Why I Am Frugal & What I Do Differently

Most of us have been in a spot financially where we have had to force ourselves frugal. It wasn't a choice. Now, since I don't HAVE to be frugal anymore, I get asked quite often why I choose to be frugal?

Frugality is not a common thing, even though statistics show that it should be. According to America Saves Week , 60% of Americans are spending all or more than what they make.

What is even more alarming is that most Americans don't care. Sorry, but listening to hipster music and posting cliche quotes on your walls isn't going to make your credit card debt, car debt, mortgage, and student loan debt disappear.

Yet, that's the way most Americans seem to be dealing with it. Gone are the days of being frugal and living on less than what you make. In fact, most Americans joke about the frugal people in their lives (think grandma & grandpa).

Maybe you shouldn't laugh at grandmas coupon book because she has over $1 million net worth and you have a mound of student loan debt, you're driving a car you put on payments, and your Jamaican vacation that you deserved has been sitting on your credit card for months.

That margarita doesn't taste so sweet if you're paying it off two years later, am I right?

Make the choice to be frugal... here's why!

Why You Should Choose to be Frugal

Frugal People Live With More Freedom

I think there is a huge misconception about what frugality is.

When most people think frugality, they think cheap and restraining. However, that couldn't be more false.

Frugal people sacrifice small things so that they can save up and buy larger ticket items. They focus less on price and more on value.

Being frugal gives security, as frugal people are able to live with freedom knowing that if a loss of job or other event were to happen, it wouldn't be detrimental to their finances.

That isn't to say that we should rely on ourselves and frugality for our financial security.

We should ALWAYS rely on God, knowing and trusting that he will ALWAYS provide for us.

However, God gives us money and we are to be caretakers of that money. I see frugality (living below my means) as a way that I can be smart with the money that God provides.

Being Frugal Allows You to Attack Debt

Frugality allows you to pay down debt fast.

I talked in my very first post about how we paid off over $20k of student loan debt in one year. This was made possible by being extremely frugal.

We made a tight, tight budget, and we stuck to it. We made sacrifices, we prioritized, and we were disciplined.

Now that we have more money than when we first started I've found that I'm even MORE frugal, because it sets you free.

Have you ever wondered what you could do with your money if you had no payments?

WHATEVER YOU WANT.

What is more freeing than that?!

Others Don't Dictate Your Spending

Have you ever wondered how much money you would save if you didn't know what other people spent theirs on?

When we become less concerned with what others think of us, we give ourselves the freedom to control our lives. Those who are frugal do not let other people dictate what they spend.

Instead, they focus on daily, monthly, and annual goals and saving/investing for their future and for the financial security of their family.

Special Outings Stay Special

When we first got married, eating out was a top budget killer. We ate out every weekend for multiple meals and multiple days of the weekend.

Holiday weekends like 4th of July were even worse. We would go out to eat, go out to the bar, and spend all kinds of money on entertainment.Now that we cut those things out and only eat out once every two weeks, we have WAY more money left over that we use to reach our goals.

What's even better? Those things that become so natural (like eating out) are now something that we look forward to after a long week.

Special outings and treats often cost quite a bit of money, so if they become common , you have a recipe for disaster.

BUDGETING & FRUGALITY

The number one way we are able to be frugal is by keeping a monthly budget.

A budget allows you to tell your money where to go instead of wondering where it all went at the end of the month.

Once we started using a budget to tell our money where to go, our lives changed.

I made a monthly budget template (you can snag four different styles of budget templates for $3.99) once we started our debt payoff journey , and I've never looked back!

Our written, monthly budget brings me great peace and security.

After I got the hang of budgeting, I made an excel template as well.

I like having both a written and digital budget because the written budget helps me commit it to memory and the excel budget helps me keep track throughout the month easier!

You don't have to do both, but if you're just starting out budgeting, I would highly recommend using a written budget.

Frugal People Aren't Pressured to Compare

When you're frugal and live below your means, you feel freedom and you don't feel pressure to compare.

You know that everything you own is paid for, and you don't have to deal with the stress of debt. That feeling alone will make you feel content and you'll find that you'll be far more interested in living a debt-free life than looking at what everyone else has.

Frugal people don't waste their time and energy comparing themselves to others.

Comparison is the thief of joy.

Frugality Reduces Waste

When you set a budget that challenges you, you are forced to reduce waste.

Joe and I cut our grocery budget in half this year because we found that we were throwing out way too much food for two people. Once we cut our budget, I had to make sure that what I bought I used.

This also forced me to start meal planning , something I have never done before!

Once the grocery budget is gone, that's it. We have to use what we have. Could we afford to go out and buy more? Absolutely, but budgeting is a learned and disciplined habit.

HOW I MEAL PLAN TO REDUCE WASTE

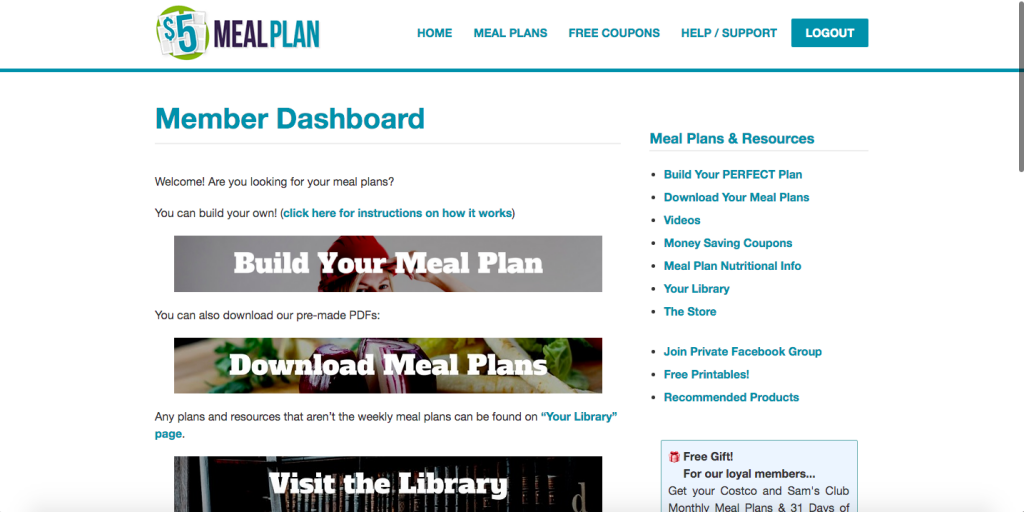

Because I don't have hours to spend meal planning (who really does) , I outsourced my meal planning and I use a service called $5 Meal Plan!

$5 Meal Plan costs me $5 per month and they send me a meal plan right to my inbox every Friday along with an ingredient/grocery list sorted by store section.

I can also build my own meal plan if I'd like using their recipe bank, as you can see below.

If I go the route of building my own meal plan, all I have to do is drag & drop! I can even "favorite" or save my favorite meal plans that I build!

My time is precious, this has been a HUGE blessing for me!

If this sounds like something that might bless you too, you can try it free for 30 days!

FREEZER MEALS

Another way I eliminate waste is by making freezer meals.

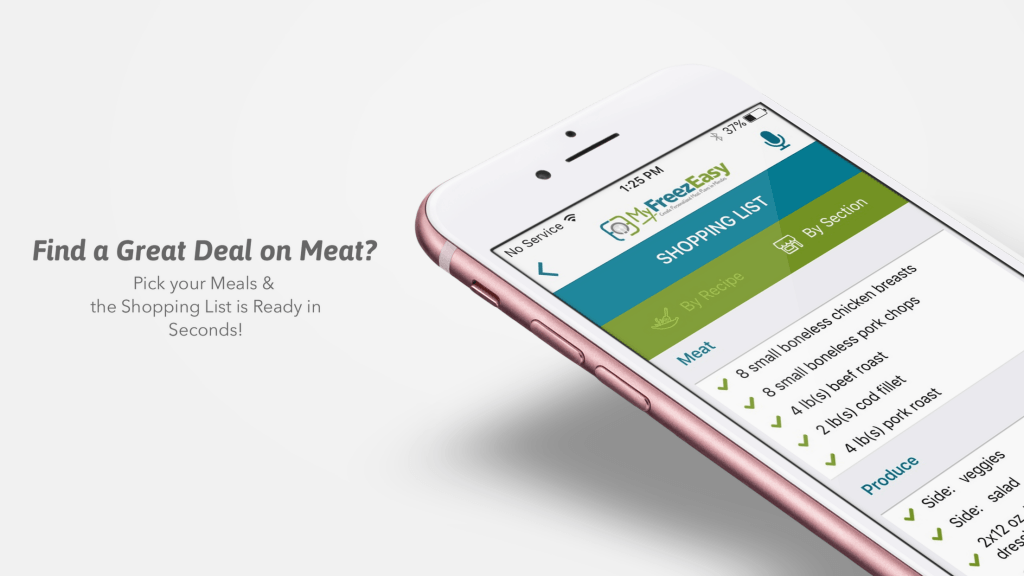

Erin Chase, the same lady who founded $5 meal plan has a sister plan, MyFreezEasy!

This plan is perfect for large, busy families who don't really have time to make dinner every night and/or who don't eat together every night of the week.

This freezer meal planning service comes with an app where you can literally drag and drop meals and build your grocery list in the parking lot.

That sounds like a dream to most moms!

The plan is designed so you can create 10-12 freezer meals for the week in ONE HOUR (it even includes assembly videos & printable meal labels).

And all the moms said.... Amen.

Grocery hacks/meal planning tips:

Frugality Keeps You Humble

Frugal people work for a cause, not for applause.

It's a humbling thing in life to have people call you cheap, controlling, budget obsessed, etc. simply because you have financial goals and have found a way that WORKS to reach them- God's way.

Remember, humility is the best teacher.

Being Frugal Allows You to Give More

When you live on less than you make, it's a lot easier to give.

When you give with a cheerful heart, you are at your financial best.

I've said this before, but if you can't live on 90% of your income, you probably can't live on 100%.

Related: Giving Until It Hurts

More is never enough. If your sole purpose in earning money is to have more money, you will never be satisfied. Those who live on less than they make are able to give more money because they aren't constrained by things.

On a final note-

Frugality is often different than misconceptions that equate it with being cheap.

It's simply about living within your means and finding ways to take control of your finances and plan for your future! Calvin Coolidge said it best...

"There is no dignity quite so impressive and no independence quite so important as living within your means."

Share this post!