The Key to Organizing Your Finances When You Have No Time

You can read all the finance books, listen to me preach on Instagram, but the truth is some of you have no idea where to start with organizing your finances!

It sounds like a great idea, but is it realistic?

How much time will it involve? Will I have to drag my already exhausted mom body out of bed an hour earlier ( If so count me out... HA )?? Is it a money discussion going to create even more tension between my spouse and I??

Organizing our finances brings peace to our home.

Money is the number one stressor among adults, in fact, many marriages end because of financial stress.

If you can bring more peace to your home WITHOUT sacrificing your sanity that sounds too good to be true, right?

Like your child let you go to the bathroom alone in peace too good to be true.

Whether you a busy parent, employee, business owner, or a few of these at once, it's possible.

I managed to keep financial peace in our home and manage our finances while working full time, taking care of an infant, and working 60 hours a week.

I stayed sane (depending on your definition of sane). Don't ask my husband for comment on that statement. L.O.L.

Here's how YOU can do it!

TIME SPENT ORGANIZING YOUR FINANCES IS NOT TIME WASTED

The good news is it takes me five minutes a day to update our budget, and less than fifteen minutes a month to create our budget.

The bad news? When you start out, it takes longer.

I don't always feel like managing our finances.

Yes, I love talking about personal finance and budgeting. I love the peace it brings.

However, for some reason when my child has been clinging to my feet all day begging to be held, had four meltdowns, I made dinner, cleaned, went grocery shopping, blogged , etc. the LAST thing I feel like doing is updating our budget and talking about MONEY.

On those days I just have to remind myself that it's a small amount of time and a small price to pay to have financial peace.

ORGANIZING YOUR FINANCES (WITHOUT LOSING YOUR MIND)

KEEP EVERYTHING IN ONE PLACE

All your financial planning tools and money related items should be kept together in one place.

If you don't keep everything in one place, you won't follow your plan.

I am notorious for having a forgetful mind.

I like to make things as easy on myself as possible, and as a mom, all my "processes" if you will need to be as efficient as possible.

This mom hardly has time to shower let alone spend hours on her finances, and I'm sure many of you feel the same way!

Personally, I've found the most efficient way to keep track of my finances without spending countless hours and losing my mind is to keep a budget binder.

It's like the mother of all binders.

CREATE A BINDER

Creating a budget and financial planning binder is a great way to keep all your financial documents and worksheets in one place.

We're taking it back to the basics. A binder. Notepad. Highlighter.

This is the Melanie-kon-do method of organizing your finances.

I like to keep all our bills, budget information, savings goal trackers and debt payoff spreadsheets in one place.

I've found if I take sections or spreadsheets out of my binder and put them somewhere else, I forget about it or I'm too lazy to go find it.

ORGANIZE BY CATEGORIES

I have five different categories in our budget binder separated by binder tabs so they are easy to find.

BUDGET

I keep our monthly budgets under one tab. You can find the exact budget templates I use (pictured above) right here , or snag my free budget template!

By keeping all my budgets from the year instead of throwing them away, I have a nice template to use for creating the next months budget!

If you are new to budgeting, click here to create a budget in 7 easy steps!

You'll also need a budget template, and you can snag my free printable budget template by subscribing to my email list below! :)

I want to stress that a key ingredient to taking control of your finances is living on a monthly budget.

You can keep your bills and debt payment documents in a binder, but if you aren't budgeting your income it is pointless.

You'll be organized but you'll never reach your financial goals!

Related Content:

Related Resources:

- The Ultimate Budget Bundle (45+ pages of financial resources)

- Budget Template Pack (4 EDITABLE PDF Templates)

- Budget by Paycheck Printable (EDITABLE PDF Template)

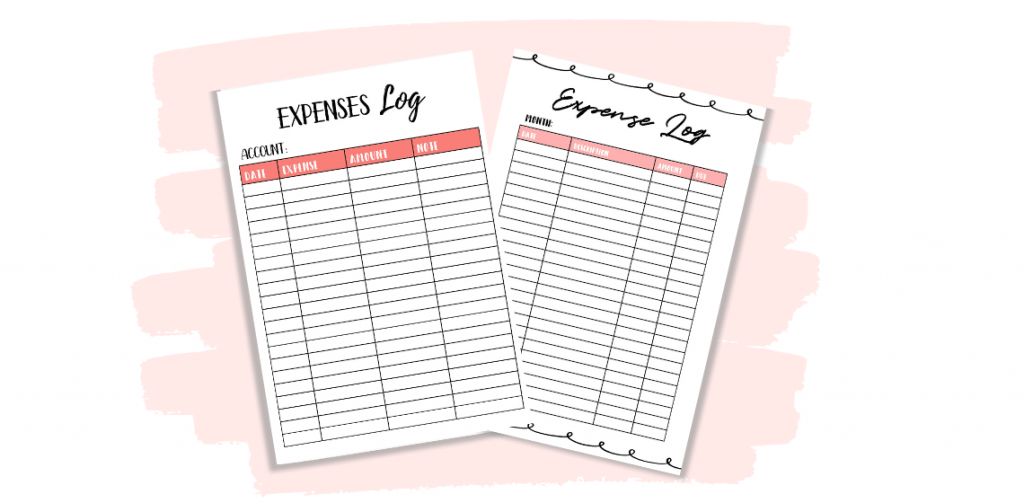

BILLS /EXPENSE LOGS

Once a bill is paid, I file it in the budget binder under the bills tab and cross it off the bill payment checklist.

I keep most important, high-dollar bills until the end of the year, and then they all get thrown out.

Any major bills for home repairs I keep in a pocket folder.

When I first started budgeting, I liked to highlight all my expenses in a color specific to each budget category, and then total them all up.

This seems time consuming, but it's a great way to get a visual of how much you're spending where!

Like I said, there is power in writing things down, it triggers a different chemical reaction in your brain than when you click, type, or swipe!

SAVING

The savings tab of your binder should include your retirement savings goals/statements, emergency fund savings , and any other sinking funds you have in your budget.

A sinking fund is just a fancy term for a specific budget category dedicated to saving for something specific.

An example would be a travel fund. We budget every month for travel whether we are planning a trip or not. The budget balance rolls over month to month.

Keep track of your savings separately!

Related Content:

GOALS

We review our financial goals together about once a month, since I pay the bills and do the tracking of our budget, I like to keep them in the budget binder so I can be reminded of them often.

The thing about goals is if you don't write them down, they'll probably never happen.

There is great power in simply writing out your goals and committing them to memory!

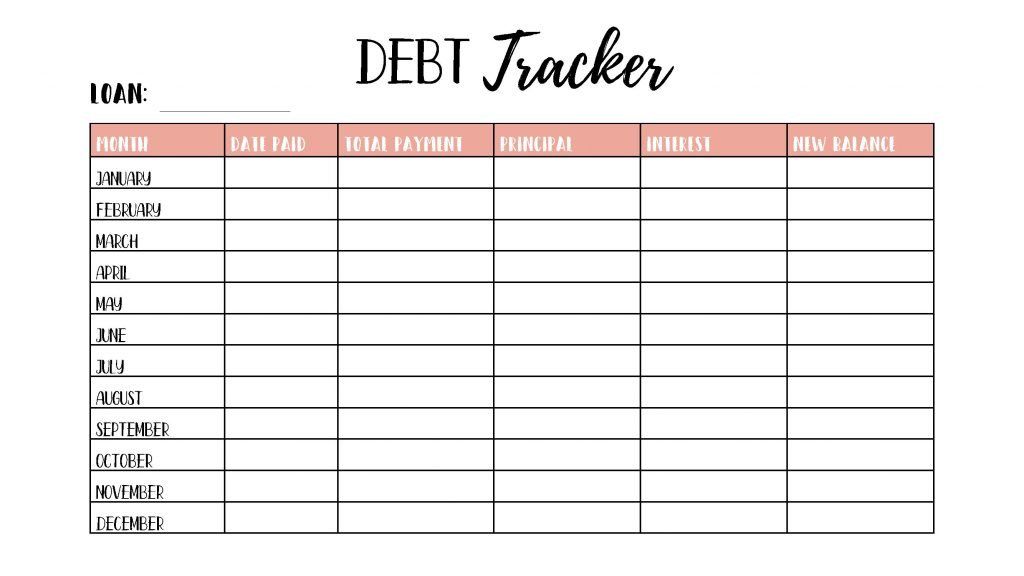

DEBT

Keep your debt snowball tracking sheets, debt amortization schedules, and any other relevant debt information filed under the debt tab.

This way, you can easily update your balance, track your extra payments, and stay motivated to pay off debt as quickly as possible.

Since we have no debt besides our mortgage, I keep an amortization schedule in the debt section!

Related Content:

KEEPING TRACK

The hardest part of getting your financial life together is not making the budget plan, but keeping track of your spending/updating your binder.

This is where time becomes an issue and our finances is the easiest chunk of time to eliminate.

Don't fall into the trap. To be honest, you can't afford to not get your finances in order.

It might not seem like it matters now, but it will bite you in the butt later, guaranteed. Life will either get more expensive and you'll be stressed to the max, or you'll hit retirement with nothing to show for it.

If you're young, start now! If you're older, it's not too late!

ORGANIZING YOUR FINANCES WILL BRING PEACE TO YOUR HOME

The most frustrating thing to me as a wife and mom is when the values I embrace and the life I live have drifted apart.

This happens when you spend too much time on things that don't matter.

Seriously think about this, what MATTERS to you and how much time do you spend on these things?

Financial peace and freedom matters to us, so we are willing to give up a half hour of TV every month to create a budget and organize our finances.

Share this post!