11 Smart Money Goals to Start the new Year Right

Money goals help us stay focused and motivated change our habits. As a result, changing our habits changes the direction of our lives. While that might seem like a stretch, the power of habit -- a pattern of behavior that becomes our default response to a situation - can't be overestimated. Developing healthy financial habits should be part of your personal goals this year.

This next year may bring many financial blessings or challenges. Either way, you can control your response and preparedness.

Pick some (or all) of these money goals to control how YOU respond and prepare for this new year!

The Importance of Goal Setting

Having clear financial goals is an essential part of financial success and a foundational to achieving financial freedom. A large amount of studies consistently show that setting high and specific goals is directly linked to greater task performance, motivation, and persistence, compared to vague, easy goals.

How to Set Personal Finance Goals

While this sounds cliché, setting goals gives you perseverance when life gets hard. They give us purpose, accountability, and action steps. SMART goal setting is a great way to develop clear, specific goals no matter what type of goal you're setting - personal, financial, professional, family, or otherwise.

- Specific -A good goal has specific objectives. The more specific, the better!

- Personal - Your goals have to be just that -yours. If you are setting goals based on anyone else's expectations for you, you'll fail.

- Timeline - Create a realistic but aggressive time frame for meeting your goals. Check in often!

- Written - Research shows that when you write your goals, it gives you a greater sense of accountability. Ask anyone who has reached a major goal or milestone in their life- they often say the key is staying motivated. Without motivation and perseverance, we can quickly feel defeated when any major or minor setback comes (and they will)!

- Measurable - Create a detailed plan for yourself to get from point A to point B. What steps do you need to take daily, weekly, monthly?

Goals help you create a straight line from point A to point B. Don't skip this step!

11 Financial Goal Examples for 2024

These examples of financial goals are meant to be suggestions, not prescriptions. Depending on your financial situation, your goals could look very different, and that's okay! The goal is to achieve financial independence, no matter your income or circumstances. If some of these goals seem unrealistic, simply break them down further into smaller steps and create your own timeframe.

Short-term Goals

Short-term goals are typically defined as goals that take a few months up to a year to accomplish. Additionally, they are often micro-goals that act as stepping stones to your larger, long-term goals!

1. Pay Off All Debt

Debt is the Greek word for poison. Ok, it’s not, but you get the point. When debt is present in your life, it slowly starts to kill all your goals in the form of monthly payments. Debt has become normal- student loan debt, car loans, personal loans, credit card debt- you name it, most people have it.

Most people don't see debt as an issue although it is eating up their income and keeping them from gaining traction financially. They think, well hey, everyone else has one, I might as well have one too! However, following the crowd isn't particularly helpful when the crowd is living paycheck to paycheck.

While there are people who have credit cards who faithfully pay them off every month, that doesn’t make them responsible. Moreover, research shows that you spend more money with a credit card than with cash or a debit card. In fact, consumers are willing to pay 20% more with credit than with cash! I wouldn’t call that responsible. I’d call it a passive negative behavior.

Small doses of tempting bad behaviors over time will negatively affect your finances.

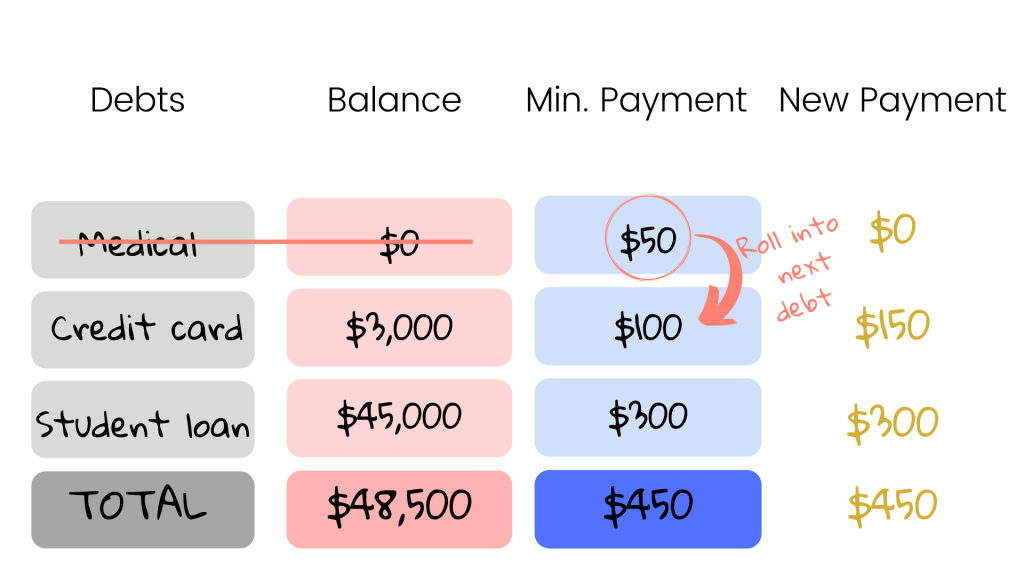

The Debt Snowball Method

If you currently have debt, make a plan to pay it all off using the debt snowball method. Using this method, you pay off all your debts in order of smallest to largest, regardless of interest rate. Once you have paid one off, you take the amount you were paying on that debt and add it to the payment for the next debt on the list. Thus, the snowball effect.

Make this a resolution and start today by listing all your debts, setting a payoff target date, and creating a visual to track your progress! Visually seeing your progress every month will help you stay motivated when you’re burnt out (we all get to that point)!

The key is to KEEP GOING until you’re completely debt-free. I’ve never met anyone who regrets getting out of debt!

2. Cut Up Credit Cards

Since you’re paying off all your debt, you might as well cut up the plastic money too. Commit to never going back. Don’t keep the card around “just in case.” Just in case ends up leaving you with a new couch, new TV, and pizza for the third night in a row because you had a rough day.

3. Save More Every Month

Saving more money is a great goal, and the good news is there are many ways to find money to save!

The truth is, saving money is rarely an income problem, it’s almost always a behavior problem. You need to change your behaviors if you want to change your outcome. Here are some ways you can save money!

Meal Plan

One of easiest budget categories to overspend on is groceries . Most people don't track how much they're spending, and most don't plan their meals. As a result, they end up hitting the drive thru multiple times per week and constantly going to the grocery store. Dinnertime at our home is cheap, stress-free, and fun! How? I use a meal planning service called $5 meal plan to plan my meals for me. It only costs $5 per month, which is more than worth it to me. They send me a meal plan, shopping list, and detailed instructions every Friday for my meal plan for the following week! Additionally, I can use their online recipe bank if I'd like! Here's a detailed review.

Use Cash Envelopes

Cash envelopes are a simple but effective way to change your money behaviors. Start small, and eventually you'll see major changes in your habits.

Here are a few tips for using the cash envelope method:

Fill. Every month or week, fill your envelopes with cash for budget categories you decide warrant an envelope (groceries, gas, blow money).

Limit. Once the money in your envelope is gone, that's it! You're done spending in that budget category for the month.

Time. Give yourself time to get used to the system. Like anything else, no one becomes an expert in a day! Be gracious to yourself until you get it down.

Cash envelopes help develop self-discipline, one the number one habits required for wealth building. Although this seems like a small change, your successes and failures are built on the small changes and decisions you make everyday!

Cut Out 1-2 Expensive Habits per Week

What are your most expensive habits? For me, before getting my own espresso machine, I would buy a latte everyday. A latte costs about $5 per day, or $25 per week. Cutting it out saves at least $100 per month.

Another common expensive habit is eating out and recreation . Don't get me wrong, I love both! However, if you don't budget for it, this can easily become a money pit.

Commit to getting rid of 1-2 expensive money habits per week!

4. Invest 15% of Your Income for Retirement

Too many people feel unqualified to start planning and saving for retirement. Don’t be intimidated! Rather, invest in educating yourself on the basics of retirement planning. Trust me, you don't need to be an expert! Simply understanding the

differences between Traditional IRAs and Roth IRAs will help you make informed decisions about where to put your retirement savings.

Here are some tips:

Here are some tips:

- Think long-term. If you’re looking for a get rich quick scheme, I can’t help you. Too many people pull out of their investments at any sign of a downturn in the market. Don’t chase short-term gains, you’ll end up getting burned in the long run. Investing is a marathon, not a sprint.

- Consistency is key. Put your investing on auto-pilot by making your investment contributions an automatic withdrawal from your bank account.

- Diversify your risk. The best way to diversify your risk in the stock market is to invest in mutual funds, which are groups of single stocks. Learn more about each here.

- Learn. Many people don’t take the time to learn about their different retirement options and plans because they think it’s too complicated. A basic understanding of the different types of plans, how they work, and investment strategies will go a long way. If you don’t know what you’re investing in, you could be setting yourself up for failure. It’s worth taking the time to learn enough to be dangerous.

- Utilize a financial advisor. Be sure to find someone you can trust that will teach you about investing, not just throw big terms at you and tell you they have it handled.

A good rule of thumb is to invest 15% of your gross (pre-tax) income after all your debt is paid off. If you have debt, focus on paying that off before investing. You are most effective when you focus on one goal at a time!

⭐️ READ:

5. Review Insurance Policies

I hate dealing with insurance. I’ll make spreadsheets, balance the budget, reconcile our accounts, but talking insurance is like nails on a chalkboard to me. It’s on my list of some of my least favorite things to do.

However, it is incredibly important. In fact, it’s essential, and therefore should be included in annual financial planning processes.

INSURANCE CHECKUP

There are many insurance products on the market, so it's hard to determine which products are necessary. I follow Dave Ramsey's guidelines, and he recommends the following (please see this post for reference):

- Auto – It goes without saying that everyone needs liability coverage. However, whether you have collision and comprehensive is up to you. If you have older vehicles that are junker cars, you may only want liability coverage.

- Homeowners – If you own a home, immediately purchase homeowner's insurance. While this insurance covers most scenarios, it typically does not cover flood damage. Therefore, if you live in a area where that is a threat, you’ll want to get flood coverage as well. It’s not cheap- so seriously consider this before moving to an area where a flood is a threat.

- Health insurance – Most people have health insurance through their employer. Often, there are different types of plans to choose from and it can be extremely confusing trying to decide what’s best for your family. If you’re a healthy individual, a high deductible plan might be best for you. On the other hand, if you have recurring medical issues or a major medical event (like having a baby), you might want to consider a low-deductible plan. Alternatively, there are also health sharing ministries that like insurance, cover medical care.

- Long-term disability – Long-term disability insurance covers you in the event you are unable work because of sickness or injury. Typically, you should have coverage for 65% of your income. If you have a fully funded emergency fund, short-term disability insurance is not necessary. You’ll pay more in premiums than if you just save up the money to cover it.

- Life insurance – Many people are underinsured when it comes to life insurance. You need life insurance 10-12x your annual, pre-tax income. Additionally, if you’re a stay-at-home mom, you still need life insurance of at least $250k. This will ensure your spouse has enough money to pay for childcare.

- Long-term care – Around age 60, it’s time to start thinking about long-term care insurance. This will cover the cost of a nursing home (which are wildly expensive), and/or in-home care. Don’t pass the financial burden onto your children or other family members.

- Identity theft protection – Identity theft is on the rise as hackers become more skilled. Be sure to have coverage that includes protection and recovery services. This will save you countless hours if you are a victim of identity theft.

Read my detailed review of my personal health insurance alternative, Christian Healthcare Ministries!

6. Build an Emergency Fund

70% of Americans live

paycheck to paycheck

and could not survive an unexpected financial emergency.

You CAN be prepared for when financial challenges come. If you’re prepared, financial challenges become inconveniences instead of crises.

- Identify your household expenses. The key word is expenses—not household income per month. If you lost your job, what expenses would have to be paid? Total how much it takes you to live per month with just the necessities.

- Save up 3-6 months of household expenses. Whether you save 3 or 6 months is completely up to you. If you’re income is stable, 3 months of expenses is probably fine. If you’re self-employed and/or have irregular income, you might want to have closer to 6 months of expenses saved.

- Park in a high-yield savings account or money market account. If you keep this money in your checking account, it can be tempting to use it for something else. Additionally, if your debit card is stolen, you are at higher risk. I recommend keeping your emergency fund in a high-yield savings account or money market account. Be sure that whatever account you keep it in, you can write checks out of the account without penalty.

You can’t avoid money challenges; they will come whether you want them to or not. However, you can control whether you are as best prepared as you can be!

Build your emergency savings, so when the rainy day comes (it will), you are ready! Plus, the peace of mind having an emergency fund brings is priceless.

⭐️ READ:

7. Create a Budget Blueprint

The best way to carry out your money goals is to create a detailed monthly budget. When you create a budget, you can tell your money where it’s going. Whether your goal is to save more, invest more, or pay off debt, creating a budget allows you to free up your income to do all those things! A budget bridges the gap between your financial priorities and reality. Many times, the severity of our frustration is the difference between our priorities and what is actually happening. Utilize a budget to prioritize your monthly expenses and cash flow.

Your budget is the foundation of your personal finances.

- Write down total expected net (after-tax)monthly income.

- List all fixed monthly expenses.

- Brainstorm irregular/seasonal expenses & convert to monthly amounts. Include both expected and unexpected expenses (annual insurance premiums, medical bills, car repairs & maintenance, home repairs & maintenance, etc. ).

- Set financial goals & add to budget.

- List discretionary ( adjustable ) monthly expenses.

- Continue until total income - total expenses equals zero .

- Track your spending & adjust as needed.

In order to be successful, your budget needs to be realistic, flexible, and detailed. Furthermore, I'd encourage you to have a written budget. This makes it official, memorable, and holds you accountable!

✏️ BUDGET WORKSHEETS & TEMPLATES:

MONTHLY BUDGET TEMPLATES

If you're tired of spending hours every single month budgeting and tracking your spending, an excel budget template kills the stress of time management.

This excel budget template boasts:

* A separate tab

for every month

* Monthly overview chart

to quickly see your budget to actual numbers

* Color coded/formatted cells

to show over and under budget amounts

* Instant download

start right now

* Error proof

certain cells are locked so you can't mess up the formula's

* Estimated & actual

inputs

If you're a time-sensitive person, the excel budget template will work wonders for you and your finances! Furthermore, you can print if you'd like!

This excel budget template allows you to take total control over your money:

- Create a unique budget based on your personal pay schedule

- Instead of budgeting once a month, budget every time you are paid

- Break your monthly budget down into bite-sized chunks

- Color coded cells to show over & under budget amounts

- Automatic totaling formula driven sheet

The budget by paycheck method of budgeting is my favorite. I like to take the big picture and break it down into simple, effective steps.

In other words, I like to have a specific, detailed plan to execute.

Long-term Goals

Long term financial goals that will take a year or longer to complete. Typically, these are your "big-picture" goals that will ultimately lead you to financial freedom.

8. Save up for Large Future Expenses

Regularly set short-term, mid-term, and long-term savings goals. In other words, you should always be saving for something, because there's always something to save for. Use sinking funds to set aside money on a monthly basis for future expenses.

- Down payment on a house.

- New baby/maternity leave.

- Car replacement.

- Major home renovation.

- Real estate investing.

In short, to set up sinking funds simply take the total savings goal and divide by months until due or target due date. For example, if you estimate you'll need a new vehicle in five or so years, and it will cost about $30,000, you'll need to set aside $500 per month for five years.

9. Track your Net Worth

Tracking your net worth is another visual motivator to make smart money decisions. Your net worth is the true measure of your wealth. While many people think that having a high income is equated with being wealthy, this is a huge misconception.

Anyone can make a lot of money. It takes financial discipline to be wealthy. If you make three figures but your lifestyle costs three figures, you’re not wealthy. You’re broke.

You can calculate your net worth with a simple equation:

NET WORTH = TOTAL ASSETS – TOTAL LIABILITIES

Assets include financial assets (retirement accounts, cash on hand, savings accounts, etc.) and non-financial assets (the fair market value of vehicles, your home, and other possessions).

Liabilities include any debt you have against those assets, and any consumer debt. Examples include home mortgage balance, vehicle loans, credit card debt, student loans, home equity loans, etc. Includes all debt in your name.

If you think about this equation logically, it makes sense. If you own a home worth $300k and your mortgage balance is $225k, the $75k difference is what you would pocket if you sold today. You wouldn’t pocket the $300k, you would have to pay off your mortgage.

Keeping track of your net worth will give you an accurate picture of your wealth and help you stay motivated! Use this net worth tracking template to understand and track your wealth.

10. Pay Off Home Early

While many people see renting as wasteful , they don’t think twice about their 30-year mortgage and how much money they are paying in interest. Depending on the size of mortgage and interest rates when you buy, you could save tens of thousands of dollars or more by making a goal to pay off your home early!

For example, if you have a $200k home loan, over 30 years, at an interest rate of 3%, you will pay $103,554 in interest. Consequently, in total, you will pay $303,554 for a $200,000 home. Wow, what a waste! Yes, you get something for it (as opposed to renting), but not for a good deal.

But what if you make extra payments and off your home early?

Continuing with this example, if you pay $200 extra on your mortgage per month, you will save $30,910.34 in interest and shave 8 years off your mortgage! Furthermore, if you pay $500 extra instead of $200 per month, you save $53, 081 in interest and shave 14 years off your mortgage!

Make it a goal to pay off your home early – in 15 years or less. If you can't pay off your home in 15 years or less, you're probably not ready to buy a home yet.

Just $200-$500 extra per month makes a huge difference. That’s most people’s car payment... hope you like that car 😉

11. Be Generous

Generous people are happy people. Even more, generous people get much more joy in giving than they do in spending on themselves.

If you're a Christian, generosity is a command . God commands us to tithe and give towards his Kingdom work for our benefit. Tithing is the scalpel He uses to perform heart surgery. It keeps our priorities in order. Being outrageously generous should always be one financial goal of the believer.

Too often, we get our security from our money. We hold it with a closed fist. We need to trust that God will provide, and when He does, we need to be outrageously generous. Ultimately, the money is not ours. It's His!

Be generous this year. For you that might be $100, or $1,000 or $10,000! God sees the heart of the giver, and God loves a cheerful giver (2 Corinthians 9:6-7).

Share this post!