Freshbooks vs QuickBooks: Powerful Tools For Small Business Owners

THE BEST

Accounting Software

For Your Business

QuickBooks and FreshBooks are two of the most popular accounting software systems for small businesses, both offering enhanced accounting features. Figuring out which is the right fit for your business can seem overwhelming!

I'm going to help you evaluate which is the best fit for your business.

As an accountant, I've mainly seen QuickBooks being used for traditional businesses, and was intrigued by FreshBooks because of it's cloud based system and enhanced features.

That being said, I will give a fair comparison between the two so you can make the best decision possible for your business!

FRESHBOOKS VS. QUICKBOOKS: SHORT VERSION OVERVIEW

WHO IS FRESHBOOKS FOR?

FreshBooks is designed for self employed entrepreneurs, service based businesses, and other professionals and independent contractors.

It's geared towards smaller businesses with a single owner or just a few employees. It has a fantastic price for the features it provides. It is NOT geared towards brick and mortar businesses that require inventory tracking, lots of bill tracking, etc. However, it will work for this type of business as well.

Recently, FreshBooks upgraded their software to provide double entry accounting, so it is becoming a tough competitor to QBO for traditional brick and mortar businesses as well. However, I'd personally still recommend QBO for traditional businesses that require inventory accounting.

WHO IS QUICKBOOKS FOR?

QuickBooks is best for traditional businesses that need advanced reporting features like inventory tracking, payroll, etc. Additionally, a major feature that QBO offers is accrual accounting.

Both software programs offer very user-friendly platforms with robust features. Additionally, they both offer monthly pricing plans and different levels based on customization, features, and users.

QBO offers great reports for your tax preparer and inventory management features. You can even give your accountant access to your QBO file and set them up as a separate user.

QUICKBOOKS VS. FRESHBOOKS DETAILED REVIEW

INVOICING

FRESHBOOKS

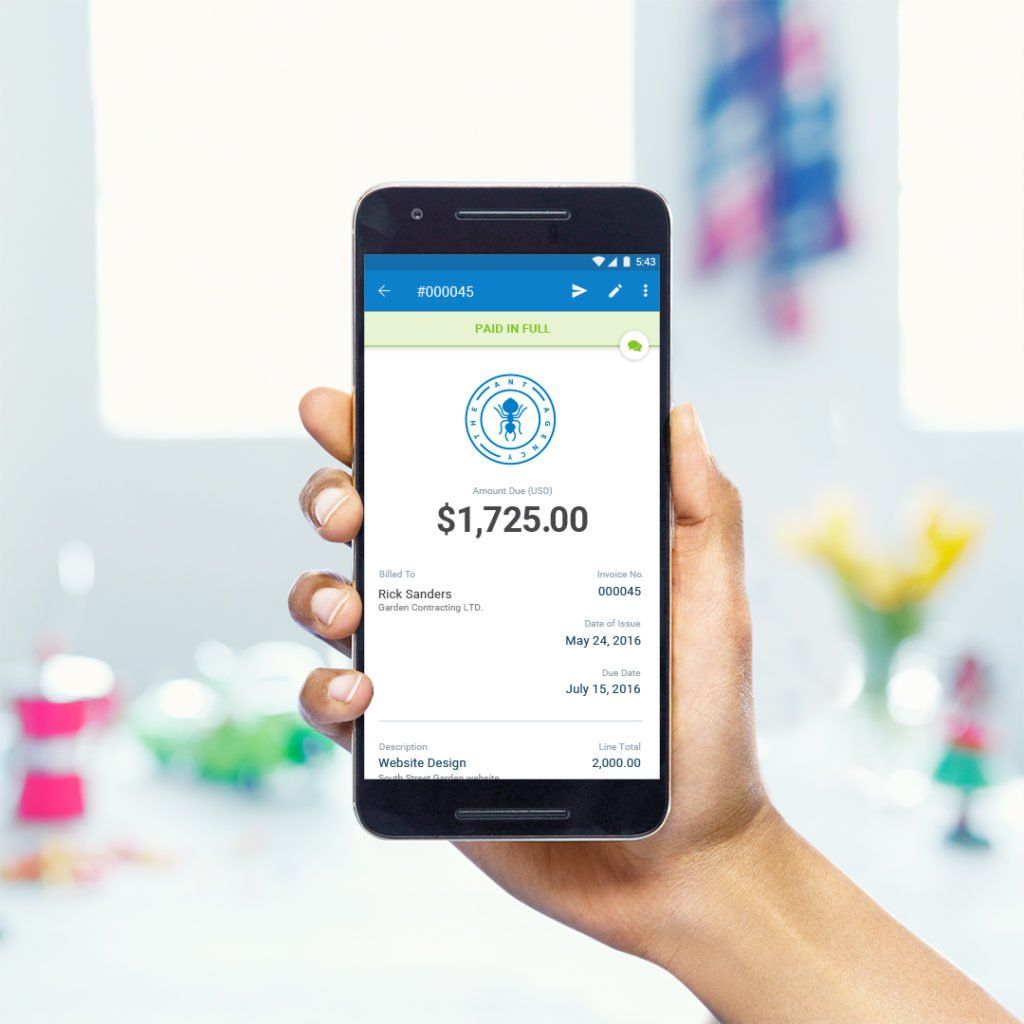

The bread and butter of FreshBooks is the advanced invoicing features that allow you to get paid faster and easily create custom proposals and project estimates. Your clients can accept estimates and proposals online, and it will be turned into a project and invoices (if desired) within FreshBooks.

Check out this video demo:

Although FreshBooks invoicing is geared towards projects and proposals, it works for traditional invoicing as well.

QUICKBOOKS

With QuickBooks invoicing , you can:

- Create professional, custom estimates and invoices with your logo that you can send from any device.

- Accept all credit cards and bank transfers, right in the invoice.

- Track invoice status, send payment reminders, and calculate sales tax on your invoices, automatically.

WINNER

Both programs offer top notch invoicing options. No clear winner.

PROJECT MANAGEMENT

FRESHBOOKS

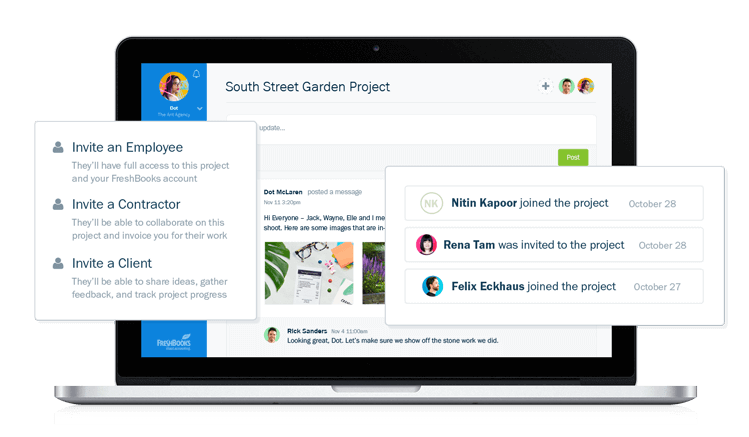

FreshBooks offers web-based centralized space for file storage. This feature works great for teams that need to collaborate on projects! FreshBooks is made for project management. Keep all your conversations, files and feedback in one place. You’ll keep your team in sync and your projects on schedule!

QUICKBOOKS

Boasting impressive job costing reports, QBO has project tracking aimed specifically at the construction industry.

WINNER

Because FreshBooks is made for project management , it is easily the winner here. However, if you need to manage projects with physical materials input, QBO is the better option.

TIME TRACKING

FRESHBOOKS

With Freshbooks the time tracking feature , you can automatically bill for tracked billable hours, review daily breakdowns of your tracked time, each team member (employee) can track their time, and add detailed time tracking notes. Additionally, FreshBooks offers a built-in, easy to use timer for both desktop and mobile.

QUICKBOOKS

In QBO, you can track billable hours by client or employee and automatically add them to invoices. Even more, you can enter hours yourself or give employees protected access to enter their own time.

On the downside, in order to get the time tracking features FreshBooks offers in QBO, you have to pay double the price.

WINNER

FreshBooks is the winner regarding time tracking. Even on the cheapest plan, unlimited time tracking is available! Additional functionality includes advanced time tracking reports filtered by project, employee, client, or contractor.

PAYROLL

FRESHBOOKS

FreshBooks does not have payroll built into the software. This is a major downfall of FreshBooks! However, they do integrate with payroll apps like Gusto.

QUICKBOOKS

In contrast, QBO offers payroll built into the software. But, the payroll feature doesn't come without an expensive price tag. Starting at $45/month + $3 per employee per month, QBO payroll does include automated taxes and forms.

If you need more advanced features, payroll will cost you $75 per month + $8/employee per month.

WINNER

While QBO has payroll built into the software, it is rather simple to connect Gusto to FreshBooks. However, QBO is the winner because of the built-in payroll feature. This takes away the need for ran extra step!

REPORTING

FRESHBOOKS

Financial reporting features in a simple, robust, easy to use and analyze format. One major downfall is there is no accounts payable report. Consequently, you will have to keep track of nay unpaid bills. Additionally, no payroll reports are available since it is not a feature offered in the software.

QUICKBOOKS

QuickBooks plus and advanced plans offer customizable, enhanced reports. Even more, QBO has a lot more reports to choose from. There is no limit to the custom reports you can build in QBO.

WINNER

QBO is easily the winner here, as it boasts TONS of reporting options, including accounts payable, payroll & 1099 reporting. However, if you feel like you won't use all those reports, FreshBooks has all the reports you NEED. Sometimes too much information creates confusion. As a result, you lose sight of your main objectives.

INTEGRATION

FRESHBOOKS

With the FreshBooks mobile app, you can work on the go with full capability- send invoices, receive payments, and even snap pictures of your receipts to easily record expenses. Additionally, you can chat with clients from the app. '

QUICKBOOKS

Similarly, the QBO mobile app also offers great features, including bank reconciliation, sending invoices, receiving payments, and snapping pictures of receipts to record expenses.

WINNER

Both programs have great integration with other apps/software, but the FreshBooks app offers more features than the QBO app.

PRICING

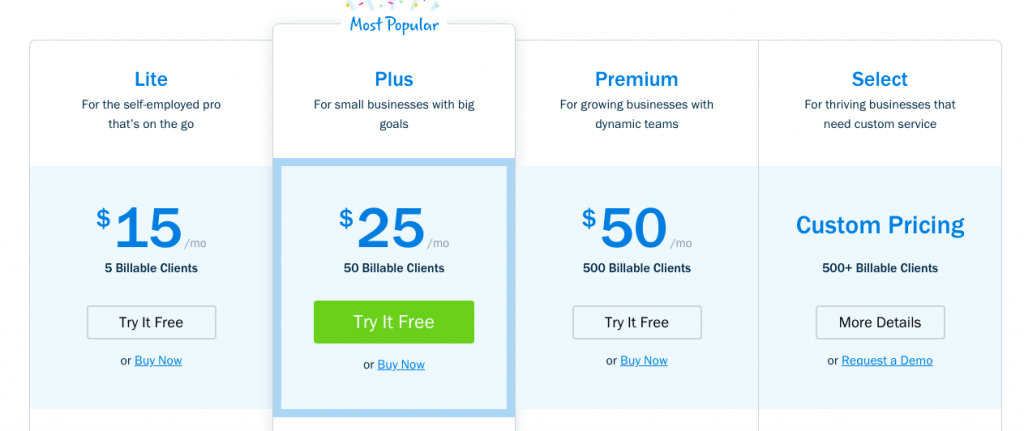

FreshBooks plans are priced based on features, number of users, and billable clients. A benefit of their pricing is the affordability.

FRESHBOOKS PLANS

Lite Plan

If you've just started your business as a blogger, freelancer, or virtual assistant, you might want to try the Lite plan first. You can invoice up to 5 clients per month, automatically import bank transactions, and accept various payment forms.

Plus Plan

For more established entrepreneurs, the Plus plan allows 50 billable clients per month. This plan will allow automatic generation of invoices for clients and double entry accounting in addition to lite plan features.

Premium Plan

The premium plan boasts 500 billable clients per month in addition to all plus plan features.

Select Plan

The select plan is a custom plan for users with over 500 billable clients per month. In addition to all other plan features, a personal, dedicated account manager will be assigned to your business. Even more, it includes super low transaction fees and customized training for you and your team!

For all plans, you can add team members for $10 per member per month.

A free 30 day trial is available for all FreshBooks plans!

QUICKBOOKS PLANS

*Please note the discounted prices below are only valid for the first 3 months, then you will be charged full price!

ESSENTIALS PLAN

The essentials plan is best for businesses that need basic accounting functions, including tracking bills due. Additionally, this plan allows up to 3 users. With the essentials plan, you do NOT get project tracking, or time and expense tracking.

PLUS PLAN

If your business requires inventory tracking, job costing, or budgeting, you will need the QBO essentials plan. Up to 5 users allowed. Note that the inventory tracking feature is only available with QuickBooks Plus & Advanced, which starts at $70/month (after the first three months).

ADVANCED PLAN

The plus plan offers advanced reporting, custom user permissions, a dedicated account support person, and up to 25 users.

A free 30 day trial is available for all QBO plans.

WINNER

When it comes to price, FreshBooks is the winner. The reason being, you can get more features for a more affordable price. QuickBooks Online is kind of like an a la carte menu. It sounds good at first (with the base price), but you find that any feature you add significantly increases your fees. Because of this, FreshBooks is especially appealing to new businesses.

FRESHBOOKS VS. QUICKBOOKS: ON A FINAL NOTE

While both software programs offer incredibly robust features, one might fit your business better than the other depending on what kind of business you run.

For example, if you are a photographer, freelance writer, tutor, web designer, or social media consultant, FreshBooks might be the best option for you because of it's advanced invoicing, project, and time tracking features. Additionally, you get a lot more bang for your buck if you don't need advanced features!

On the other hand, if you own and operate a small retail store, restaurant, plumbing business, auto store, etc, QuickBooks might be the best for you because of the inventory tracking, job costing, reporting, and payroll features.

If you have limited accounting experience , FreshBooks is by far the easier program to operate and understand. Conversely, QuickBooks Online is the entire accounting package on a cloud based system.

If you're unsure of which is the best fit for your business, you can try FreshBooks free for 30 days and try QuickBooks free for 30 days!

This way you can get your hands dirty for a month and make your own evaluation :)

Share this post!