How to Cut Your Grocery Bill in Half Without Sacrificing Healthy Foods!

I have a confession- I used to absolutely LOATHE cooking and preparing meals, planning meals, and looking at our grocery bill every month.

This was solidified when after a few months of marriage I decided try a new, time-consuming dinner recipe to try to impress my husband.

This was no easy feat for a girl who for most of her life lived off of cereal and granola bars.

By the end of the new recipe fiasco, my emotions were teetering between a newfound hatred for cooking and defeat.

I finally finished, wiped the sweat from my brow, and despite the challenges faced whilst putting together the meal, I felt my perseverance had paid off.

I could picture my husband swooning over my meal, and us laughing and enjoying the delicious, home-cooked meal.

So when we finally sat down to eat and he took his first bite, I waited in anticipation. I didn't say anything quite yet, as I didn't want to be too proud.

Finally, I couldn't take it and inquired, "So, what do you think?"

What did he say?

"I've had worse."

I'VE. HAD. WORSE.

(He really is a nice guy, I promise).

I decided then and there I was D O N E.

Since then, I've come a long way. I really do hate cooking, but I've learned that we can't live on take out and minute-meals.

I've also learned that food is EXPENSIVE...Especially if you want to try and eat somewhat healthy!

For two people, our grocery budget is $300 per month, and that INCLUDES household items (cleaning supplies, batteries, light bulbs, toilet paper, paper towels, etc).

We've been able to really cut d own our grocery bill from when we first got married just by following the tips I outline below!

Other grocery & meal planning tips/hacks:

TRACK YOUR SPENDING FOR A MONTH

First, you need to be aware of how much you are spending.

This seems like a simple concept, but the truth is most people have no idea what they are spending on groceries (or anything else for that matter).

Even if you THINK you have an idea, I can almost promise you will be surprised when you actually track it religiously for a month.

So the first way to save money on groceries is simply to keep track.

You can use a pen and paper or any budgeting app. I personally use the every dollar app , and I've heard really good things about the mint app as well. They are both free!

So, if you aren't already, start keeping track of your grocery spending so that you have a starting number to use to set a goal.

If you want to completely take control of your finances, learn to budget, and stop living paycheck to paycheck, my budget bundle is perfect for you!

Here is a sneak peak of what is inside...

I custom made these templates specifically for those who find themselves running low on time , and high on financial anxiety.

Don't let your fear or lack of time stop you from taking control of your finances for good.

Other budgeting resources:

PLAN, PLAN, PLAN!

The last thing I want to do on a Sunday night is plan my meals out for the next week.

HOWEVER, when you plan, you SAVE. By having every meal planned out for each night of the week, you should be able to create a list pretty easily.

Once you have your list, STICK TO IT. Don't deviate.

Don't make impulsive purchases because you think you might want to use the item to make a meal at some point in the week.

When you have all your meals planned out already, you don't have to guess what you might need.

If you really don't like planning (like me), try freezer meals!

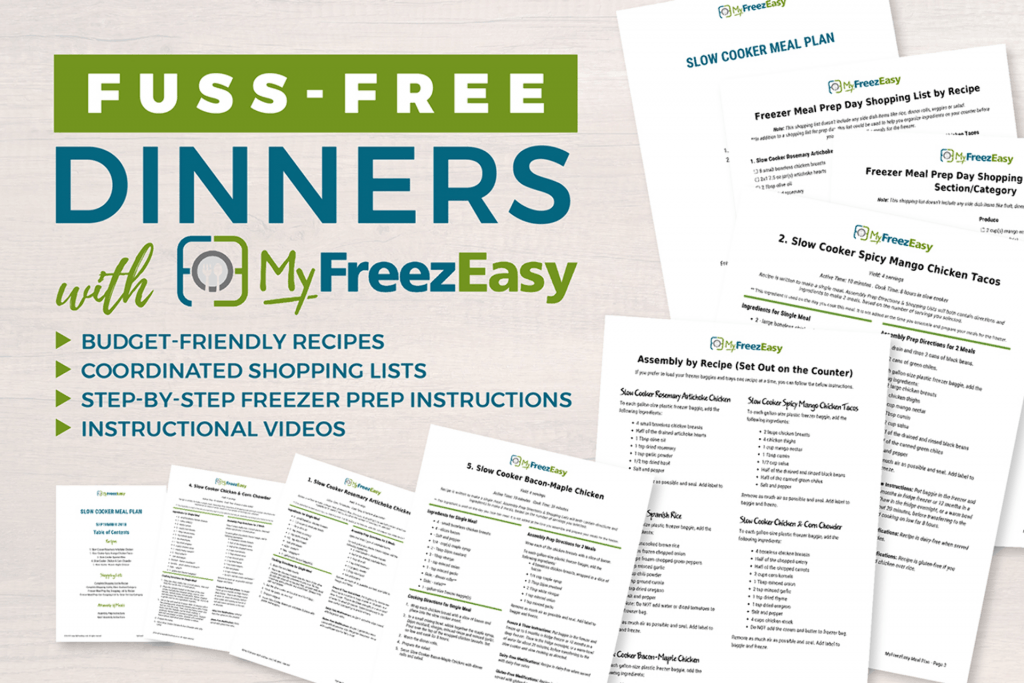

MyFreezEasy is a great resource to simplify meal planning and save money at the same time. Through this site, you will get recipes to freezer meals every week and even better yet, HEALTHY freezer meals.

You can get a taste of freezer meal cooking by signing up for the free freezer meal workshop!

You can check out my full review/tutorial of MyFreezEasy.

IF YOU DON'T HAVE TIME, USE $5 MEAL PLAN

You are probably reading this and thinking to yourself "yeah, meal planning would be great... IF I had any spare time..." then I'd recommend using a meal planning service!

I use $5 meal plan to do all the hard work of meal planning for me. It costs $5 per month and each meal is designed to cost under $5/person to make!

As a busy mom, I have to be as efficient as possible, and I'm willing to pay $5 a month to save me hundreds of dollars AND hours of time.

Seriously, it costs less than one latte per month.

My time is precious and I guard it well. I highly recommend this service, here's what I love about it (and some pictures from my member dashboard)!

HOW IT WORKS

KEY FEATURES

- Budget-friendly . Every meal is designed to cost $5 or less to make.

- HUGE HUGE HUGE time saver. Your weekly meal plan is delivered right to your inbox.

- Dietary preferences available! Gluten free, vegetarian, Paleo, dairy-free recipes & plans available!

- "Favorite" your families favorite meal plans.

- Build your own meal plan using the recipe bank. All you have to do is drag & drop, and then hit print or download! It will build the plan into a pdf document with ingredients, instructions, and a grocery list!

- Nutrition information for every meal plan.

- Organized grocery shopping list included with every plan!

- COUPONS listed on the site!

WEEKLY MEAL PLANS

Weekly meal plans will be delivered to your inbox every single week.

The plan contains 6 dinner recipes, a breakfast recipe, lunch recipe, dessert recipe and usually a snack, beverage or side dish idea!

Included is a shopping list, written by category with special notations for each recipe so it’s super simple to customize the list if you already have ingredients on hand, or want to skip a meal.

MEMBER DASHBOARD

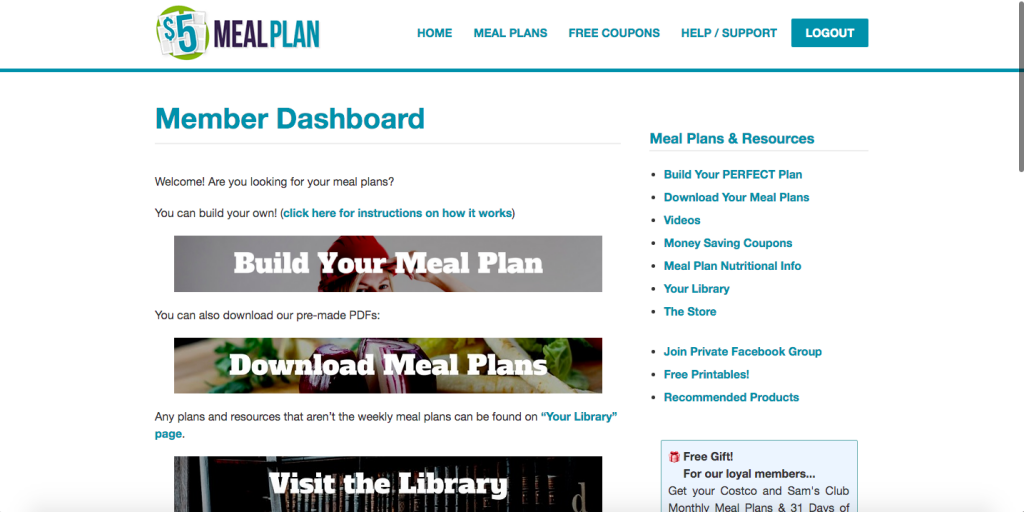

When you login to your member area, this is what your dashboard will look like:

You can see you have the option to build your own meal plan, download past meal plans, or go to the library for ideas!

BUILD YOUR OWN MEAL PLAN

If you decide one week to build your own meal plan, it's a simple drag and drop process and you can easily review & print, like pictured below.

Once you hit "review & print" you'll be given the option to download the meal plan immediately to your desktop or send it to your email!

You can also make the plan you build a 'favorite' so you can easily access it again for future use!

You can add as many meals as you'd like when using the build your own meal plan option.

The meal plan you create will look just like the one emailed to you weekly- with the recipe for each and shopping list sorted by ingredient & store section!

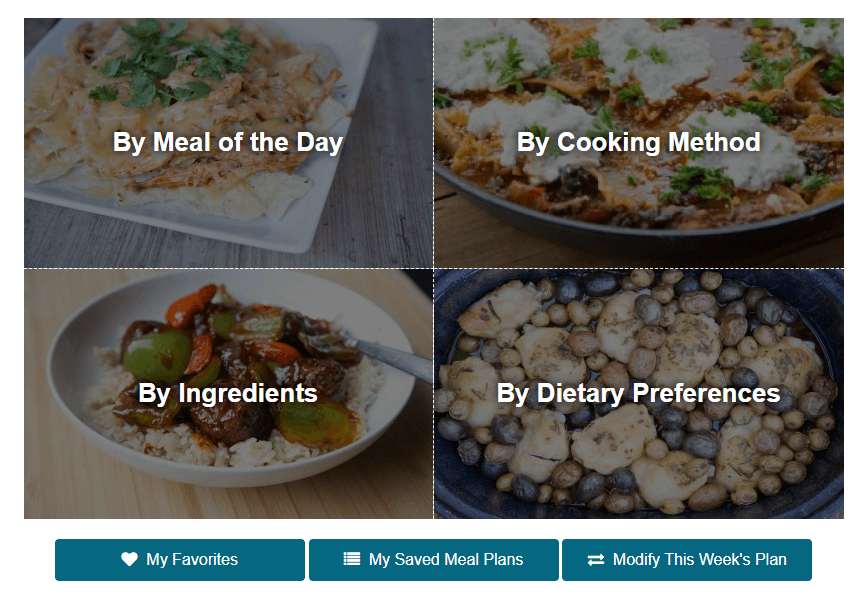

FINDING RECIPES

You can search the library for recipes by meal (breakfast, lunch, dinner), cooking method, ingredient, or dietary preference.

DIETARY PREFERENCE PLANS

Dietary preferences include:

- Dairy-free

- Vegan

- Gluten-free

- Gluten, dairy, soy-free

- Paleo

For busy moms, $5 meal plan is a life-saver!

PAY WITH CASH

I know I've preached this over and over, but statistics back me up on this- you spend less when you use cash.

If you have a problem with overspending on groceries, try using cash!

Credit cards can be really tempting- most companies only require you to pay off 1-3% of your balance every month.

This is especially appetizing if your budget is tight.

DON'T FALL FOR IT.

Whether you pay off your balance every month or not, it will STILL hurt you in the end (see my post about why we don't have any credit cards ).

How?

It's all about behavior.

Think about it - spending $30 at the grocery store feels like a lot if you only have $75 cash in your wallet for groceries that week.

On the other hand, if you have a credit card with a $5,000 limit on it, that $30 doesn't seem like much.

It sure doesn't hurt as much to swipe.

EVEN with a debit card you spend more than you would with cash- so beware!

RESIST THE URGE TO BUY PREPARED FOODS

Have you ever found yourself in the Deli department looking at the foods that are pre-made like pasta or potato salad and suddenly you consider scrapping your dinner plans and just taking the easy route?

I have been tempted a few times, but the one thing that keeps me from doing this is the price of the prepared foods!

I try to remind myself how much I can save by making the pasta or potato salad myself and having leftovers for later too.

Besides, the already prepared foods usually don't taste as good as homemade!

DON'T MAKE COMPLICATED MEALS

At first as a new wife, I tried a handful of recipes that a long list of ingredients and took a long time to prepare. Huge mistake.

When I try to make a recipe that requires a lot of ingredients, I usually end up with a lot of waste.

This is another tip that has saved me tons of money- SIMPLIFY your meals.

I've recently been using the Pioneer Woman's 16-Minute Meals , as I've been super busy with work, getting ready for the baby, and a handful of other things that are keeping us busy! One of my favorites from the 16-minute meals is the Greek Yogurt Pancakes- they are a healthy alternative to regular pancakes! Give them a try!

When I'm meal planning, I look for meals that don't require more than 10 ingredients AND it's a bonus if you can double the recipe and freeze the second batch for later!

If you are health-conscious, stick to baking/grilling your produce and usually all it needs is olive oil and a little salt/pepper or maybe some cheese.

Keep it SIMPLE.

TRY TO ONLY GO GROCERY SHOPPING ONCE A WEEK

This has been the number one way I have saved money.

If you plan well for the week ahead, you should cut down your trips to the grocery store.

Before I started planning out meals, I would go to the grocery store at LEAST three times a week to get ingredients when we would finally decide what were having for dinner.

When you don't have a plan and you go to the grocery store multiple times a week, you tend to make more impulsive, expensive purchases.

Set a goal- try to cut down your trips to the grocery store little by little until eventually you're down to one time per week!

Of course there will be exceptions and you'll forget an item on your list every once in a while, but try to get into a habit of buying all your groceries a week in advance!

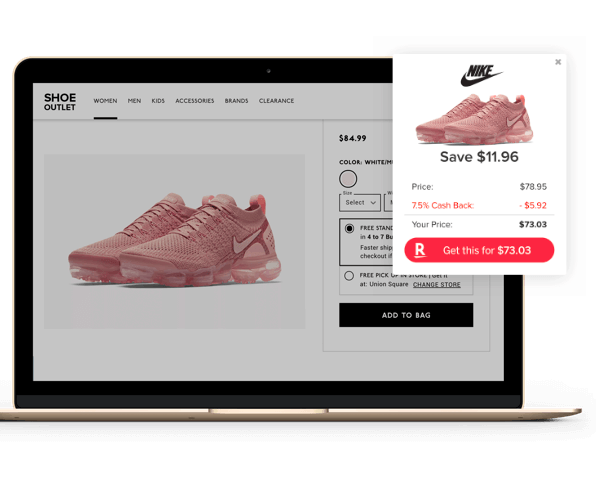

Use Rakuten to get Cash Back

Rakuten is a free app that offers cash back for thousands of stores (almost every well known retailer is on Rakuten) both online and in-store!

My favorite things about Rakuten include:

- Easy to install web browser app

- You can get cash back on in-store purchases

- Double cash back

- Thousands of stores use Rakuten

- Coupons automatically applied

You can install it on your internet browser, so whenever you visit a site that offers cash back, it will pop up and ask you to activate your cash back- so you never miss an opportunity for free money!

What's even better is that Rakuten automatically searches the web for coupons available for the site you're visiting and automatically applies coupons at checkout for you !

It's SUPER simple. All you have to do is install the web browser button, and you're done!

I like to make sure I use Rakuten when they do double cash back , which they do on most major holidays and they'll have random flash sales!

My only word of warning here would be to make sure that you don't buy something JUST because you'll get cash back.

A COUPLE TIPS ON HEALTHY/CLEAN EATING ON A BUDGET...

It can seem almost impossible to eat healthy on a budget.

However, you can make it by pretty cheap if you use the tips above, and a few more things that I specifically try to do in order to keep healthier foods in our budget.

BUY HEALTHY FOODS THAT ARE IN SEASON (& FREEZE FOR LATER) OR BUY FROZEN FRUITS/VEGGIES

Fresh fruit/veggies often go bad fast, and in our house, if we aren't careful, we end up with a lot of waste (budget killer!!).

Solution?

Either buy your fruits/veggies only when they are in season and use what you need and freeze the rest, or buy already frozen produce that is available year-round.

Click here for a guide to what is in season when.

LEARN TO INCORPORATE CHEAPER HEALTHIER OPTIONS INTO MOST MEALS

b

However, I cannot justify buying them all the time.

I set some simple 'guidelines' for myself for foods that I like that are more expensive- I only allow myself to buy them when the price drops below a certain amount. For grapes, I only buy them when they are on sale for $1.99/lb or less, and I usually only buy sweet red cherries and they have to be under $1.99/lb as well. I refuse to buy them if the price is above those points.

Since I've started following this rule, I've noticed that those healthier, more expensive options now seem like a treat, so I enjoy them more and don't eat them quite as fast.

I typically try to stick with the less expensive healthier staples, like eggs, milk, yogurt, meat, apples/oranges, frozen berries, potatoes, oats, etc.

MATCH COUPONS WITH STORE SALES

When I plan meals for the week every Sunday, I try to match store specials with coupons/rebates.

I specifically plan all my meals around what is on sale for the week!

First, I scan the flyers and compare prices at the two stores that I pretty much exclusively shop at.

Next, I see if any of the specific items that are on sale either have a coupon available (Sunday paper or coupons.com ), or if there is a rebate for the item on Ibotta.

Then, I calculate the cost of each item on my grocery list (after coupons/rebates) so that I can adjust my list/meals accordingly if I am over-budget.

This way, there are no surprises when I'm in the checkout line at the grocery store!

NO, YOU DON'T HAVE TO SACRIFICE MEAT

We have meals that require meat as the main ingredient at least 3x per week, and our grocery budget is $75 a week. My husband and I both eat a ton of meat, so I have to carefully plan our meals.

How do we save?

With meat, you can almost always save a ton by buying in bulk.

You can get the best prices if you're buying more than a few pounds.

I'll buy a 10-pound tube of ground beef for $1.99/lb, and I can make a TON of meals out of that.

Choose meals that require meat and not much else.

Plan meals that don't require much other than the meat.

We usually have tacos one night a week for sure, burgers are pretty regular for us in the summer, and enchiladas and spaghetti are other great options (plus they freeze well).

Don't buy already-prepared options.

We always make our own burgers from ground beef that I buy in bulk.

I can usually get 3-4 burgers from one pound of ground beef, so that is $1.99 for three burgers vs. 2 burgers for $5 already prepared!

Hopefully these tips will help you to take control of your grocery budget!

The tips I shared are ones that have helped Joe & I drastically reduce our food expenses and food waste.

Remember, the most important piece is to have a budget ( see how to create a budget here ) and these tips will help you stick to it.

LIKE THIS POST? PIN ME :)

Share this post!