How to Meal Prep on a Budget [What You're Doing Wrong]

Do you want to learn the secret to meal prep on a budget? Most of y'all are doing it all wrong!

When I first got married, I did it all wrong too. Maybe you can relate...

I was at the store almost every other day picking up an ingredient.

Meal time was frustrating and stressful for me.

I absolutely hated it.

I'm happy to report that I've come a LONG way in meal planning and making meals in general (I once asked my husband how my meal tasted and all he said was "I've had worse").

Here's my best meal planning tips and what I credit for sticking to a $300/month grocery budget (including our 1.5 year olds meals).

Other meal planning tips/hacks:

HOW TO MEAL PREP ON A BUDGET

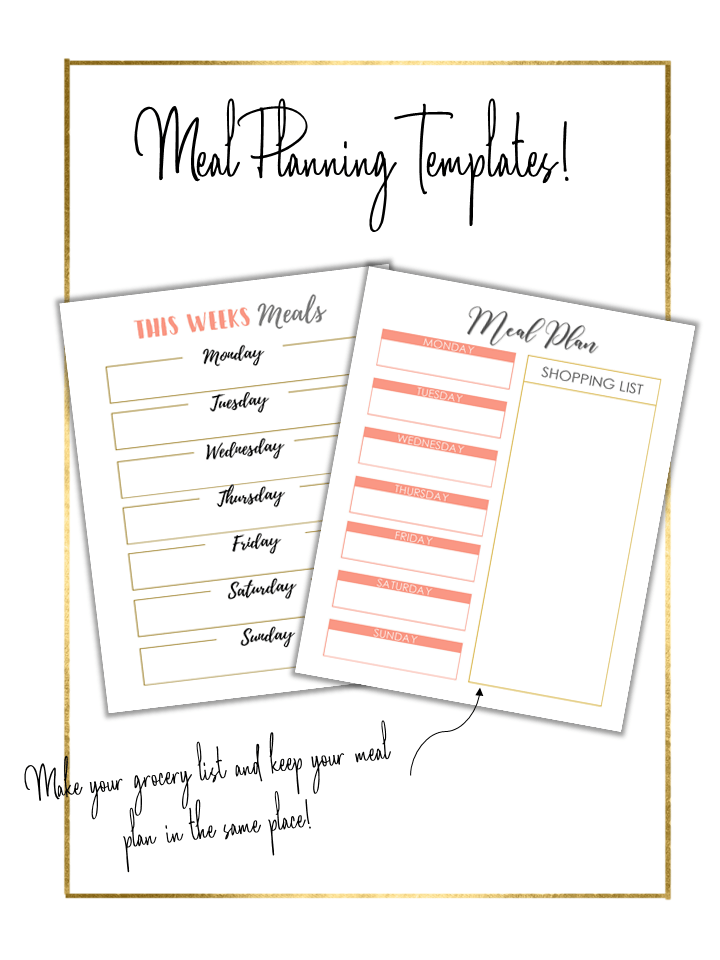

First, you'll either need to keep a digital copy of your meal plan for the week or keep a written copy that you can easily hang on the fridge or put in your planner.

You can subscribe below and get my free meal plan template!

It's important to keep your meal plan somewhere it can be easily accessed, because otherwise you won't stick to it!

1. INVENTORY WHAT YOU ALREADY HAVE & BUILD MEALS

INVENTORY

The FIRST step in meal planning for those who like to save money is to inventory what you already have on hand.

This is how you reduce waste , which is the biggest budget killer.

Inventory your fridge, freezer and pantry BEFORE making your meal plan and grocery list.

I start with what meat and dairy products I have first, because that is the bread and butter of most of our meals.

BUILD AS MANY MEALS AS POSSIBLE BASED OFF WHAT YOU HAVE

Once I've done a quick inventory, I go online to the $5 meal plan dashboard and sort through recipes by ingredient.

I then build as many meals as I can for the week using only what I have on hand already, OR if I have most of the ingredients already I'll add it to the list.

2. BRIEFLY SCAN STORE SALES

Look at the weekly specials for your favorite grocery stores.

Pro tip: the front page and back page of the flyer typically show the biggest deals. The rest is just fluff.

If there is a great deal on an item, I'll build a meal (or multiple) around it and buy it in bulk.

For instance, if there is a sale on meat, I will stock up and use the meat for multiple meals that week (or prep it for lunches).

Don't spend too much time on this, just quickly look at the front and back pages of your favorite stores.

3. BUILD REMAINDER OF MEAL PLAN

After you take inventory and build as many meals as possible, scan store ads and build meals around sales, the next step is to build the remainder of your meal plan.

You can choose a family favorite, or do whatever you like for the remainder of the meals, as long as you are on budget.

4. PRICE IT OUT

Before you go to the store, price out what your grocery trip will cost you.

If you are over your budget, cut out one of the more expensive meals (typically meals that require a lot of ingredients or have expensive protein).

If you're not sure what you're grocery budget should look like, a good rule of thumb is $100/person in your family.

I always make sure that I know approximately how much my trip should cost me so I know that I am on budget.

5. ASSIGN EACH MEAL TO A DAY

Take out your calendar or planner and use it as a reference for assigning a meal to each day.

Here are some basic guidelines I use:

- Days I will be out running a lot of errands I assign to either a crockpot or freezer meal.

- If I'm going to be home most of the day, I do a skillet or one of the dinners that takes longer to prep. I'll also do some lunch prep these days.

- On weekends, we make it quick and easy. Homemade pizza is a Sunday night favorite, and Saturday is fend-for-yourself day many times (typically leftovers).

Figure out what works best for your schedule. If you have kids in lots of activities, you may want to stick to freezer meals and crockpot meals.

6. WRITE IT DOWN

Make it a habit to write your meal plan down and/or post is somewhere so your entire family can see.

This way everyone is on the same page.

7. SAVE TIME & MONEY BY USING A MEAL PLANNING SERVICE

We're all busy. When meal planning, you have to weigh whether or not you have time to research/find recipes and make a grocery list every single week.

If time is a big struggle for you, I'd highly recommend using a meal planning service.

Because if something is time consuming, boring, and stressful, you likely won't do it, even if it has great benefit.

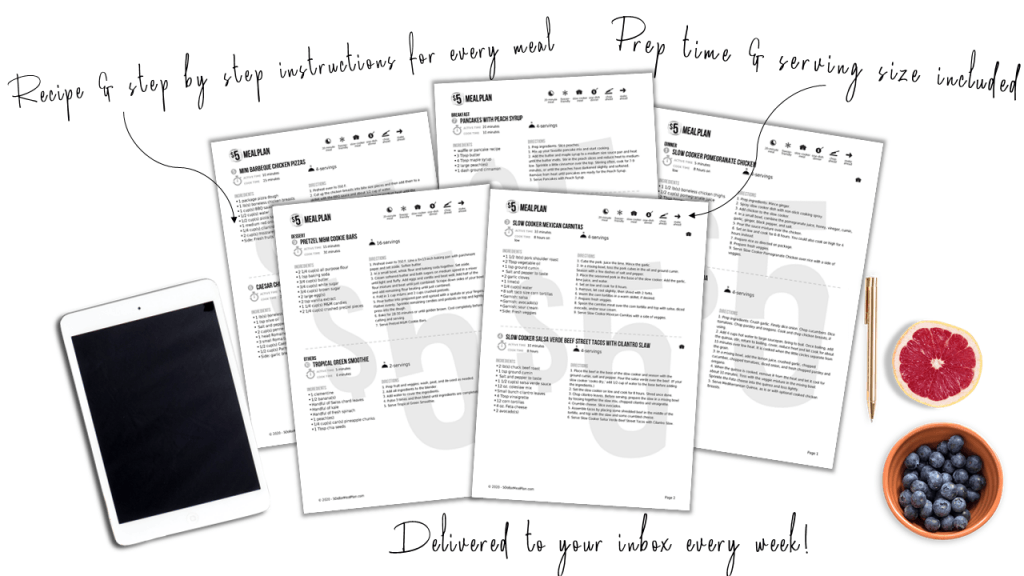

The service I use is $5 meal plan , costs $5 per month and every meal you make is designed to cost under $5!

Each week, my meal plan is delivered right to my inbox!

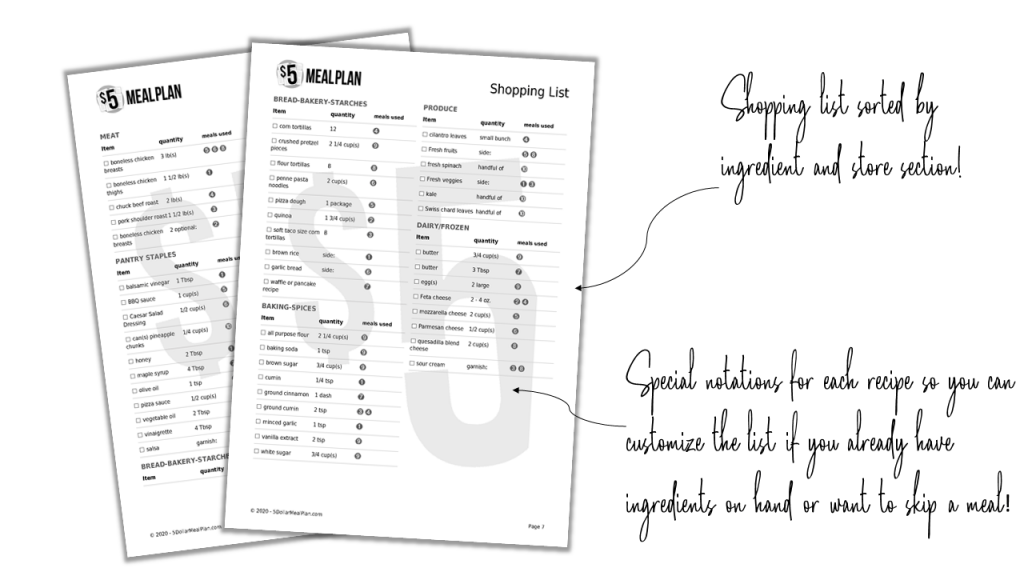

The meal includes a menu and a shopping list sorted by ingredient/store section. The menu includes:

- Five dinner entrees with sides – Each week we’ll include one freezer friendly, one slow cooker, and one 20-minute.

- We will also include one lunch and one breakfast , plus,

- A random goodie each week – sometimes it’ll be a dessert , sometimes a beverage , and sometimes it’ll be a snack (sometimes more than one!) – Treat yourself to something fun!

Additionally, you get a shopping list for the week organized by store section and ingredient!

You can read my full review (and tutorial) of how I use $5 meal plan for more info!

OTHER WAYS TO SAVE MONEY ON GROCERIES

USE CASH

Cash is king. When you use cash, it triggers a different effect in your brain than when you swipe a debit or credit card.

Have you ever noticed that it's harder to hand over a $100 or $20 bill than it is to swipe a card?

You think about your purchase more. Maybe you put something back. You pay more attention to prices.

I love me some good, hard cash. Check out the cash envelopes I use here.

FREEZER MEALS FOR BUSY NIGHTS

Often times being busy holds people back from meal planning. Between kids practice, school concerts, social events, work, and other activities, let's be honest it's easier to just pick up a pizza or run through the drive thru.

If you can take just one day (many moms like to plan on Sunday-I do mine on Thursdays) out of the week and plan your meals, there is an easy way around this.

Freezer meal planning is the busy moms best friend!

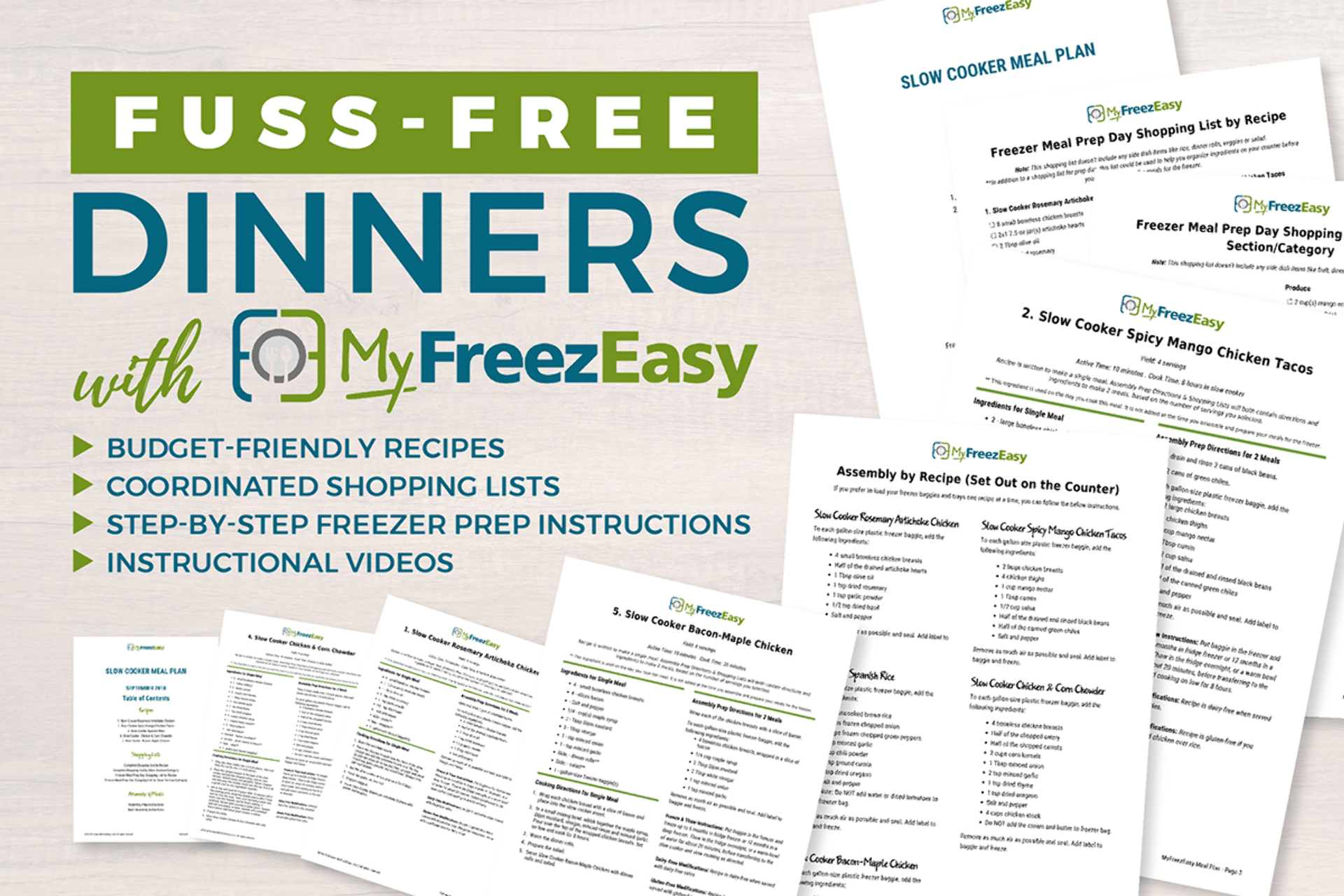

The same gal that founded the meal planning service I use ( $5 meal plan) , founded MyFreezEasy, which is exactly what it sounds like- a freezer meal planning tool.

The MyFreezEasy monthly meal plans have some fantastic features:

- Each plan makes 10-12 meals in under an hour

- Create your own freezer meal plan that’s perfect for your family’s taste and dietary preferences

- Customizable serving sizes – adjust to 2, 4, 6 or 8 servings

- Option to swap recipes in and out of the meal plans that our team creates each month

- Email yourself the meal plan that you create

- Option to “clear meal list” to build a second meal plan – there is no limit to number of downloads each month

- 'Tag' your family’s favorite recipes to appear in your My Favorites section

- Option to ‘save a meal plan’

- Printable labels for your freezer meals

- Syncs with mobile app

Learn more about the MyFreezEasy membership in my detailed review.

My favorite feature is the mobile app! You can easily build a meal plan from scratch in minutes (yes minutes) , or use the meal plan for the month.

ONLINE GROCERY PICKUP

Many people have said that they saved money on their grocery bill when they switched from in store purchasing to online grocery pickup.

The only thing I don't like about online grocery pickup is that I can't use cash.

However, I have tried it and I do feel like I tend to spend less when using this feature because I'm less tempted to buy things not on my list.

If you have trouble with impulse buying and you tend to end up with unplanned purchases in your cart while in store, try online grocery pickup!

* Through my link get $10 off your first Walmart grocery order pickup!

LIMIT TRIPS TO THE STORE

I try to stick to a once a week grocery store trip. The more I'm at the store, the more I spend.

Obviously there are times when I forget an ingredient or we have a quick change of plans, but for the most part I stick to once a week grocery shopping!

This will be hard at first, especially if you find yourself at the store 3-4x per week, but once you make it a habit you'll be amazed at how much money you save.

MEAL PREP THE RIGHT WAY

The most common mistake when learning to meal prep on a budget is organizing your meals from scratch without looking at what you have on hand.

This is also known as shelf-cooking. I honestly can't tell you how much I've reduced our food waste by meal planning this way.

This is one of my biggest tips, a long with using a meal planning service if you're just way too darn busy to spend hours meal planning!

Share this post!