How to Budget When You Don't Have Time

You want to take control of your finances, but you struggle because you need a quick budget technique that allows you to efficiently manage your finances every month.

I get it. Sometimes I want to go back to my pre-kid self who is "so busy" and "so tired" and smack myself in the face. Hard.

Some of you don't have kids, and you feel like you're being pulled in a million different directions.

Maybe your job is demanding, and at the end of the day the last thing you want to think about is your finances.

Or, maybe you're a stay at home mom (which studies have shown is the equivalent of working two full time jobs), and whenever you have a free moment you just want to sit. In peace.

You could be someone who wants to take control of your finances, but you're not sure where to start and you're bad at organizing.

Whatever it may be, I get it. I'm right here with you.

HACKS FOR A QUICK BUDGET METHOD THAN IS EFFECTIVE

SPEND MONEY TO CREATE TIME.

Every decision you make has trade-offs.

You are always trading your time for money, and therefore it makes sense to analyze your decisions in this way.

I want you to start thinking about your money decisions by asking yourself the following questions:

If I outsource _________ instead of doing it myself, will it save me time and therefore money?

To free up my schedule, what am I willing to pay so that I can spend more time with my family, but also be responsible?

Simply thinking about things in this way will change your habits and ability to process decisions almost immediately.

If you find yourself without enough time to budget, review your spending, and plan for retirement, what are you willing to give up so that you can make time?

To be quite honest, you can't afford not to plan for retirement.

SCHEDULE. EVERYTHING.

You need to literally write your finances into your schedule.

If you want to be wildly successful in any area of life, you have to be willing to do what 99% of people aren't.

Do you want to take control of your finances?

Be the 1% that actually makes a plan. Start a budget. Track your spending. Calculate what you need for retirement.

I schedule my budget updating and expense tracking, it has a time slot just like my appointments and other social obligations.

That sounds silly, but our finances are important to me, I want to be a good steward of what God has given us.

Put it in your schedule and make it non-negotiable!

USE A PRE-MADE TEMPLATE FOR A QUICK BUDGET

You can make your own budget template, but if you want to save time you can snag my free template.

Templates are the key to a quick budget that works every single time!

I have tons of templates available for you, just find what works best for your budgeting style. There is no right or wrong template, as long as your total budgeted income minus your total budgeted expenses equals zero, it doesn't matter!

Some people prefer to use a broad monthly budget overview, and some prefer to break down their budget into smaller chunks by paycheck.

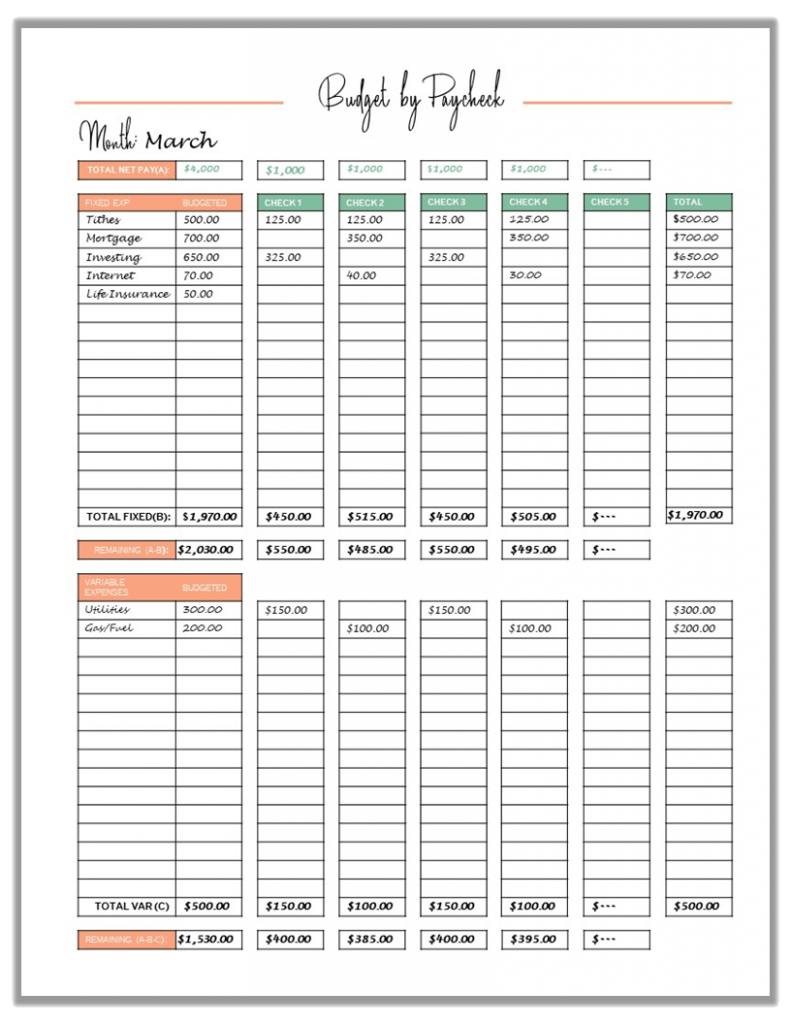

PAYCHECK BUDGET

Here's an example of what a paycheck budget looks like using one of my templates:

In this style budget template, you take your total monthly budget (left) and allocate it to your paychecks.

I personally love this style budgeting and that is why I do a combination of two styles, I take my broad monthly budget, and then I break it down into pay periods.

Then, as we either spend more or less on certain things than anticipated during the month, I can easily adjust the template for ACTUAL amounts.

Ultimately, you want to use your actual income during the month. So, if it's different than what you expected, you need to update your budget.

Budgeting requries you to be proactive . This ensures your money is working for YOU, and not the other way around.

Use the budget by paycheck template if you like every process broken down into smaller, more manageable chunks.

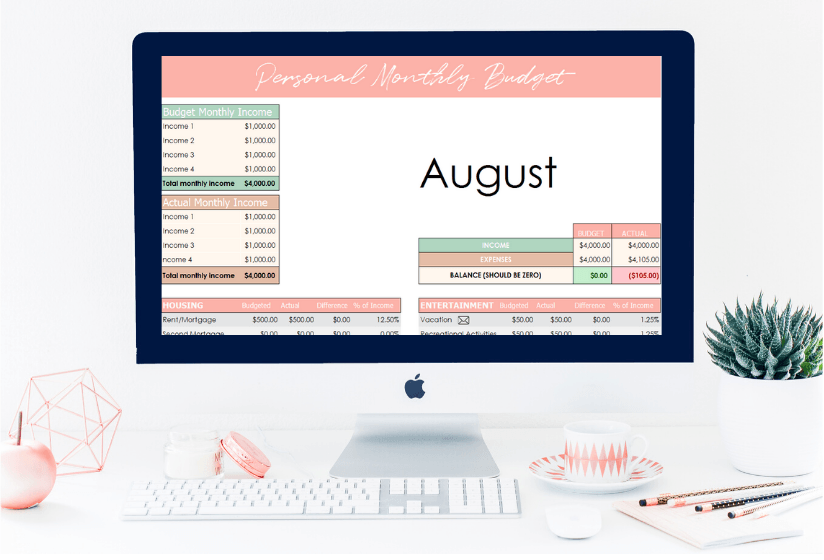

EXCEL BUDGET

A digital budget template will help you save time every month making your budget because all you have to do is copy & paste and then update for any budget adjustments!

This excel budget template is perfect for those of you who love spreadsheets (like myself).

Personally, I use the excel version of the budget by paycheck template because I like the simple copy & paste feature to get me started on my next months budget.

Additionally, you can always print it if you'd like!

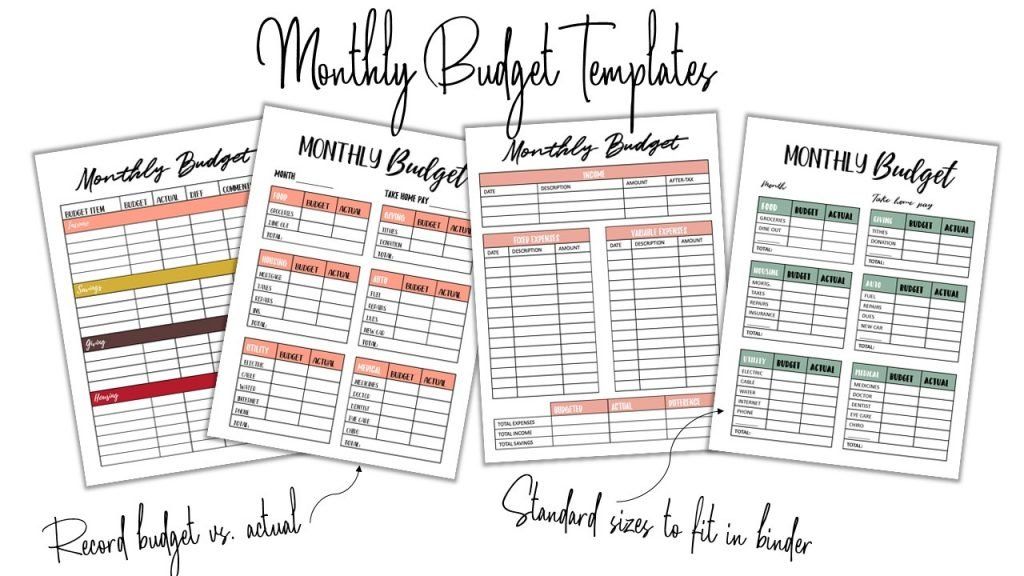

TRADITIONAL MONTHLY BUDGET

These traditional monthly budget templates are created based on the Dave Rmasey budget templates!

This is what I use to create my broad overview monthly budget and then I make my paycheck budget worksheet based off of these amounts!

Especially for beginner budgeters, these templates are a great place to start!

As an added bonus, they are editable ! You can type directly into them and print if you'd like!

All of my budget templates I've created to make budgeting easy can be found here:

If you use these printables faithfully, it will be sooo easy to see how the year went.

The fun part is comparing your progress year to year!

I never thought we'd be able to put away thousands a month, have a kid, own a home, and stay debt-free, but ya'll, we've done it!

Simply tracking our spending, net worth, and using the debt snowball to pay off my student loans propelled us into a life of financial freedom.

That is exactly what I want for YOU :)

More budgeting resources:

MAKE IT A 20 MINUTE HABIT.

Taking control of your finances doesn't mean hours on end of financial planning and tracking, just 20 minutes a week and a few hours a month can completely change your financial future.

Part of the reason why I didn't track our finances when we first got married was because it seemed so time consuming.

Now, it takes me fifteen minutes every month to update our budget. I take twenty minutes a week to group our expenses for the week into categories and write them on our spending log.

Start small and allot yourself a set chunk of time to budget, track your spending, and evaluate your financial habits.

Every week, start by scheduling 20 minutes for your personal finances.

MEASURE RESULTS, NOT TIME.

One thing that will be vital to your success is to SCHEDULE YOUR RESULTS .

Write down exactly what needs to be accomplished in those twenty minutes and no matter what, accomplish it.

For instance, on my calendar instead of penciling in "budgeting" from 530 a.m. to 630 a.m., I write "create new monthly budget and update budget binder."

In order to be efficient, you need to produce more in less time.

By forcing yourself to schedule results and being specific, you'll naturally be more productive.

BATCH YOUR TASKS.

Batch tasking is when you schedule similar tasks in blocks.

The goal is to have a productive burst of work and completing a group of similar tasks.

For instance, I will reconcile out bank account, update our expense log, and update our budget all in the same time block.

This is much more efficient than randomly and sporadically doing different tasks throughout the day.

Our minds were not created to multitask, and studies have shown over and over that we are less productive and produce lower quality work when we multitask.

Have a method to your madness!

GET IN A ROUTINE.

Having a routine creates structure, reduces our need to plan, and makes us more efficient.

If you think about it, having a routine eliminates the fifteen minutes you spend thinking about how to set up your day.

Routines save time, which is our most valuable and unreplenishable resource.

Pick a day every month to create your budget for the next month.

Choose a day or even more specifically, a time, that you will update your expense log every week.

Routines allow actions to become habits.

Related Content:

These hacks will make you more efficient at managing your finances and creating a quick budget process that works for YOU! Remember, just because your process doesn't look like everyone else's doesn't mean it's wrong.

Share this post!