Stop Living Paycheck to Paycheck & Get A Month Ahead On Your Bills

Living paycheck to paycheck is a frustrating and dangerous cycle that can seem nearly impossible to get out of when you're stuck in it!

I'm going to show you how to break the cycle and give yourself some breathing room!

When live on your prior months income, you have money waiting for your bills instead of your bills waiting for money.

If you currently live paycheck to paycheck and you feel as if you're constantly trying to stretch your last dollars until you get paid again, the best thing you can do is build a buffer in your checking account.

I recommend having a buffer of a month's worth of income.

In other words, your checking account balance will rarely dip below one months worth of income!

How amazing would that feel??

Here's how to do it.

HOW TO GET A MONTH AHEAD ON YOUR BILLS

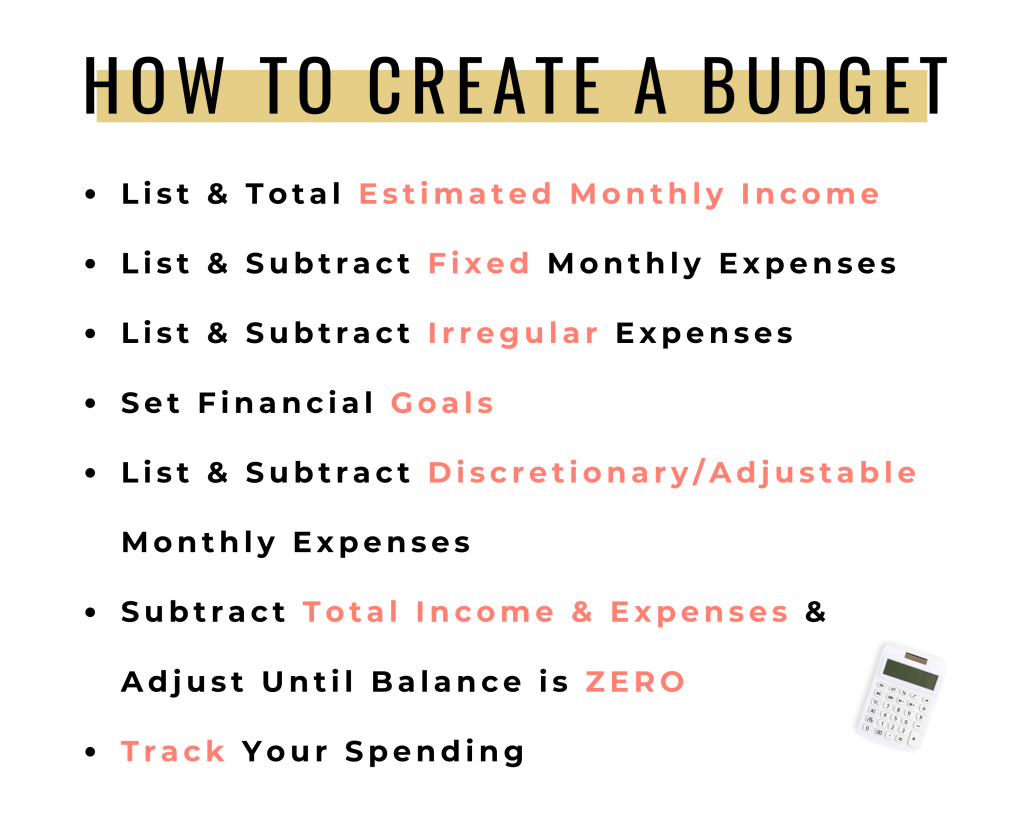

FIGURE OUT YOUR TOTAL EXPENSES.

The first thing you need to do is figure out what it will take to get a month ahead on your bills.

In other words, what does it take your family to live every month? Do NOT guess.

Most of the time, if someone thinks it takes their family $3,000 to live every month, the number is actually closer to $4,000. Just for fun, write down what you THINK it takes you to live every month (if you aren't already on a budget and don't know this number for certain).

List out ALL your household expenses (both monthly and irregular/seasonal expenses ). Additionally, for variable expenses, use an average monthly amount.

Here's how to do this in just a few steps:

- Review your last bank statement (I'd recommend reviewing at least two to make sure you don't miss anything).

- List fixed monthly bills.

- List variable monthly bills (using an average).

- Think about & write down any yearly/semi-annual or other irregular expenses (car registration fees, school dues, sports fees, property taxes, etc). Convert these to monthly amounts by taking the total expense & diving by 12.

You don't have to include discretionary expenses (expenses that are desired by not necessary) when doing your spending calculations, but include it if you'd like to have these expenses accounted for in your cushion.

BUILD A CUSHION.

Once you have calculated what you spend every month, now it's time to SAVE that amount as a cushion in your checking account.

To some this might seem impossible, but I promise if you're willing to put in the work it will be worth it!

When you live off of OLD money, you'll never want to go back to the paycheck to paycheck lifestyle again!

In order to get a month ahead on your bills, you either need to find extra money or cut your spending.

Did you get a tax refund this year? A year-end bonus? Use that to give you a head start!

The goal is to do this as quickly as possible, if you drag it out too long you're more likely to quit and continue the paycheck to paycheck cycle.

CUT SPENDING.

One way to start building your cushion is to cut your spending for a few months.

- Groceries - One of the biggest areas of overspending for many families is groceries. I recommend budgeting $100/month per family member. Here's how we cut our grocery spending in half. The #1 way I save money every month on groceries is by meal planning ! I pay $5 per month for a meal planning service that sends me a meal plan right to my inbox every single month. It's a life-saver for busy moms who don't have hours to spend meal planning!

- Dining out - Scale back your eating out for a few months, or cut it out completely and use that money to build your cushion!

- Entertainment - Do you have a weekly movie habit? Find an activity you can do without for the time being while you save money.

- Personal spending - How much money do you spend on random things for yourself? Create a limited personal spending budget to cut costs.

- Clothing - Dig into your closet and do without buying any new clothing for a little while. This is one of the biggest areas of impulse shopping for many people!

USE CASH.

Start using cash envelopes to really get the ball rolling!

When you use cash instead of a debit or credit card, studies have shown that you spend less. Not only do studies show this, but I can assure you from personal experience that when I use my cash envelopes I'm a lot more likely to stick to my budget.

You can also get my free cash envelope templates sent right to your inbox by subscribing to my email list!

Plain envelope templates work just as good as my fancy floral envelopes, they just aren't as pretty to look at ;)

MAKE EXTRA MONEY.

Another way to build your cushion that might be more realistic for you if you are living on a tight budget already is to make more money.

Remember, this doesn't have to be forever (unless you end up really enjoying your side gig or turning it into a full time deal). The temporary sacrifice is worth the lasting impact it will have on your finances.

Here are some of my favorite ways to make extra money/save more money:

- Start a blog (DUH ;) ). This is one of the cheapest and most practical ways to make more money. Through my link , you can start blogging for less than what one latte per month costs. The key is to treat it like a business and not a hobby!

- Use Rakuten to get cash back. By installing the browser add on, Rakuten automatically applies coupons to my orders, and alerts me when I visit a site they offer cash back on. It's an easy way to earn cash back without credit cards!

- Instacart. Get paid to shop for people. Another flexible option!

- Teach English online. This is a great option because you make your own schedule and make pretty good money!

EXTRA PAYCHECK MONTH.

If cutting spending and making more money are not practical for you right now, another option is to wait for a month where you will have an additional paycheck (5 week months).

Save the additional paycheck instead of spending it and use it to get a good cushion!

I'd use this as last resort because it will likely take you more than one full paycheck to get one months worth of expenses in your checking account, so it could take you a whole year to build your cushion!

Ideally, you'd like to have your cushion saved in less than six months.

HOW TO BUDGET LAST MONTHS INCOME

GET ON A BUDGET

First things first, you need to live on a monthly budget if you want to keep your cushion intact. If you don't live on a budget, the cushion will disappear and you'll be right back to living paycheck to paycheck.

When you don't live on a budget, you never really have any idea how long the money in your bank account at any given time is going to last you.

It's a game of Russian roulette- is there going to be more money than week or more week than money?

By living on a budget you are able to assign every single dollar in your checking account .

You are also able to account for every dollar in your checking account, meaning, at any given time you can say exactly where each dollar of your checking account balance is going to go!

No more guessing games. Gone are the days of wondering if you'll have enough money to make it to payday. Less stressing about bills.

If you don't already budget, you need to figure out what method will work best for you and/or your family.

DECIDE WHICH BUDGETING METHOD WORKS BEST FOR YOU

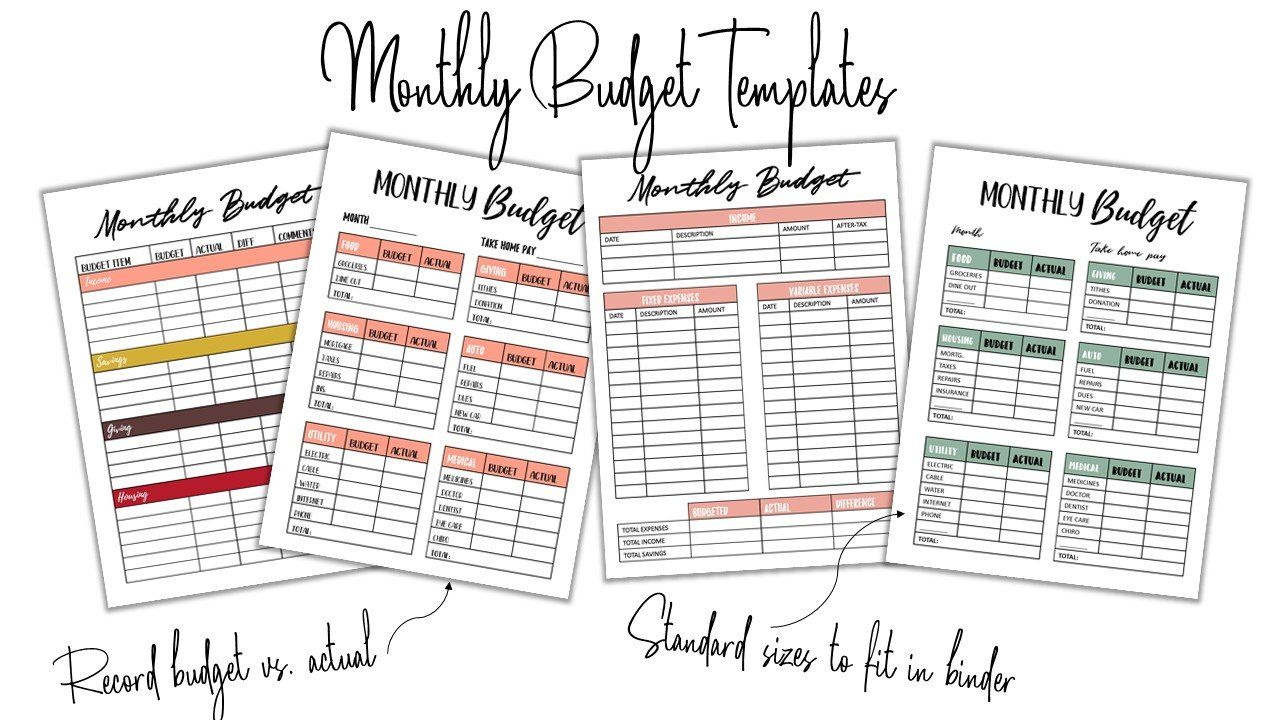

MONTHLY BUDGETING

The first and most common method of budgeting is monthly budgeting. I preach about budgeting A LOT (like it's a full time job) , but I think there are a lot of misconceptions about the method of budgeting that I actually use.

Yes, it's important to set and create a MONTHLY budget, however if all you do is create a monthly budget, tuck it safely in your budget binder and forget about it until the last day of the month, the budget is worthless.

Don't get me wrong- creating a monthly budget is an essential step in the budgeting process , but it's not where the process ends.

If all you do is create your monthly budget and nothing else, you've created a forecast.

You'll likely find yourself frustrated and out of money at the end of the month if this is all you do.

I'd highly recommend creating your budget (see steps below), and then breaking it down by paycheck.

For a step by step tutorial, you can follow my guide to creating your first budget here!

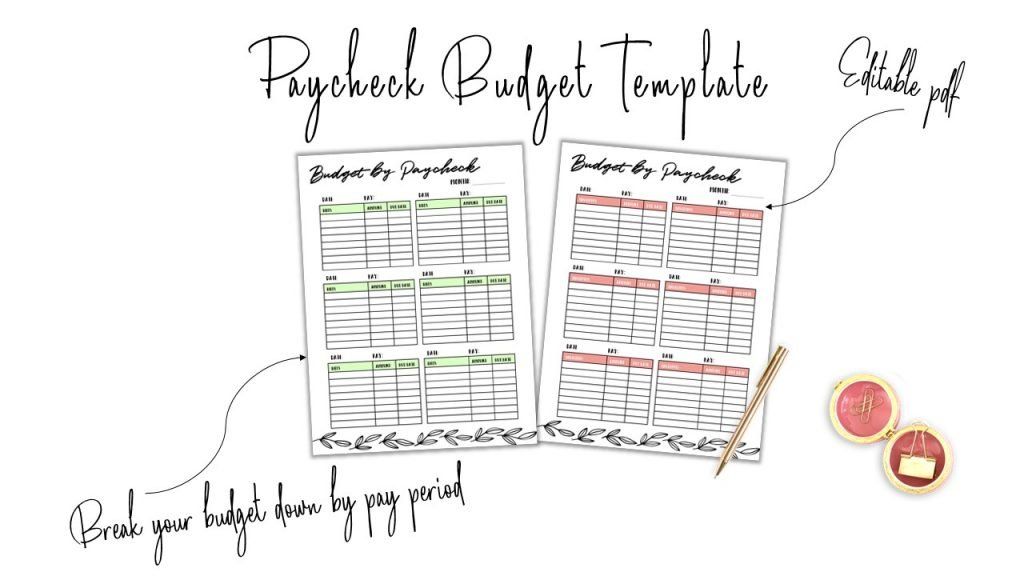

PAYCHECK BUDGETING

Once you have your broad overview monthly budget, breaking it down and allocating income to budget categories is the next step.

This will make it easier to follow your monthly budget, because every dollar not only has a purpose BEFORE the month begins, but you have a plan for whenever a paycheck it deposited!

Don't over complicate this step. Obviously if you're paid once a month this step is very simple.

However if you're paid weekly, it's a little bit more difficult to think about your big picture budget if you don't break each paycheck down.

I have some handy editable PDF paycheck budget templates available in my Etsy shop to help you start getting a handle on your monthly budget!

Don't confuse paycheck budgeting with living paycheck to paycheck.

When you break your budget down BY paycheck you are simply allocating funds.

When you are living paycheck to paycheck, you are out of funds and relying on your next paycheck to replenish your supply and pay bills.

The goal is to use the paycheck budgeting system to strategically plan so that you have money waiting for every single bill that comes due- not the other way around.

For an in depth overview of the budget by paycheck system, read this tutorial.

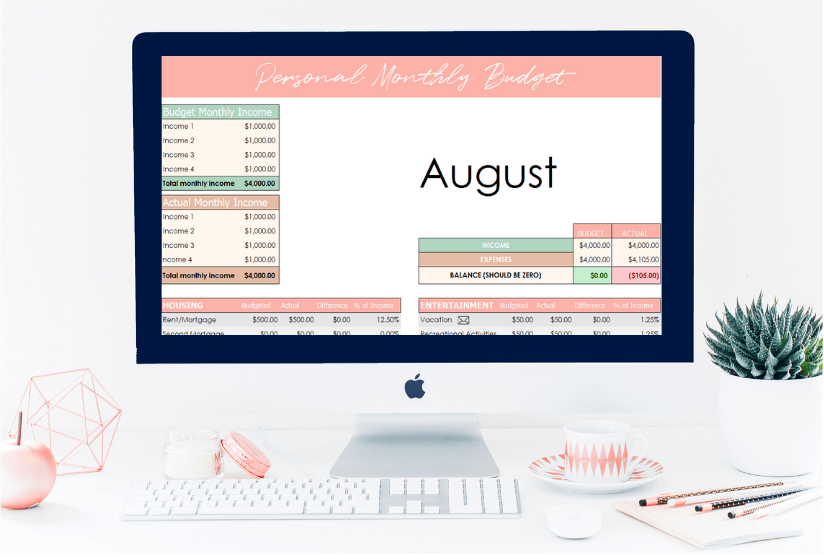

EXCEL BUDGET

You can also create and track your monthly budget using excel, I personally use an excel budget template to track our budget in addition to a written budget (both monthly and paycheck budgets).

I'm a huge fan of being as efficient as possible (#momlife) , but just know that's when you use digital/electronic tools, it's harder for your brain to connect concepts.

In this case, it's harder for your brain to adjust to budgeting concepts if all you're using is digital products.

That being said, if you're a beginner budgeter, I'd recommend starting with a written budget or using BOTH methods!

MY BUDGETING METHOD

I actually use a combination of all the budgeting methods listed above!

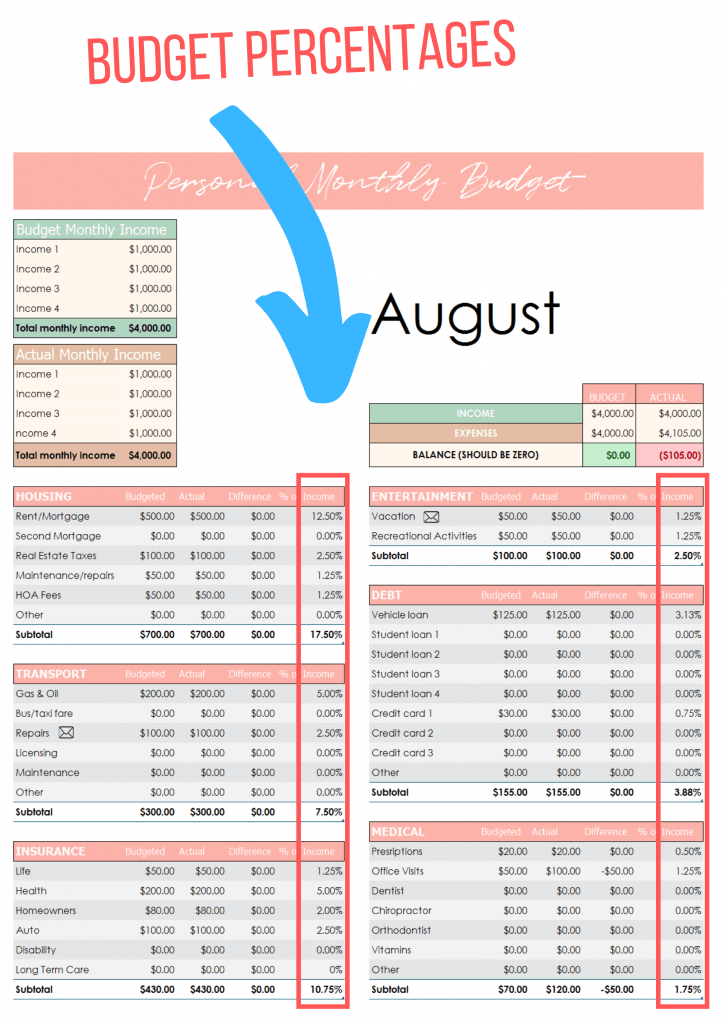

Personally, I like to keep a monthly budget which I use as a broad overview to break down what percentages of our income went to/are going to certain budget categories and so I can see the big picture.

In addition, I keep a budget by paycheck spreadsheet that breaks our budget down by paycheck. This spreadsheet tells me exactly where every dollar of any given paycheck will be allocated. Essentially, it's our monthly budget broken down into smaller chunks. Here's how to create your own.

FINAL POINTS TO AVOID LIVING PAYCHECK TO PAYCHECK

Since I know that when you are living paycheck to paycheck it can be an extremely discouraging time, I want to leave you with some encouragement and key takeaways/pointers.

- You can always find ways to make more money. Don't write off this option. There are tons of work from home jobs, jobs for stay at home moms, and other ways to make money online. Seriously consider this if you feel like there's no extra room in the budget to get ahead.

- Trust me when I say living on a monthly budget will transform your finances. I know. It seems too good to be true. Please don't underestimate the power of a budget! We had NO IDEA how much we were overspending until we got on a monthly budget.

- Aging your money will give you CONTROL over your money instead of letting your money control YOU. It is so freeing to be in control of your money! It is a worthy cause and is definitely worth the temporary sacrifices! Keep going!

I hope this was encouraging and helpful!

If you are living paycheck to paycheck, just know that it doesn't have to be that way.

Choose to take control and change your financial future!

Share this post!