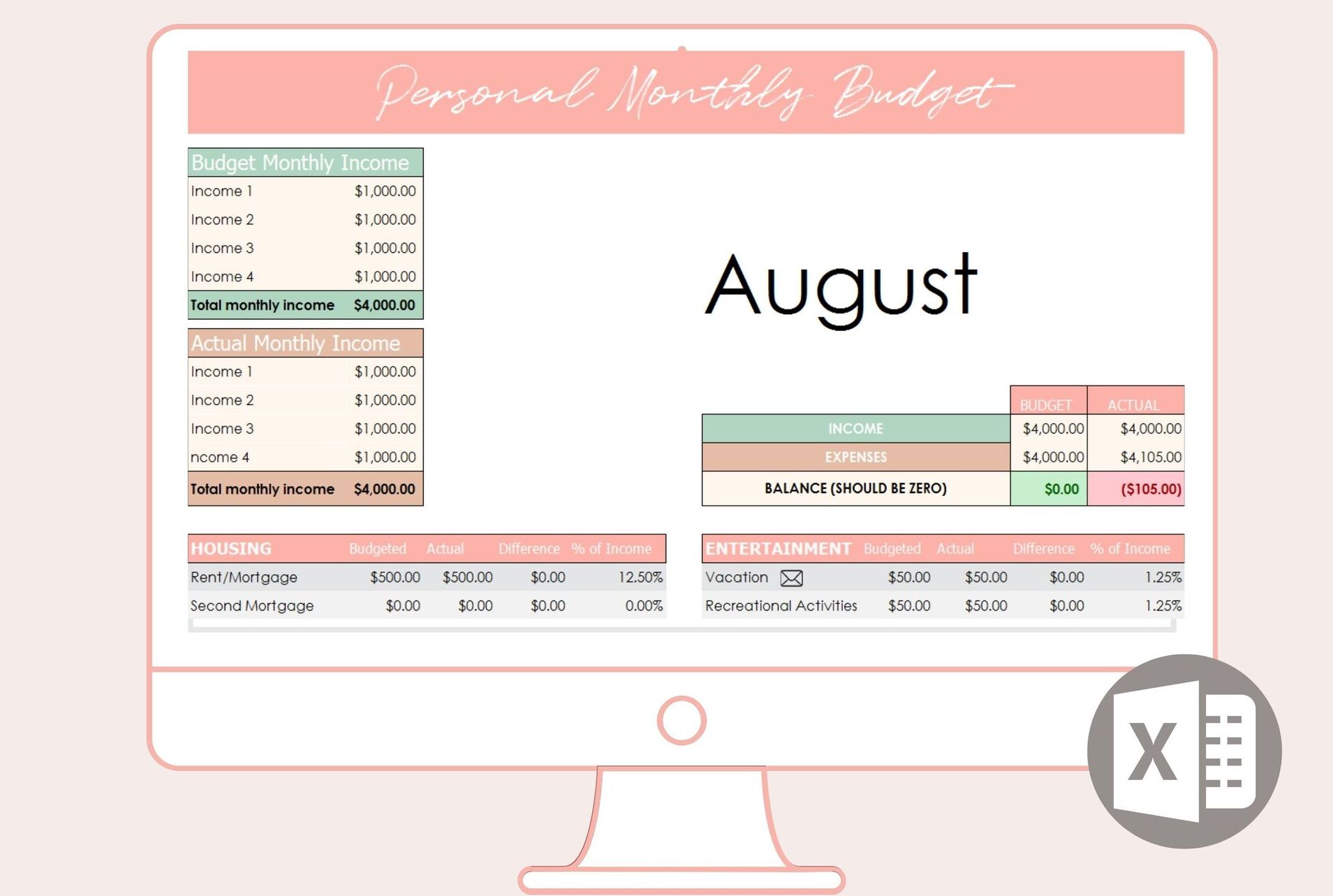

I like to keep our personal budget in an excel template, uploaded to google docs for easy cloud access. My most popular budget template is the excel budget template, pictured below. It's a great budget template for beginner budgeters!

A budget is your road map for financial success.

You might think you know where your money is going, but until you TELL it where to go you'll never hit your financial goals.

This is why most millionaires live on a budget.

If millionaires need a budget, why wouldn't you?

3. IDENTIFY THE SPENDER & THE SAVER.

Understanding the key differences in how the saver and spender operates has been key for us in developing a money strategy that works.

I'm the saver (nerd) in our relationship.

While I'm really savvy with spreadsheets, charts, reports, and I don't spend much money, I tend to have control and trust issues.

My husband is the spender (free spirit).

Though he's better at staying grounded in both good and bad financial times, he can tend to make some irresponsible money decisions if he's not careful.

We both recognize these things about each other (and ourselves) and make our best effort to work on these traits.

Be willing to look in the mirror and identify what you need to work on. Recognize that just because you might be the saver in the relationship, doesn't mean your a dictator and your spouse has no say.

UNDERSTANDING HOW MEN & WOMEN RELATE TO MONEY DIFFERENTLY

Often times, a man's deepest fear is failure and a woman's deepest fear is abandonment or lack of security.

When you understand your spouse's fears, you can respond to them in a way that reassures or calms their fears.

Avoiding comments that wreck your wife's sense of security or your husband's fear of failure will go a long way in getting them to discuss money in a peaceful, united way.

4. COMBINE YOUR FINANCES.

This is a marriage, not a joint venture. I don't care who makes more, who spends more, or whatever else. Combining your finances creates unity.

But what if one person makes more money?

Regarding the budget, you don't get more votes if you make more money. That's not how a successful, unified marriage operates.

When you see every penny that comes into your bank accounts as OURS instead of yours or mine, it forces you to create money goals together.

Every marriage is either growing together or apart.

Combine your finances, agree on goals, work through problems together and grow together!

5. NEVER KEEP MONEY SECRETS FROM YOUR SPOUSE.

Never ever keep money secrets from your spouse, big or small.

Always be truthful when talking to your spouse about money and avoid being defensive of any bad money behaviors you have.

Often I hear women joke about hiding shopping bags in their car so their husband won't see them.

I get the humor, but it's not helping your marriage. It's a sign of an underlying problem, because if you feel like you have to hide your purchases your spouse obviously has a problem with your spending.

A LITTLE REFLECTION...

As we close in on three years of marriage, I am grateful for how much progress we've made in working together as a TEAM.

When we first got married, I definitely had the attitude that money was MY thing and since I was the saver I was in charge of all decisions.

That created a lot of strife in our marriage as my husband became more and more frustrated with my controlling nature.

I was frustrated with his lack of caring about how our money was spent and irresponsible spending.

Once I stopped seeing myself as right and him as wrong , my perspective shifted and I was able to understand we BOTH had areas to grow in.

Yes, we still fight, but we are always working towards fighting fair.

Share this post!