Creating a Business Budget For Small Business Owners

I get it. You're looking at all this budgeting and money saving ideas thinking "that's great and all... but I'm a business owner, so this isn't applicable to me."

Creating a business budget is an essential piece of owning your own business.

Budgeting is still applicable to self-employed individuals, just in a different way.

If you own your own business, you have all the reason more to budget, because your business depends on it!

CREATING A BUSINESS BUDGET

First things first, if you don't have a budget template, you can either snag my free template by signing up below, or purchase a template from my shop.

Don't think because you're self employed that budgeting does not apply to you, that couldn't be further from the truth!

BUSINESS AND PERSONAL FUNDS MUST BE SEPARATE

Do not fall to the temptation to only have one bank account, it can hurt your business well-being and it can create legal troubles.

If you don't separate your business funds from your personal funds, you are potentially setting yourself up for a lot of trouble down the road.

This could lead to large accounting fees to get everything sorted out, and if you don't keep your business and personal expenses separate, you could get audited and penalized.

YOU CAN STILL BUDGET WITH AN IRREGULAR INCOME

It takes three easy steps to make a personal budget for a self employed individual.

First, find your lowest earning month from the previous year and use that as your baseline budget.

Take your lowest earning month from the previous year and build your budget off that amount. Be sure that you are using the net pay, not the gross pay.

Second, list all fixed and variable expenses.

List all your expenses out, with one column being fixed (expenses that don't change month to month), and one column being variable (expenses that vary month to month).

Also be sure to include an amount that you would like to budget for saving and investing.

Third, order your expenses by importance.

Of course, expenses like clothing, food, and shelter are the most important. If you have more expenses that your lowest paying month would cover, that's okay!

Try to trim down expenses that are the least-important and most variable.

On months that you make over the "bare bones" budget amounts, use the excess to save and invest and cover the expenses you couldn't pay.

It is essential that you have a budget in place to help you keep your variable income going to the right places.

AN EMERGENCY FUND IS ESSENTIAL

To hedge the risk of being self employed, it is a good idea to have 6-12 months of money set aside in the case of an emergency, as opposed to 3-6 for others.

The reason for this is that most self-employed individuals are willing to weather the storm and ride out months/years of business downtown.

On the other hand, an employee who loses their job is going to in most cases actively look for another job immediately.

In years where business is not great, it's important that you are able to provide for your family, and an emergency fund is a good way to hedge that risk!

BUDGET BY PAYCHECK IS THE BEST METHOD

For self-employed individuals, the budget by paycheck method isthe best method to use for your PERSONAL budget.

Since your income will be variable, as you receive it you can adjust your budget.

Simply put, the budget by paycheck method allows you to break down your monthly budget into smaller categories by paycheck.

In the picture above, you can see that each paycheck has carved out what expense/envelope/budget item will be coming out of it.

For detailed instructions on the budget by paycheck method, read this post.

You can snag this budget by paycheck template below!

KEEP TRACK OF EVERYTHING

You need to keep track of every personal and business expense item. Don't let the business of owning your own business keep you from taking care of the small details.

Remember, a small leak sinks a big ship.

This is applicable to both your personal and business budget.

Pay attention to the small details, they are often sinking your ship.

SOFTWARE IS YOUR FRIEND

All business owners, an accounting/recordkeeping software is your FRIEND.

This is an essential part of owning your business- taking care of the recordkeeping.

As a tax accountant, I've seen many people get in trouble simply because they didn't have good records!

Even if you are 100% honest, if you don't keep track or keep good records, you have the potential to get burned. Don't overlook this aspect of being a business owner.

FreshBooks

Freshbooks is an amazing, cloud based accounting system for small businesses that includes invoicing, expensing, time tracking, projects, payments, estimates and more.

Here a few of my favorite features:

- FreshBooks has everything you and/or your accountant need to stay organized year-round and be 100% ready for tax season

- You can create and send super polished invoices in about 30 seconds with FreshBooks

- FreshBooks keeps you organized with smart and simple time tracking for you and your team

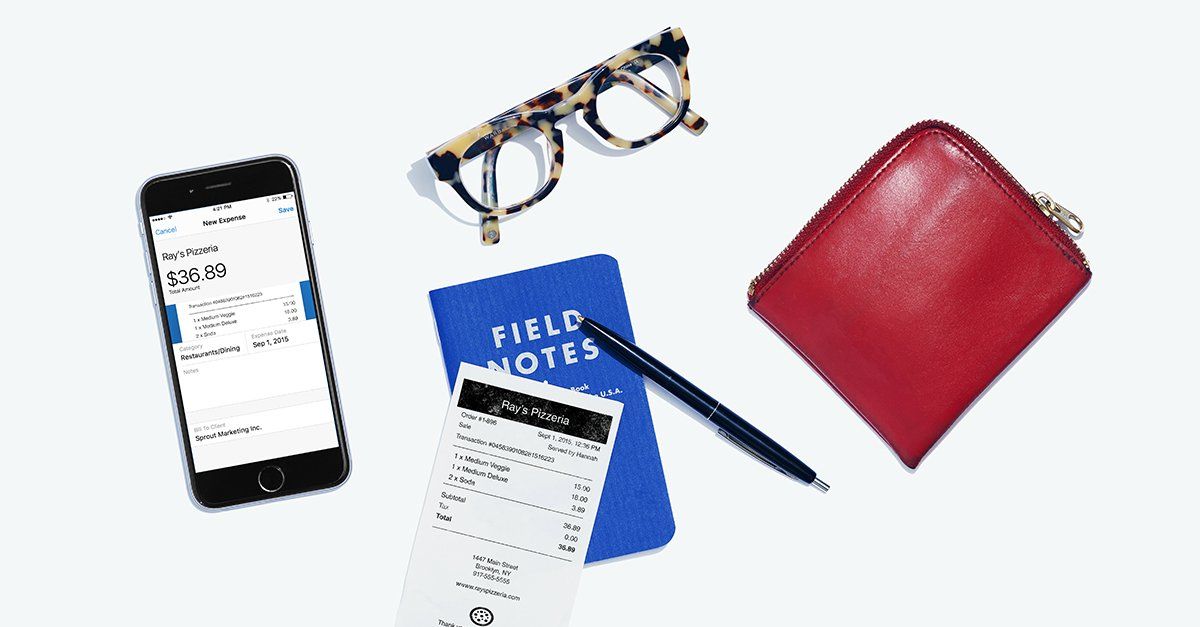

- FreshBooks lets you record and organize expenses with a tap of your mobile camera

- FreshBooks gets you paid in a snap by accepting credit card payments directly on invoices

- For faster payment next time, you can save credit card info directly in client profiles

FRESHBOOKS FEATURES

1. MOBILE FRIENDLY

You can literally create invoices from your phone, snap pictures of your receipts and capture expenses, view customers payments/balances, and much more FROM YOUR PHONE.

Let's face it, we're doing more and more from our phones, which is awesome because it allows us to get things done on the go!

2. EASY INTEGRATION

Freshbooks is built to integrate with apps like Stripe, Gusto, Yearli, etc.

This gives your clients a variety of payment options and allows you to easily send out 1099's (through Yearli).

This is what separates Freshbooks from Quickbooks- the ability to connect Stripe and other payment applications that make it easy for your customers/clients to pay you!

Bonus point for FreshBooks!

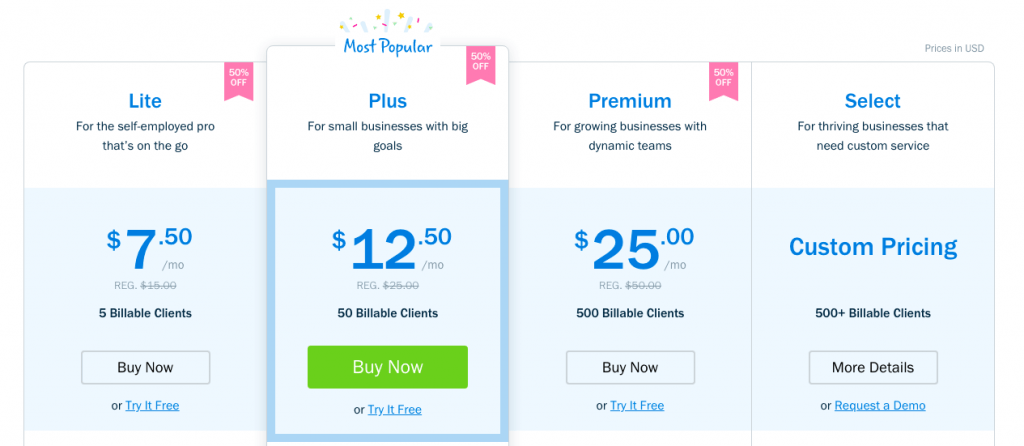

3. COMPETITIVE PRICING

Freshbooks offers affordable pricing for all users. You're not stuck with one large flat fee!

This is very affordable considering all the perks/customizations you get, including a cloud based system accessible from all your devices!

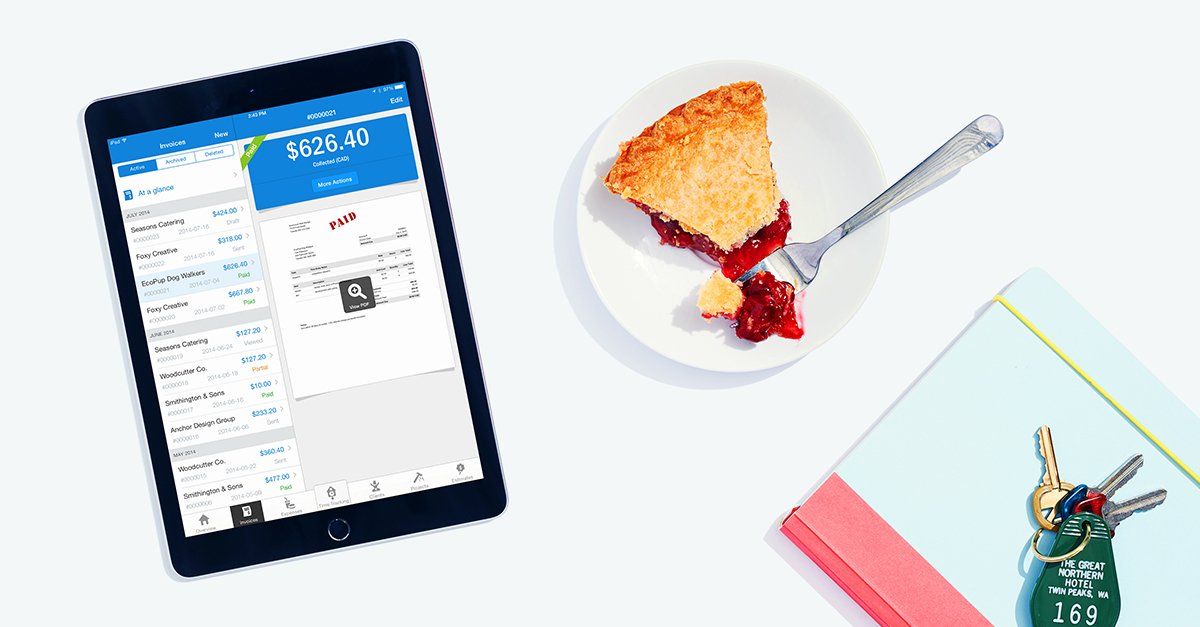

PAYMENTS

Customers can now pay directly through invoices, and since Freshbooks is able to link to your bank account, it will mark customers as paid immediately when it reads your bank account data.

Find out more about Freshbooks payments through my affiliate link !

Here are some benefits of the Freshbooks ACH payment options:

- Secure for you and your clients

- Accepts all major credit cards

- ACH connects to most major banks in the U.S.

- No hidden fees

REPORTING

Freshbooks offers all the reports you need to keep your business running smoothly and have a clear picture of where things are at.

The reports include...

- Balance Sheet

- Color coded expense report

- Profit & Loss

- Bank reconciliations

- Sales Tax Reports

TIME TRACKING

Time tracking for various clients is easy with Freshbooks, and with just one click you can easily create invoices for various clients!

- Time keeping for your entire team

- Automatically bill based on time charged to client

- Built-in, easy timer for desktop and mobile

You can try it free for thirty days through this link , no credit card required and you can cancel anytime.

TAKE AWAY

HAVE A BUDGET, THIS IS YOUR PLAN.

In order to create a business budget, you need to know where things are and keep good track of your income and expense items.

If you don't have time to spare, because let's face it, most small business owners don't, then invest in a software like FreshBooks to easily do your accounting and record keeping.

I hope this helped all you entrepreneurs out there!

Related Content:

Share this post!