The 7 Most Important Financial Habits You Need to Master

Your life will reflect your habits, and your habits will cultivate the person that you will become.

If you have poor spending habits, you will probably be poor. It's not rocket science. The funny thing is that the most important habits you can develop in your lifetime are not taught to you in school.

In fact, most students don't come out of high school knowing how to balance a check book, but I'll be damned if they don't know what the Pythagorean Theorem is.

Everything I learned about personal finance, the power of investing, and compound interest was never taught to me in school (and I was an accounting major). I've read a lot of books, studied the habits of many millionaires, and then implemented them into my own life.

I've come to the conclusion that the following 7 habits are vital to your financial success.

1. Make Sure You Have an Adequate Emergency Fund

This is crucial. Whether you make $20,000 or $100,000, you must have an emergency fund. While you are paying off debt, your emergency fund doesn't have to be big, but it should be enough to cover a few 'rainy days', such as a car breaking down, medical emergencies, etc.

Once you are done paying off debt, your emergency fund should have at a minimum 3 months worth of household expenses in it.

According to CareerBuilder, 78% of Americans said they live paycheck to paycheck. That is up 3% from last year. This sounds like a simple concept, but according to the statistics most people do not get it or they don't want to get it.

If you have trouble saving, try creating a budget.

This worked wonders for our finances!

If you are unsure how to budget, take my five day budgeting for beginners email course, jam-packed with budget tips, tricks & a step by step tutorial!

2. Don't Work For Money, Make Your Money Work For You

I n his book Rich Dad Poor Dad, Robert Kiyosaki makes the point that the poor and middle class let their money control them. If they want more money, they work harder, put in more hours, and continue to live paycheck to paycheck. Most poor and middle class Americans wouldn't be able to go a couple months without a paycheck. This is why they will never acquire much wealth - because they are working for money, and their money is not working for them.

Rich people focus on acquiring more assets, poor people focus on increasing their income.

Poor and middle class people spend their whole life chasing promotions and working more hours to increase their standard of living.

Poor people are constantly thinking "how can I make more money to afford ____________." Or, "If only I had more money I could invest, save, etc. " They are constantly running the rat race.

Once they do work more or get promoted, they instantly increase their standard of living so they are no better off than before. Sure, they may have a bigger house and a nicer car, but so are the payments that come with them and after the increased tax deductions taken from their paycheck, they STILL don't have much of a margin to invest (stocks, bonds, mutual funds, etc.).

The truth is it isn't all about making more money. It's about increasing your assets that produce cash flow and decreasing your expenses and liabilities.

3. Give First, Save & Invest Second, Buy Luxuries Last

One of the most important and rewarding things you can do with your wealth is help others.

I've said this before, but it is so important. Learn to give more (even when you feel like it's not in your budget)!

Second to giving, saving and investing is one of the most important keys to financial success. If you're in debt, temporarily put off all saving and investing and put EVERY extra dollar towards that debt.

Those who are focused on building wealth and reaching financial freedom must understand that it is essential that you decrease your expenses and liabilities. When you do this, more money is available to either pay debt or save and invest. Those who are rich tend to buy luxuries last, and the poor and middle class tend to buy them first.

Related:

Giving Until it Hurts

4. Have a Plan For How You Will Build Wealth

You will not build a net worth of more than a million dollars without a plan.

I wrote about this last week (find the post here ), so for more on budgeting see that post. However, I have to include this as one of the most important habits you can have to build your financial toolbox.

Make sure that you are budgeting and re-evaluating your budget often. Ask yourself questions such as:

- Will we have enough money to retire comfortably? (Hint:Your 401k and the government probably won't get the job done).

- What can we cut out right now to save and invest more?

- Are we prepared for the future (kids, a house, etc)?

Make sure you have specific, realistic , and attainable financial goals.

5. Learn to Say "I (We) Can't Afford it Right Now"

R ight now, say it out loud.

Contrary to popular belief, this is actually not a phrase of the poor- it's a phrase of the rich and those who are seeking to build wealth. It is a phrase that those seeking financial stability learn to say often. In a culture where you are taught to 'treat yourself' no matter what your financial position is, learning the word "no" can be difficult for some. We are taught that if we can't afford something at the moment, we can just use debt instead to fund it.

Can't afford a down payment on a house? Get a 0% down loan.

Can't afford a honeymoon? Put it on the credit card.

Can't afford a vacation? Put it on the credit card.

Can't afford a new car? Get a loan.

... and so on so forth.

I think the truth about our generation is that we want what our parents have and what took them thirty years to acquire, but we want it NOW.

We may have to go into debt to get it, but you can bet we're going to have a better honeymoon than mom and dad, a bigger house than mom and dad, and a newer car than mom and dad.

There is no shame in saying that something isn't in the budget right now, I know many very wealthy individuals who say that often.

Related: Is Comparison Keeping You Broke?

6. Only Take Advice From Trustworthy Individuals

WARNING: Be careful who you take advice from. Based on the statistics I mentioned earlier, you probably shouldn't take advice from 78% of Americans. .

Seek advice from those who are debt free and know the power of making your money work for you, not working for your money. Do not take advice from people who don't have a plan for their money.

A final note on this point- be careful who you hang out with. Whether you like it or not, you become who you hang out with.

I'm not saying select your friends based on your financial situation. I would never tell someone to do that. I'm saying if there are people in your life who encourage you to spend more money or mock your passion for paying off debt, they probably aren't very good for your financial health.

7. Learn the Power of Compound Interest

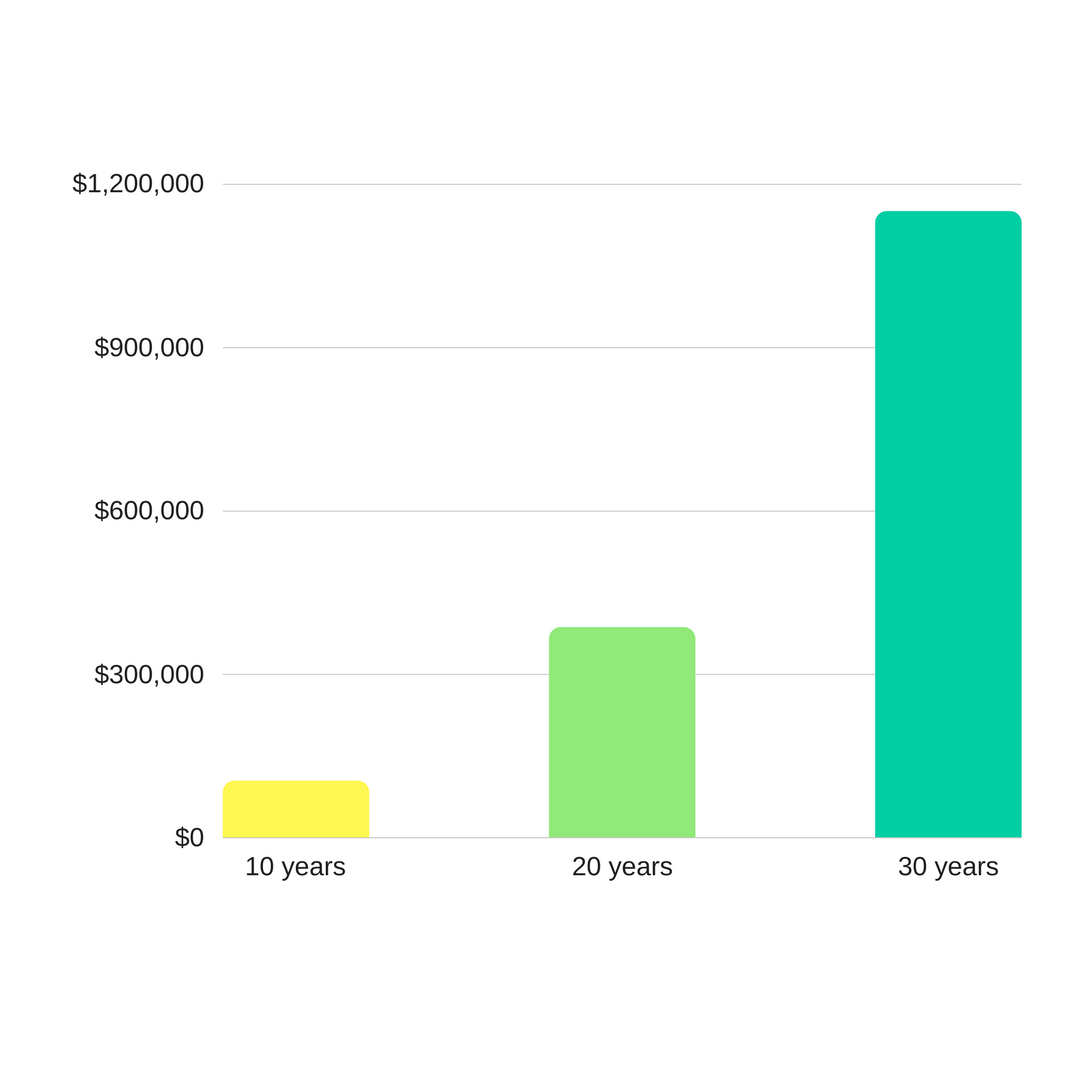

The basic idea of compound interest is that you earn interest on any investment that you make, and then you earn interest on your investment plus the interest earned going forward.

The longer that you keep your investment in the account, the greater the ratio of interest to your original investment. So, if you invest $1,000 and earn $30 in interest on the $1,000 annually, the next year the interest you earn will be calculated based on $1,030.

Take for example: You invest $1,000 in a mutual fund that over the course of 30 years averages 10%, and every month you add $500 to your investment account. After 30 years, you will have accumulated $ 1,150,081. The reason this happens is because of compound interest.

The graph above illustrates the growth of money invested at 10% using the theory of compound interest. It is actually a quite simple idea, but most people think that investing is too sophisticated for them.

I wouldn't advise that you invest in anything you don't understand , but most trustworthy financial advisers will make sure you understand where your money is going and how it works.

These are the 7 habits that we have learned and have begun to master that we feel have been vital to our financial success!

The key isn't to know a lot about a few things, the key is to know a little about a lot of things.

As we continue our financial journey, I can't wait to share with you the things that we learn a long the way! It is a process of many trials and many errors, but we're getting there!

Thanks for reading! For more tips, be sure to follow me on Pinterest!

Share this post!